|

|

|

|

|||||

|

|

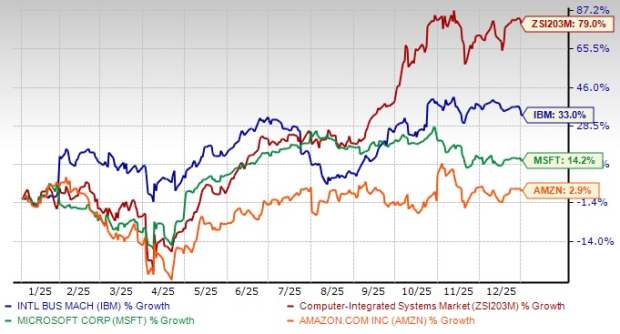

International Business Machines Corporation IBM has surged 33% over the past year compared with the industry’s growth of 79.1%, driven by a strong demand for hybrid cloud and artificial intelligence (AI) products. The stock has outperformed peers like Microsoft Corporation MSFT and Amazon.com, Inc. AMZN. While Microsoft has gained 14.2%, Amazon rallied 2.9% over this period.

One-Year Stock Price Performance of IBM

IBM is poised to benefit from healthy demand trends for hybrid cloud and AI, which drive the Software and Consulting segments. The company’s growth is expected to be aided by analytics, cloud computing and security in the long run. A combination of a better business mix, improving operating leverage through productivity gains and increased investment in growth opportunities will likely boost profitability.

With a surge in traditional cloud-native workloads and associated applications, along with a rise in generative AI deployment, there is a radical expansion in the number of cloud workloads that enterprises are currently managing. This has resulted in heterogeneous, dynamic and complex infrastructure strategies, which have led firms to undertake a cloud-agnostic and interoperable approach to highly secure multi-cloud management. This, in turn, has translated into a healthy demand for IBM hybrid cloud solutions. In addition, the buyout of HashiCorp has significantly augmented the company’s capabilities to assist enterprises in managing complex cloud environments. HashiCorp’s tool sets complement IBM RedHat’s portfolio, bringing additional functionalities for cloud infrastructure management and bolstering its hybrid multi-cloud approach.

IBM’s watsonx platform is likely to be the core technology platform for its AI capabilities. watsonx delivers the value of foundational models to the enterprise, enabling them to be more productive. This enterprise-ready AI and data platform comprises three products to help organizations accelerate and scale AI: the watsonx.ai studio for new foundation models, generative AI and machine learning, the watsonx.data fit-for-purpose data store built on an open lake house architecture and the watsonx.governance toolkit to help enable AI workflows to be built with responsibility and transparency.

IBM has collaborated with Cisco Systems, Inc. CSCO to develop a connected network of fault-tolerant quantum computers by 2030. The companies aim to pool their individual resources and key expertise to create a pathway toward an exponentially large computational space, leading to the formation of a quantum computing Internet. This is likely to create a platform where many distributed quantum-based technologies, such as quantum computers, quantum sensors and quantum communications, are connected to share information across distances.

As part of this collaborative effort, IBM intends to develop a quantum networking unit (QNU) to serve as the interface linking several quantum computers to a quantum processing unit (QPU). This will facilitate the conversion of stationary quantum information in the QPU into "flying" quantum information for transfer across potentially multiple quantum computers through a network. Cisco is developing a high-speed software protocol framework that can continuously and dynamically reconfigure network paths to drive the quantum information transfer required for a given quantum algorithm or application.

It has also unveiled IBM Quantum Nighthawk – the most advanced quantum processor developed to date. With an architecture that complements high-performing quantum software, IBM Quantum Nighthawk boasts superior qubit connectivity that enables users to execute circuits with 30% more complexity than its predecessors. The quantum processor brings a new dimension to the realm of quantum computing by enabling users to increase the complexity of algorithms in the quantum hardware. As users seek to achieve quantum advantage — where quantum computers outperform the classical ones — the new quantum processor could pave the way for technological innovations across the quantum ecosystem, with future reiterations far exceeding the current performance.

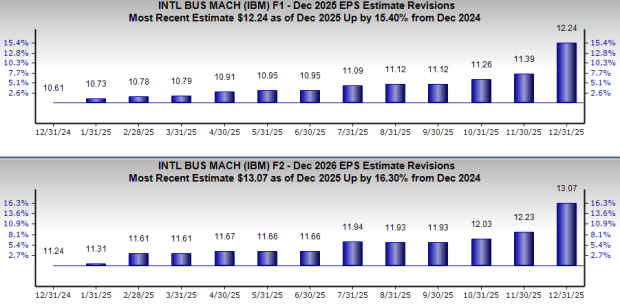

IBM is currently witnessing an uptrend in estimate revisions. Earnings estimates for 2025 have jumped 15.4% to $12.24 over the past year, while the same for 2026 has increased 16.3% to $13.07. The positive estimate revision portrays bullish sentiments about the stock’s growth potential.

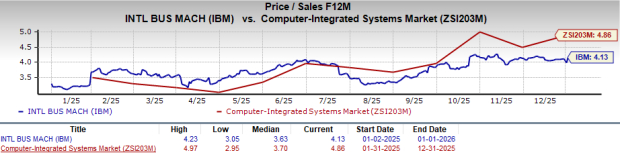

From a valuation standpoint, IBM appears to be trading at a discount relative to the industry but is trading well above its mean. Going by the price/sales ratio, shares of IBM currently trade at 4.13 forward sales, lower than 4.86 for the industry but higher than the stock’s mean of 3.63.

With solid fundamentals and healthy revenue-generating potential, driven by robust demand trends, IBM appears to be a solid investment proposition. Further, a strong emphasis on hybrid cloud & AI, diligent execution of operational plans and focus on quantum technology are driving more value for customers.

Moreover, with improving earnings estimates, the stock is witnessing a positive investor perception at the moment. The stock is also trading at a relatively cheaper rate than the industry.

IBM delivered a trailing four-quarter average earnings surprise of 8.1% on average. IBM currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Riding on a robust earnings surprise history and favorable Zacks Rank, it appears primed for further stock price appreciation. Consequently, investors are likely to profit if they bet on this high-flying stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 50 min | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

MSFT

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite