|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Celsius Holdings, Inc. CELH and Monster Beverage Corporation MNST are two prominent names in the global energy drink category, operating at different ends of the growth and scale spectrum. CELH is a fast-growing functional beverage company focused on zero-sugar, health-oriented energy products. The company has delivered outsized revenue growth in 2025, driven by portfolio expansion and market share gains in the U.S. energy category, and carries a market capitalization of roughly $11.5 billion.

Monster Beverage, by contrast, is a mature, global energy drink leader with a broad portfolio led by Monster Energy, Monster Ultra, Reign and other brands, supported by deep international distribution and strong operating leverage. MNST generates significantly higher revenues and profitability, with consistent margin expansion and a strong global footprint, translating into a much larger market capitalization of $75.6 billion.

Celsius Holdings and Monster Beverage are worth comparing now as they represent two structurally different plays on the same category, making this a timely face-off within the evolving energy drink landscape.

Celsius Holdings is a high-growth challenger in the energy drink category, driven by strong brand momentum and expanding distribution. The core CELSIUS brand remains one of the fastest-growing energy drinks in the United States, with continued market-share gains across convenience, mass and grocery channels. Retail takeaway remained healthy in the third quarter of 2025, supported by better shelf placement, expanded cooler presence and stronger merchandising under PepsiCo’s distribution network.

The company is also accelerating growth through portfolio expansion and integration. The transition of Alani Nu into PepsiCo’s direct-store-delivery system (beginning Dec. 1) is expected to meaningfully expand distribution and visibility into early 2026. In addition, Rockstar Energy provides access to a broader consumer base and creates longer-term brand revitalization opportunities as Celsius works to optimize production and sourcing.

Innovation remains a key growth driver. Limited-time offerings, seasonal launches and a steady flow of new flavors across CELSIUS and Alani Nu continue to resonate with younger consumers. Management highlighted strong performance from recent flavor launches, reinforcing Celsius’ ability to stay relevant in a competitive category focused on taste, functionality and clean-label attributes.

Celsius is also seeing benefits from an improving margin profile. Gross margin remained above 50% in the third quarter, supported by lower promotional intensity, improved revenue mix and operational efficiencies in freight, warehousing and co-packing. Increased scale within PepsiCo’s DSD network and clearer co-manufacturing plans are helping improve cost alignment.

That said, near-term results may remain volatile. Management expects the fourth quarter to be “noisy,” reflecting integration costs, distributor transitions, inventory returns and timing-related impacts from Alani Nu’s network shift. Higher freight, marketing spend and temporary co-packing inefficiencies may pressure margins, while Rockstar is unlikely to contribute meaningfully to profitability until 2026. Despite these headwinds, consumer takeaway trends remain constructive, supporting the longer-term growth outlook.

Monster Beverage remains a dominant, global leader in the energy drink category, supported by strong brand equity, broad distribution and consistent execution. The company continues to deliver solid top-line growth, driven by sustained demand for its core Monster Energy franchise and expanding traction across international markets. Management highlighted steady consumer takeaway trends, underscoring MNST’s resilience in amid a competitive and promotional environment.

Innovation remains central to Monster’s growth strategy. The company continues to refresh its portfolio through new flavor launches, extensions of the Monster Ultra line and targeted offerings under brands such as Reign and Java Monster. These launches are designed to capture incremental occasions, appeal to evolving consumer preferences and defend shelf space against emerging competitors.

Monster’s global footprint is a key competitive advantage. International markets continue to post strong growth, supported by the company’s long-standing strategic partnership with The Coca-Cola Company, which provides unmatched distribution reach and execution capabilities. Management emphasized continued momentum across the EMEA, Asia-Pacific and Latin America, helping offset category normalization in parts of North America.

Profitability remains a core strength. Monster Beverage continues to generate healthy operating margins and strong cash flow, supported by scale benefits, disciplined cost control and favorable pricing actions. While input costs and logistics remain areas of focus, management indicated that margins remain well-supported, reflecting the company’s ability to absorb cost pressures.

Overall, Monster Beverage represents a high-quality, cash-generative energy drink leader with durable brands, global scale and a proven operating model. While growth is more moderate compared with smaller peers, MNST’s consistency, margin strength and international expansion runway position it well for long-term value creation, making it a compelling core holding within the beverage space.

The Zacks Consensus Estimate for CELH’s current fiscal-year sales and earnings per share suggest a year-over-year increase of 79.7% and 78.6%, respectively. The consensus estimate for EPS for the current fiscal year has declined by a penny to $1.25 over the past seven days. The consensus mark for the next fiscal-year sales and EPS implies year-over-year growth of 32.8% and 18.7%, respectively. The consensus mark for EPS has dropped from $1.50 to $1.48 over the past seven days.

The Zacks Consensus Estimate for MNST’s current fiscal-year sales and EPS implies year-over-year growth of 9.7% and 22.8%, respectively. The consensus estimate for EPS for the current fiscal year has increased from $1.98 to $1.99 over the past seven days. The consensus mark for the next fiscal-year sales and EPS suggests a year-over-year jump of 9.5% and 13.2%, respectively. The consensus mark for EPS has risen by a penny to $2.25 over the past seven days.

Over the past year, shares of Celsius Holdings have surged 61.6% compared with Monster Beverage’s jump of 47%.

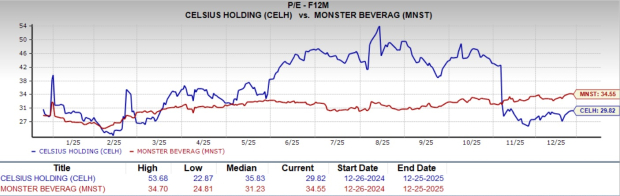

Celsius Holdings’ forward 12-month P/E of 29.82 stands below its one-year median of 35.83, indicating the stock is trading at a relative discount to its recent growth-driven valuation. Monster Beverage’s forward P/E of 34.55 sits above its median of 31.23, suggesting the stock is valued at a modest premium to its recent historical range. MNST’s premium valuation underscores its status as a high-quality, cash-generative leader in the energy drink category, with investors willing to pay up for consistency, brand strength and a long runway for international growth.

Both Celsius Holdings and Monster Beverage are well-positioned to benefit from the long-term growth of the energy drink category, though through different paths. Celsius offers an attractive growth profile, supported by strong brand momentum, expanding distribution and a growing innovation pipeline, though near-term execution risks and integration-related volatility remain. Meanwhile, Monster Beverage stands out for its scale, consistency and global reach, underpinned by durable brands, strong cash generation and a proven operating model. At this juncture, MNST appears better suited for investors seeking stability and steady growth, while CELH remains an appealing option for growth-oriented investors willing to tolerate near-term variability.

MNST sports a Zacks Rank #1 (Strong Buy), whereas CELH currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite