|

|

|

|

|||||

|

|

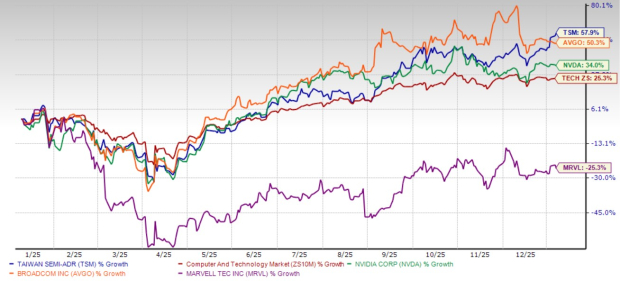

Taiwan Semiconductor Manufacturing Company TSM, also known as TSMC, shares hit a 52-week high of $333.08 yesterday before closing at $327.43. TSM stock has soared 57.9% over the past year, easily surpassing the broader Zacks Computer and Technology sector’s gain of 25.3% over the same time frame.

TSMC is benefiting from the artificial intelligence (AI) boom by manufacturing advanced chips for major AI clients like NVIDIA Corporation NVDA, Broadcom Inc. AVGO and Marvell Technology, Inc. MRVL, which has led to record profits and a significant increase in revenues.

Taiwan Semiconductor stock has also outpaced several chip peers, including Broadcom, NVIDIA and Marvell Technology. Over the past year, shares of Broadcom and NVIDIA have soared 50.3% and 34%, respectively, while Marvell Technology has declined 25.3%.

This outperformance shows investors are becoming increasingly confident in Taiwan Semiconductor’s long-term story, even during a volatile market shaped by trade conflicts and geopolitical risks. We believe this momentum is grounded in strong fundamentals, and TSM’s long-term outlook justifies a hold position for now.

Taiwan Semiconductor continues to lead the global chip foundry market. Its scale and technology make it the first choice for companies driving the AI boom. NVIDIA, Marvell and Broadcom all count on TSMC to build advanced graphics processing units (GPUs) and AI accelerators.

AI-related chip sales have become a major driver. Though the actual figures will be known from the company’s upcoming fourth-quarter 2025 results, the contribution of AI-related chip sales is anticipated to reach approximately 30% of total revenues in 2025, up from mid-teens percentage in 2024. Management had also previously expected that AI revenues would grow 40% annually over the next five years. That makes TSMC central to the AI supply chain.

To keep up with the growing demand for AI chips, Taiwan Semiconductor is spending aggressively. The company had previously projected to invest between $40 billion and $42 billion in capital expenditures in 2025, far outpacing its $29.8 billion investment in 2024. The bulk of this spending, approximately 70%, is focused on advanced manufacturing processes, ensuring TSMC remains ahead of other chip manufacturing rivals.

Taiwan Semiconductor’s latest earnings report highlights just how dominant the company remains. In the third quarter of 2025, TSM’s revenues surged 41% year over year to $33.1 billion, while earnings per share (EPS) jumped 39% to $2.92. This growth was powered by the booming demand for its advanced 3nm and 5nm nodes, which now account for 60% of total wafer sales. Gross margins improved 170 basis points to 59.5%, reflecting better cost efficiencies.

Taiwan Semiconductor Manufacturing Company Ltd. price-consensus-eps-surprise-chart | Taiwan Semiconductor Manufacturing Company Ltd. Quote

Buoyed by strong demand for its 3nm and 5nm chips, Taiwan Semiconductor raised its revenue growth guidance for full-year 2025 to a mid-30% range from around 30% projected earlier. Analysts are also optimistic about the company’s prospects in 2026. The Zacks Consensus Estimate for full-year 2026 revenues and EPS indicates year-over-year improvement of 20.8% and 20%, respectively.

Despite its strengths, Taiwan Semiconductor witnesses near-term hurdles. Softness in key markets like PCs and smartphones also dampens near-term prospects. According to a report by the International Data Corporation, these traditionally strong revenue drivers are projected to see a decline in shipments in 2026, limiting Taiwan Semiconductor’s growth despite rising AI demand.

The company’s global expansion strategy adds further strain. New fabs in the United States (Arizona), Japan and Germany are vital for geopolitical risk mitigation, but they come with higher costs. These facilities are expected to drag down gross margins by 2-3 percentage points annually over the next three to five years due to higher labor and energy costs, along with lower utilization rates in the early stages.

Escalating geopolitical tensions, particularly U.S.-China relations, pose strategic risks. With significant revenue exposure to China, Taiwan Semiconductor is vulnerable to export restrictions, supply-chain disruptions or further regulatory pressure. These uncertainties could weigh on near-term performance.

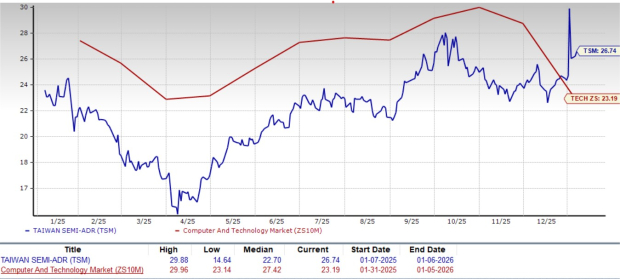

Taiwan Semiconductor stock isn’t cheap. It trades at a forward 12-month price-to-earnings (P/E) of 26.74X compared with the sector average of 23.19X.

Compared with other major semiconductor players, Taiwan Semiconductor has a lower P/E ratio than Broadcom, NVIDIA and Marvell Technology. Currently, Broadcom, NVIDIA and Marvell Technology trade at P/E multiples of 32.33, 26.64 and 24.95, respectively.

Taiwan Semiconductor remains a cornerstone of the semiconductor industry. Its unmatched capabilities in advanced chip manufacturing, strong exposure to AI demand and expanding capacity give it a solid long-term trajectory.

However, premium valuation and short-term headwinds, including weakness across the consumer end market, global expansion pressures and geopolitical friction, call for a more cautious stance.

Currently, Taiwan Semiconductor carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 24 min |

Stock Market Today: Dow Skids As EU Makes Trump Tariff Move; These Gold Stocks Shine (Live Coverage)

NVDA

Investor's Business Daily

|

| 38 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow Dives As EU Makes Trump Tariff Move; Novo Plunges On This (Live Coverage)

NVDA

Investor's Business Daily

|

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite