|

|

|

|

|||||

|

|

Since late 2025 till now, the global economic and strategic landscape has been drastically changing, backed by persistent geopolitical friction and trade tensions that are recalibrating world trade patterns and accelerating state-led technology agendas. A United Nations report projects global growth slowing to 2.7% in 2026, noting that increased U.S. tariffs and broader policy uncertainty have weighed on world trade, even as resilient activity in key markets has prevented complete disruption (Reuters).

Against this backdrop, policymakers are responding by forming new coalitions focused on securing critical technology supply chains, rather than traditional trade in goods alone. Most recently, Qatar and the UAE joined the U.S.-led Pax Silica initiative to strengthen cooperation in semiconductors and AI infrastructure. India is also expected to be invited as a full member in the coming months, reflecting broader efforts to secure global silicon supply chains.

In this shifting environment, the 2026 investment thesis for growth-oriented equity investors is increasingly anchored where advanced technology intersects with national security priorities—specifically AI, quantum technologies, and defense and security. These are not short-term trends. Instead, they are being structurally reinforced by government policy, expanding public budgets, and intensifying strategic competition among major economies. Three stocks that we picked from these genres are NVIDIA NVDA, Lockheed Martin LMT and International Business Machines IBM.

Let’s delve deeper.

Geopolitically, tariffs, export controls and technology restrictions, particularly around advanced semiconductors, AI accelerators and defense and security-related sensitive software, have reshaped global trade into parallel technology blocs rather than open markets.

The Pax Silica initiative reflects this shift. Unlike traditional trade deals focused on goods, it targets the entire semiconductor and AI value chain, from fabrication and advanced packaging to compute infrastructure and skilled talent among aligned countries. Qatar and the UAE’s participation highlights the role of energy-rich nations in financing fabs and data centers, while India’s expected inclusion underscores its growing importance as a manufacturing hub and strategic technology partner.

Against this backdrop, AI, quantum, as well as defense and security, stand out as the most compelling equity themes for 2026 because they sit at the intersection of commercial scale and government mandate. AI is increasingly embedded in defense systems, intelligence, logistics, and cybersecurity, ensuring demand beyond enterprise use. Quantum technologies, particularly sensing, secure communications and post-quantum cryptography, are being prioritized for their long-term strategic value. Defense and security act as the delivery channel, turning geopolitical risk into sustained, government-backed spending.

In AI infrastructure, apart from NVDA, AMD and Microsoft MSFT support sovereign compute and defense workloads. In defense, other stocks are Northrop Grumman, Palantir PLTR and RTX, which are expanding AI-enabled platforms and autonomous systems. In quantum, IonQ and Rigetti are also closely tied to government-funded research and security use cases.

NVIDIA: Through fiscal 2026 quarters, NVIDIA has reported strong Data Center revenue growth, including record $51.2 billion Data Center revenues in the third quarter of fiscal 2026, driven by high demand for its AI infrastructure platforms such as Blackwell. NVIDIA has also announced the upcoming Rubin platform, designed to accelerate large-context AI inference and reasoning workloads across cloud and enterprise deployments. With ongoing growth in sovereign AI cloud partnerships and broad adoption of its accelerated computing stack, NVIDIA is well-positioned at the nexus of AI infrastructure demand.

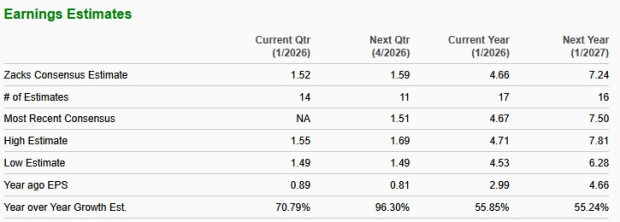

NVDA currently carries a Zacks Rank #3 (Hold). In fiscal 2027 (ending January 2027), the stock is projected to report earnings growth of 55.2% on 43.2% revenue improvement.

Lockheed Martin: The company is positioned to benefit from accelerating defense spending and geopolitical demand for advanced air-and-missile defense systems. In 2025, the U.S. Army awarded the company a $9.8 billion multiyear contract for nearly 2,000 Patriot Advanced Capability-3 Missile Segment Enhancement (PAC-3 MSE) interceptors, the biggest in the history of its Missiles and Fire Control unit. Lockheed is also part of a new seven-year framework agreement to more than triple PAC-3 MSE production capacity, reflecting sustained global demand amid heightened air-defense needs. The company is integrating AI and machine learning into missile guidance and other systems, enhancing decision speed and precision, and aligning its portfolio with national security priorities and stable government-backed revenues.

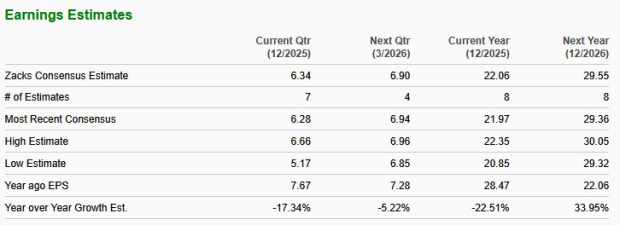

LMT currently carries a Zacks Rank #3. In 2026, the company is projected to report earnings growth of 33.9% on 4.2% revenue improvement.

IBM: It is positioned to gain from both enterprise AI transformation and the quantum computing race. Its strategic focus includes AI systems innovation and infrastructure trends for 2026, emphasizing integrated AI solutions that meet enterprise and sovereign requirements. On the quantum front, IBM is advancing new processors and ecosystem development aimed at achieving practical quantum advantage by late 2026, strengthening its role in future-proof computing platforms that governments and corporations are prioritizing.

IBM currently carries a Zacks Rank #2 (Buy). In 2026, the company is projected to report earnings growth of 7.5% on 5% revenue improvement. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 min | |

| 5 min | |

| 8 min | |

| 13 min | |

| 18 min | |

| 26 min | |

| 36 min | |

| 37 min | |

| 37 min | |

| 41 min |

Nvidia Stock Drops Despite Bullish Q4 Report. AI Angst Blamed.

NVDA -5.28%

Investor's Business Daily

|

| 45 min | |

| 46 min | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite