|

|

|

|

|||||

|

|

Digital advertising remains one of the most attractive long-term growth markets in the technology space. According to a Grand View Research report, the global digital advertising market is expected to witness a CAGR of 15.4% from 2025 to 2030.

Both The Trade Desk, Inc. TTD and Amazon.com, Inc. AMZN play pivotal roles in the digital advertising ecosystem. While TTD is a pure-play ad-tech firm built around a demand-side platform (DSP), AMZN is an e-commerce and cloud giant with advertising quickly becoming one of its key revenue drivers.

Since both firms have sizeable exposure to the booming connected TV (CTV) and retail media trends, this makes for an intriguing comparison for investors.

Let us break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

The Trade Desk has emerged as one of the leading independent DSP players in the digital advertising space. Unlike Amazon, advertising is TTD’s entire business, thereby allowing management to focus relentlessly on product innovation, customer relationships and performance improvements. Over time, this focus has translated into strong customer retention, with reported retention rates consistently above 95% in the third quarter of 2025.

CTV remains a major growth driver for TTD. On the last reported quarter’s earnings call, management noted that the transition toward biddable CTV is gaining rapid momentum and it expects decision CTV to become the default buying model in the future. The benefits of decision-based buying (like greater flexibility, control and performance) compared with traditional programmatic guaranteed or insertion-order models, are rendering it the logical choice for advertisers.

Strategic partnerships with Disney, NBCU, Roku, Netflix, LG and Walmart, among others, bode well. In the third quarter, video advertising, which includes CTV, represented more than 50% share of the total business. While video remains the largest share of its business, audio is emerging as a key driver of growth.

TTD had a strong balance sheet at the end of the third quarter, having cash, cash equivalents and short-term investments of $1.4 billion with no debt. Moreover, the company continues to generate healthy profitability and cash flow. The financial firepower gives TTD significant room to maneuver as it accelerates innovation, scales AI-driven capabilities and deepens its presence across global markets.

The Trade Desk price-consensus-eps-surprise-chart | The Trade Desk Quote

The Trade Desk is deploying resources to boost platforms like Kokai (next-generation AI-powered DSP experience) and data transparency tools like OpenPath and Sincera. Among its clients, 85% use Kokai as their default experience. This strengthens its competitive moat. TTD highlighted that Kokai delivered (on average) 26% lower cost per acquisition, 58% lower cost per unique reach and a 94% higher click-through rate compared with Solimar.

While The Trade Desk remains a leading independent DSP, the competitive environment is intensifying. Walled gardens like Meta Platforms, Apple, Google and Amazon dominate this space as they control their inventory and first-party user data, allowing for highly targeted ad campaigns.

Though TTD is focusing on geographic expansion, executing well across disparate markets can be complex and risky. Regulatory and privacy-related changes like the deprecation of cookies and tightening data-privacy laws like Europe’s GDPR also pose ongoing challenges. Macro volatility and higher expenses remain additional concerns.

Amazon’s advertising business has gradually emerged as a strong contender in the digital advertising space, leveraging its first-party data. In the third quarter of 2025, AMZN’s ad business delivered $17.6 billion in revenues, up 22% year over year, driven by its full-funnel advertising offerings. In the United States itself, advertisers can now reach an average ad-supported audience of more than 300 million across its retail marketplace, Prime Video, Twitch, Fire TV, Live sports (NFL, NASCAR, NBA), as well as third-party websites and apps.

At the center of Amazon’s advertising strategy is Amazon DSP. AMZN’s DSP platform enables advertisers to plan, activate and measure full-funnel investments. The DSP platform leverages trillions of proprietary browsing, shopping and streaming signals. These, when paired with AMZN’s wide-ranging supply-side relationships and secure clean rooms, help advertisers achieve optimization and higher ROI.

Partnerships with Roku and Netflix and integrations with Spotify and SiriusXM bode well. Integrations with Spotify and SiriusXM offer advertisers programmatic access to more than 560 million (400 million on Spotify and 160 million on SiriusXM) monthly digital listeners across both platforms.

Live sports on Prime Video emerged as another major driver of ad business momentum. On the last reported quarter’s earnings call, Amazon noted strong advertiser interest during upfront negotiations for 2025 and 2026, exceeding its expectations with significant growth in commitments.

Amazon.com, Inc. price-consensus-eps-surprise-chart | Amazon.com, Inc. Quote

AI is playing an increasingly important role in Amazon’s advertising business. In September 2025, the company announced an agentic AI tool and creative studio capable of planning and executing the entire creative process in a matter of hours rather than weeks.

Ads are still a relatively small share of Amazon’s total revenue base compared with retail and AWS, meaning ample room to scale. That said, competition in CTV and DSP remains intense, and as Amazon ramps up, The Trade Desk faces growing pressure to defend its share. For investors, it is important to note that AMZN’s business diversification, especially retail, cloud and AI, with stupendous financial resources, gives it an edge and reduces reliance on one segment.

Over the past month, TTD shares have declined 4.6% while AMZN stock is up 0.5%, respectively.

Both TTD and AMZN are overvalued, as suggested by the Value Score of D and C, respectively.

In terms of the forward 12-month price/earnings ratio, TTD shares are trading at 17.84X, lower than AMZN's 29.02X.

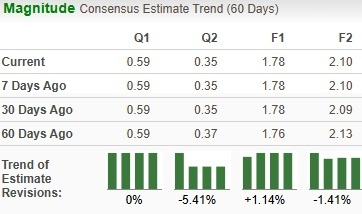

Analysts have made marginal upward revisions for TTD’s bottom line for the current year in the past 60 days.

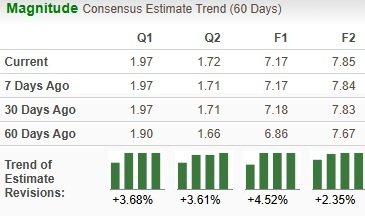

For AMZN, there is an upward revision of 4.5% for the current fiscal year.

TTD currently carries a Zacks Rank #3 (Hold), while AMZN is a Zacks Rank #2 (Buy).

For investors, Amazon stands out as the stronger pick based on. Its diversified business model spanning retail, cloud, AI and advertising provides stability and multiple growth engines, unlike TTD’s reliance on ad-tech alone.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 min | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Walmart To Report Results, Fresh Off New Highs, A New CEO And $1 Trillion Market Cap

AMZN

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite