|

|

|

|

|||||

|

|

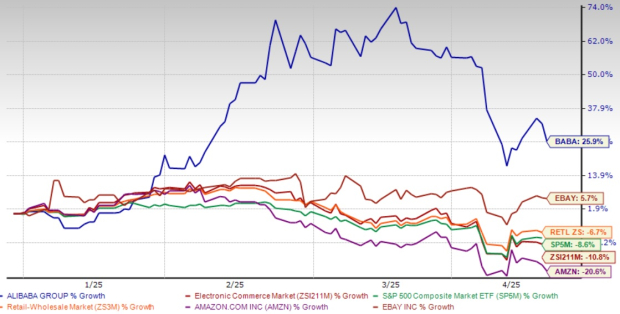

Alibaba Group BABA shares have already gained an impressive 25.9% year to date, outperforming the Zacks Internet-Commerce industry, the Zacks Retail-Wholesale sector and the S&P 500’s decline of 10.8%, 6.7% and 8.6%, respectively.

Although evidence suggests this Chinese tech giant still has a substantial runway ahead despite competition from global e-commerce bigwigs like Amazon AMZN and eBay EBAY. BABA also faces rising competition from the leading cloud players, namely Amazon, Microsoft and Google. Shares of Amazon have lost 20.6% year to date, while eBay has returned 5.7%.

Alibaba presents a compelling opportunity in 2025 with three key growth catalysts set to drive significant value creation.

Alibaba's December quarter results demonstrated remarkable progress in the company's strategic refocusing efforts. The e-commerce titan reported revenues of $38.38 billion, up 8% year over year. More impressive was the acceleration in customer management revenues for Taobao and Tmall Group, which grew 9% year over year, reflecting successful monetization initiatives like software service fees and increasing adoption of Quanzhantui.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $137.03 billion, indicating 5.01% year-over-year growth. With the Zacks Consensus Estimate for fiscal 2025 earnings indicating an upward revision of 1.4% over the past 30 days to $8.92 per share, the market appears to be optimistic about Alibaba's growth trajectory.

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

See the Zacks Earnings Calendar to stay ahead of market-making news.

Recent developments in AliExpress highlight the company's international growth momentum. The platform introduced AliExpressLocal Marketplace, a new self-serve option that provides U.S. sellers with greater flexibility and control over pricing, marketing, and merchandising. This expansion has already yielded impressive results, with the platform's March Expo event recording a 27% year-on-year increase in orders from U.S. SME buyers. Sports products saw particularly strong growth, with pickleball-related products surging 197%.

Additionally, Fliggy, Alibaba's travel subsidiary, recently unveiled AskMe, an AI-powered travel assistant designed to transform personalized travel planning. Powered by multiple intelligent agents integrated with Qwen AI models, AskMe breaks down complex travel requests and deploys specialized sub-agents to deliver real-time, bookable itineraries. This innovation positions Fliggy to capture greater market share in China's rebounding travel sector, which has seen "Buy Now, Plan Later" travel bookings increase more than 20% in 2024.

The second compelling reason to consider Alibaba stock is its aggressive and well-positioned AI strategy. The company's Qwen AI model family has achieved remarkable traction, with more than 90,000 derivative models developed globally, making Qwen the most popular among developers across major model families. More than 290,000 companies and developers have already accessed Qwen APIs through Alibaba Cloud's platform.

Notably, AI-related product revenues have maintained triple-digit growth for an impressive six consecutive quarters. This momentum has prompted Alibaba to make its most significant long-term investment commitment ever, planning to invest more in cloud and AI infrastructure over the next three years than it did in the past decade combined.

Alibaba's recent AI innovations are rapidly transforming into commercial success. The company's AI-driven B2B search engine, Accio, reached one million users within just five months of launch. Built on Alibaba's Qwen large language model, Accio has introduced two powerful new features: Business Research, which automates market analysis and generates actionable business plans, and Deep Search, which revolutionizes global sourcing by adapting to intricate requirements. These applications directly address the needs of the 64% of sourcing decision-makers across the United States, United Kingdom, Germany, and France who plan to integrate AI into their strategies by 2025.

Alibaba's affiliate, Ant Group, has made significant strides in AI model development, showcasing an innovative approach to reducing AI training costs. By strategically combining Chinese and U.S.-made semiconductors, Ant Group has reduced the time and computational expenses associated with training AI models. The company reported a 20% reduction in computing costs through its unique approach, which limits reliance on a single-chip supplier like NVIDIA Corporation NVDA.

Investors should consider Alibaba stock for its exceptional financial position and growing commitment to shareholder returns. The company maintains a robust net cash position of $51.9 billion, providing ample resources for both strategic investments and significant shareholder returns.

Management has delivered on its commitment to enhance shareholder value through substantial buybacks, with $1.3 billion of repurchases in the December quarter alone. Combined with approximately $10 billion repurchased in the first half of the fiscal year, Alibaba achieved a 5% net reduction in share count over just nine months. With $20.7 billion remaining in the authorized buyback program through March 2027, this trend of steadily reducing share count could continue to boost per-share earnings.

BABA has also made impressive progress in simplifying its corporate structure and enhancing operating efficiency. The company has completed the sale of non-core assets like Sun Art and Intime for combined proceeds of approximately $2.6 billion, streamlining operations to focus on higher-growth, higher-margin businesses. This capital discipline, alongside innovative investments, presents an attractive balance between growth and shareholder returns.

Alibaba is currently trading at a discount with a forward 12-month Price/Earnings of 9.8X, lower than the industry’s 19.17X. This valuation metric indicates that BABA's stock is significantly undervalued compared to its industry peers, trading at nearly half the industry average P/E ratio. The lower-than-median forward P/E suggests an attractive entry point for investors, as the stock appears to be trading below its fair market value despite strong fundamentals.

While Alibaba stock has already delivered impressive gains in 2025, the company's strengthening fundamentals across e-commerce, cloud computing, and AI position it for sustainable long-term growth. Its massive infrastructure investments, expanding ecosystem of AI applications, and commitment to shareholder returns create a compelling investment case beyond the recent price appreciation. For investors seeking exposure to both AI transformation and Asian e-commerce growth, Alibaba offers a unique value proposition at current levels. BABA stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite