|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The final trading days of 2025 are delivering textbook year-end window dressing as institutional investors position portfolios for favorable year-end reports. With the S&P 500 up more than 16% year to date at 6,834 and the Dow Jones hovering near record highs above 48,000, fund managers are loading up on winners while shedding underperformers before Dec. 31 statements go to clients, according to S&P Dow Jones Indices data.

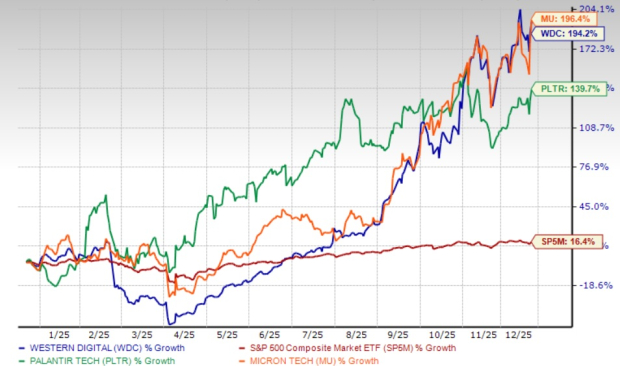

Window dressing — the practice of buying top-performing stocks to display in quarterly holdings reports — is creating predictable patterns this December. Institutional investors are actively positioning select AI-infrastructure stocks for 2026. The phenomenon particularly benefits stocks, including Micron Technology MU, Western Digital WDC and Palantir Technologies PLTR, which returned 196.4%, 194.2% and 139.7%, respectively, over the past year, all outperforming the S&P 500’s 16.4% growth in the same time frame.

Western Digital gained Nasdaq-100 inclusion effective Dec. 22, prompting index-tracking funds to add shares, while Morgan Stanley and Cantor Fitzgerald designated it a top 2026 pick given storage supply constraints extending through calendar year-end. Micron Technology, upgraded to Buy by Bank of America following Dec. 17 earnings, has HBM memory sold out through 2026 with multiyear customer agreements. Major holders Vanguard Group and BlackRock increased their Palantir Technologies stakes in the third quarter of 2025 by 4% and 6.4%, respectively, reflecting continued institutional confidence in AI-software positioning.

The Federal Reserve delivered its third consecutive rate cut on Dec. 10, reducing the benchmark rate to 3.50-3.75% in a divided 9-3 vote. Fed Chair Jerome Powell emphasized that officials are "well positioned to wait and see how the economy performs," with projections indicating just one additional cut expected in 2026, per official Federal Reserve statements. The cautious stance reflects concerns about persistent inflation despite a moderating labor market.

Despite monetary caution, AI infrastructure spending continues powering market momentum heading into 2026. Nvidia NVDA reported third-quarter revenues of $57 billion in November, up 62% year over year, with CEO Jensen Huang noting "Blackwell sales are off the charts" and cloud GPUs remaining sold out. Similarly, Broadcom AVGO announced in December that AI semiconductor revenues surged 74% year over year, with first-quarter 2026 AI chip sales expected to double to $8.2 billion.

Major financial institutions project significant upside for 2026. JPMorgan set a baseline S&P 500 target of 7,500 with potential to exceed 8,000 if the Fed continues cutting rates, citing 13-15% expected earnings growth. Goldman Sachs projects 12% earnings growth to $305 per share in 2026, while Morgan Stanley forecasts 17% earnings expansion driven by AI productivity gains and accommodative policy.

The convergence of year-end positioning, resilient corporate earnings, and substantial AI infrastructure investment suggests favorable conditions for equity markets entering 2026, despite elevated valuations and monetary policy uncertainties.

Micron Technology offers exceptional growth potential for 2026 investors following fiscal first-quarter 2026 results announced on Dec. 17, 2025. The company delivered record revenues of $13.64 billion (57% year over year) and projected second-quarter revenues of $18.7 billion with 68% gross margins. This Zacks Rank #1 (Strong Buy) company secured agreements for its entire calendar 2026 high-bandwidth memory supply, including industry-leading HBM4 ramping in second-quarter 2026. With the HBM market expanding from $35 billion (2025) to $100 billion (2028) — accelerated two years — and supply constraints persisting beyond 2026, Micron's $20 billion fiscal 2026 capital investment positions it to capture surging AI data center demand while maintaining pricing power across tight DRAM and NAND markets. The Zacks Consensus Estimate for MU’s fiscal 2026 earnings has moved north by 35% to $21.9 per share over the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

Western Digital presents a compelling buy opportunity for 2026 following its October 2025 fiscal first-quarter results, where revenues surged 27% year over year to $2.82 billion with non-GAAP gross margins expanding to 43.9%. This Zacks Rank #1 company's Dec. 22, 2025, Nasdaq-100 inclusion triggers passive fund inflows from $600 billion in tracking assets. Management demonstrated confidence by delivering strong second-quarter guidance projecting $2.9 billion in revenues with 44.5% gross margins. As AI accelerates data creation, Western Digital's high-capacity storage solutions address supply-constrained cloud demand extending through 2026, positioning the focused HDD provider for sustained shareholder value. The Zacks Consensus Estimate for WDC’s fiscal 2026 earnings has moved north by 14.9% to $7.63 per share over the past 60 days.

Western Digital Corporation price-consensus-eps-surprise-chart | Western Digital Corporation Quote

Palantir Technologies represents an investment opportunity, backed by strongly accelerating revenues and AI adoption. December 2025 contracts include a $448 million U.S. Navy ShipOS deployment and strategic Accenture partnership to scale enterprise AI globally. Palantir renewed its DGSI contract with France's intelligence agency and unveiled Chain Reaction — the operating system for American AI infrastructure. With third-quarter 2025 U.S. commercial revenues surging 121% year over year and 204 deals exceeding $1 million closed quarterly, this Zacks Rank #2 (Buy) company's Foundry and AIP platforms demonstrate unmatched traction. Government spending tailwinds combined with proven platform scalability position Palantir for sustained growth throughout 2026 as enterprises accelerate AI transformation initiatives. The Zacks Consensus Estimate for PLTR’s 2026 earnings has moved north by 20.9% to $1.04 per share over the past 60 days.

Palantir Technologies Inc. price-consensus-eps-surprise-chart | Palantir Technologies Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite