|

|

|

|

|||||

|

|

As digital transformation reshapes industries worldwide, Equinix EQIX stands out as a cornerstone of the global digital infrastructure ecosystem.

Analysts seem bullish on this Zacks Rank #2 (Buy) stock. The estimate revision trend for 2026 funds from operations (FFO) per share indicates a favorable outlook for the company, with estimates moving north over the past two months.

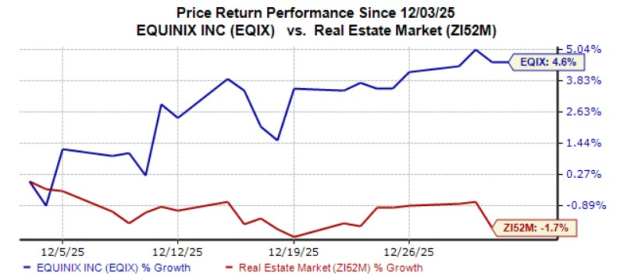

Over the past month, shares of Equinix have increased 4.6%, outperforming the real estate market. Given its solid fundamentals and positive estimate revisions, the stock is likely to keep performing well in the quarters ahead.

Solid Market Fundamentals and Recurring Revenues: Enterprises and service providers are steadily integrating artificial intelligence (AI) into their operations and expanding their digital transformation initiatives, a trend that is expected to sustain strong demand in the near term. In this environment, Equinix’s geographically diverse portfolio of IBX data centers stands to gain from enterprises’ growing reliance on technology and the accelerated pace of digital transformation efforts.

Its business generates a substantial portion of monthly recurring revenue bookings (greater than 90% of total revenues over the last three years) from existing customers. The company generated 36% of its recurring revenues from its 50 largest customers in the second quarter of 2025. Given the growing demand for data exchanges worldwide, Equinix is well-positioned to grow its revenue base. Higher revenues, along with lower costs, will expand margins and increase profitability in the long run.

Portfolio Strength: Equinix has been achieving continued business momentum with its critical mass of customers and the resultant “network effect” within its IBX centers. Direct interconnection with its networks enables customers to increase the efficiency of their IT infrastructure, remove complexities associated with infrastructure administration and management and reduce costs.

Further, the benefits provided by the Platform Equinix have led to a loyal and blue-chip customer base. Platform Equinix's global reach, low-latency interconnection to the world's networks, robust ecosystems and cloud adjacency are increasingly being recognized by both enterprises and service providers as essential elements in private AI infrastructure. As a result, Equinix is gaining importance as a preferred location for private AI infrastructure deployment, which is likely to benefit the company over the long term. Currently, through its 273 IBX data centers, in 77 metros across 36 countries, customers can connect and satisfy their critical traffic exchange requirements.

Expansion Efforts: Equinix continues focusing on acquisitions and developments to expand data-center capacity in key markets and strengthen its competitive positioning and global reach. In September 2025, Equinix announced the opening of its first IBX data center, CN1, in Chennai, India. This facility is located in Siruseri, Tamil Nadu, covering nearly six acres. In June 2025, Equinix completed its acquisition of three data centers in Manila, Philippines, for $183 million from Total Information Management ("TIM").

The company’s expansion efforts have increased its total number of IBX data center facilities to 273 as of Sept. 30, 2025. Moreover, Equinix has an encouraging development pipeline. As of Sept. 30, 2025, it had 58 major projects underway across 34 markets in 24 countries, including 12 xScale builds.

Balance Sheet Strength: Equinix’s robust balance sheet position enables it to capitalize on long-term growth opportunities. As of Sept. 30, 2025, the company’s liquidity totaled $6.9 billion. Moreover, it enjoyed investment-grade credit ratings of Baa2 from Moody’s, BBB+ rating from S&P Global Ratings and BBB+ from Fitch Ratings as of the end of the third quarter of 2025, rendering it favorable access to the debt market.

Favourable Dividend: Solid dividend payouts remain the biggest attraction for REIT investors, and Equinix has remained committed to that. Moreover, Equinix has increased its dividend five times in the past five years, and its payout has grown 13.78% over the same period. EQIX's payout ratio currently sits at 50% of earnings. Given a robust operating platform and healthy financial position, its dividend distribution is expected to be sustainable over the long run.

Some other top-ranked stocks from the REIT sector are Digital Realty Trust DLR and Prologis PLD, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for DLR’s 2026 FFO per share is pegged at $7.91, suggesting a 7.6% increase year over year.

The Zacks Consensus Estimate for PLD’s 2026 FFO per share is pegged at $6.09, calling for a rise of 4.9% year over year.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite