|

|

|

|

|||||

|

|

JPMorgan JPM is one of the “Big Four” global banks, benefiting from immense scale and a highly diversified mix across consumer and community banking, corporate and investment banking, commercial banking and asset & wealth management. PNC Financial Services PNC, by contrast, is a leading super-regional bank known for disciplined underwriting, measured balance sheet growth and selective expansion within attractive U.S. markets.

With interest rates substantially down from the highs of 5-5.25%, it is important to understand how both these “systematically important financial institutions” navigate the evolving operating backdrop. Let’s analyze JPMorgan and PNC Financial’s business models to determine which one presents a solid investment opportunity.

JPMorgan’s balance sheet is highly asset-sensitive. Therefore, rate cuts are likely to adversely impact the company’s net interest income (NII). Lower rates will lead to reduced asset yields on variable-rate loans and securities, compressing margins unless deposits or funding costs are repriced more quickly.

JPMorgan expects the near-term impact of rate cuts to be manageable, driven by robust loan demand and deposit growth. Management projects its 2025 NII to be $95.8 billion, implying almost 3% year-over-year growth. Further, the company projects 2026 NII (excluding Markets) to be nearly $95 billion, driven by balance sheet growth and mix, partially offset by the impact of lower rates.

The shift toward easier monetary policy is expected to support client activity, deal flow and asset values. Thus, JPMorgan’s non-interest income streams will likely see robust improvement.

Moreover, JPM continues to invest in brick-and-mortar to strengthen its competitive edge in relationship banking, having a presence in all 48 contiguous states. In 2024, JPMorgan opened nearly 150 branches and plans to add 500 more by 2027 to deepen relationships and boost cross-selling across mortgages, loans, investments and credit cards. The company has also expanded through strategic acquisitions, including a larger stake in Brazil’s C6 Bank, partnerships with Cleareye.ai and Aumni, and the 2023 purchase of First Republic Bank.

Lower rates will likely support JPMorgan's asset quality, as declining rates will ease debt-service burdens and improve borrower solvency. The company lowered its 2025 card charge-off rate to approximately 3.3% from the previously expected 3.6% “on favorable delinquency trends.”

Similar to JPM, PNC Financial is expected to have a limited impact of interest rate cuts on its 2025 NII. The repricing of fixed-rate assets, loan growth and stabilizing funding costs are expected to support the metric. Management anticipates NII to rise 6.5% year over year in 2025.

Last week, PNC completed its previously announced acquisition of FirstBank Holding Company. This significantly strengthens the company’s presence in Colorado and Arizona, two of the fastest-growing banking markets in the United States. Further, it has been accelerating growth through acquisitions and partnerships, with an aim to broaden its capabilities and revenue streams.

Last year, it acquired Aqueduct Capital Group, strengthening fund placement services at its global IB arm, Harris Williams. In 2024, it partnered with Plaid to enable secure data sharing and expanded its TCW Group alliance to offer private credit to middle-market firms. These, together with earlier moves like the 2022 acquisition of Linga and the 2021 buyout of BBVA USA, help diversify its business mix.

Further, PNC has announced plans to enhance its coast-to-coast branch network. By 2030, it aims to invest $2 billion to open more than 300 new branches across 20 U.S. cities and renovate its existing locations. With the addition of these branches, the company will solidify its position as one of the largest retail banks in the United States.

An elevated expense base remains a headwind despite PNC Financial's cost-containment measures. Further, the lack of diversification in the loan portfolio is concerning and may put pressure on its asset quality.

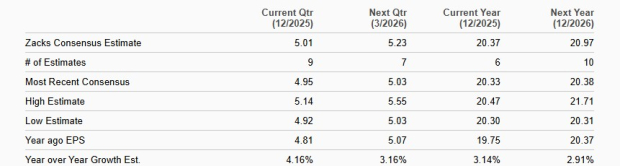

The Zacks Consensus Estimate for JPM’s 2025 earnings implies a rise 3.1% for 2025 and 2.9% for 2026. In the past seven days, earnings estimates for 2025 have been revised north, while for 2026, it has been revised lower.

JPM Earnings Estimate

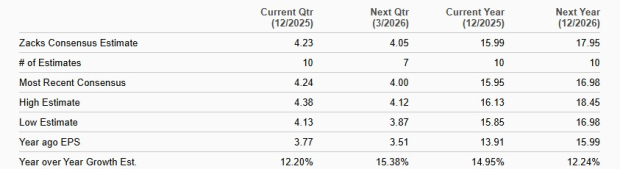

On the contrary, the Zacks Consensus Estimate for PNC’s 2025 and 2026 earnings indicates an 15% and 12.2% rise for 2025 and 2026, respectively. In the past week, earnings estimates have been revised upward.

PNC Earnings Estimate

In 2025, shares of JPMorgan performed well, given the bullish investor sentiments on the changing operating backdrop. The stock jumped 34.7%, while PNC Financial gained 8.4%. In terms of investor sentiment, JPM has the edge, making it a momentum play.

JPM & PNC One-Year Price Performance

In terms of valuation, JPM is currently trading at a 12-month forward price-to-earnings (P/E) of 15.34X, while PNC stock is currently trading at a 12-month forward P/E of 11.70X.

P/E F12M

Meanwhile, the industry has a 12-month forward P/E of 14.98X. Hence, PNC Financial is trading at a discount compared to the industry and JPM.

JPMorgan’s scale, diversification and sentiment support it in a more accommodative rate environment, but the stock looks more “steady-and-priced” than compelling. Rate cuts remain a headwind for its asset-sensitive balance sheet, keeping NII reliant on volume and mix to offset margin pressure. Even with a lift from capital-markets activity, branch expansion and solid credit trends, consensus earnings growth for 2025-2026 is modest and estimate revisions are mixed.

PNC Financial offers better risk-reward at today’s valuation. Management expects materially stronger NII growth for 2025, and consensus points to faster earnings expansion in 2025 and 2026. The bank is also combining organic investment in a broader branch footprint with targeted acquisitions and partnerships that deepen capabilities and expand into faster-growing markets. Although expenses and loan concentration warrant monitoring, those risks appear discounted in the company’s lower multiple versus JPM and the industry, making PNC the better buy.

Currently, PNC carries a Zacks Rank #2 (Buy), while JPM has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite