|

|

|

|

|||||

|

|

International Business Machines Corporation IBM and Microsoft Corporation MSFT are two of the leading players in the global cloud computing industry. IBM offers cloud and data solutions that aid enterprises in digital transformation. In addition to hybrid cloud services, the company provides advanced information technology solutions, computer systems, quantum computing and supercomputing solutions, enterprise software, storage systems and microelectronics.

On the other hand, Microsoft’s Azure cloud platform offers several hybrid solutions that can host applications and workloads and provide security and operational tools for hybrid environments. Azure hybrid services range from virtualized hardware that hosts traditional IT apps and databases to an integrated platform as a service solution for on-premises, edge and multi-cloud scenarios.

With a focus on hybrid cloud and AI (artificial intelligence), both IBM and Microsoft are strategically positioned in the cloud infrastructure market and have the wherewithal to cater to the evolving demands of business enterprises. Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

IBM is poised to benefit from healthy demand trends for hybrid cloud and AI, which drive the Software and Consulting segments. The company’s growth is expected to be aided by analytics, cloud computing and security in the long term. With a surge in traditional cloud-native workloads and associated applications, along with a rise in generative AI deployment, there is a radical expansion in the number of cloud workloads that enterprises are currently managing. This has resulted in heterogeneous, dynamic and complex infrastructure strategies, which have led firms to undertake a cloud-agnostic and interoperable approach to highly secure multi-cloud management, translating into a healthy demand for IBM hybrid cloud solutions.

In addition, the buyout of HashiCorp has significantly augmented the company’s capabilities to assist enterprises in managing complex cloud environments. HashiCorp’s tool sets complement IBM RedHat’s portfolio, bringing additional functionalities for cloud infrastructure management and bolstering its hybrid multi-cloud approach.

IBM’s watsonx platform is likely to be the core technology platform for its AI capabilities. watsonx delivers the value of foundational models to the enterprise, enabling them to be more productive. This enterprise-ready AI and data platform comprises three products to help organizations accelerate and scale AI: the watsonx.ai studio for new foundation models, generative AI and machine learning, the watsonx.data fit-for-purpose data store built on an open lake house architecture and the watsonx.governance toolkit to help enable AI workflows to be built with responsibility and transparency.

Despite solid hybrid cloud and AI traction, IBM is facing stiff competition from Amazon.com, Inc.’s AMZN Amazon Web Services and Microsoft Azure. Increasing pricing pressure is eroding margins, and profitability has trended down over the years, barring occasional spikes. The company’s ongoing, heavily time-consuming business model transition to the cloud is a challenging task. Weaknesses in its traditional business and foreign exchange volatility remain significant concerns.

Microsoft's Azure platform maintains a commanding position in the enterprise cloud market, capturing approximately 25% market share. The company's comprehensive cloud ecosystem benefits from deep integration with existing Microsoft enterprise products, creating substantial switching costs and customer stickiness. Azure's infrastructure capabilities are particularly well-suited for hybrid cloud deployments, addressing the complex needs of large organizations transitioning legacy systems.

The rising adoption of enterprise capabilities of Azure OpenAI and Copilots across Microsoft 365, Dynamics 365 and Power Platform is expected to be a game changer. With Azure AI, Microsoft is building out the app server for the AI wave, providing access to the most diverse selection of models to meet customers’ unique cost, latency and design considerations.

The company's substantial investment in OpenAI provides exclusive access to leading-edge language models, creating a significant competitive moat in enterprise AI adoption. Unlike competitors developing standalone AI products, Microsoft monetizes AI through existing customer relationships, reducing customer acquisition costs while expanding revenue per user. Early enterprise adoption metrics suggest a strong willingness to pay premium pricing for AI-enhanced productivity tools. The company's vast computing infrastructure and data resources create sustainable advantages in training and deploying AI models at scale, positioning Microsoft to capture substantial value as businesses increasingly prioritize AI implementation.

However, Microsoft's capital spending has reached alarming levels, raising serious concerns about return on investment and financial sustainability. Microsoft expects the fiscal 2026 capital expenditure growth rate to be higher than fiscal 2025, driven by accelerating demand and a growing RPO balance. The company's infrastructure buildout to support AI capabilities and cloud expansion requires tens of billions in annual capital expenditures, dramatically exceeding historical spending patterns. This aggressive investment strategy strains cash flow generation and limits financial flexibility for shareholder returns and strategic opportunities.

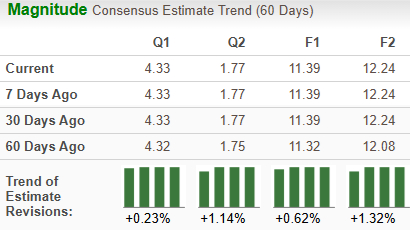

The Zacks Consensus Estimate for IBM’s 2025 sales and EPS implies year-over-year growth of 6.8% and 10.2%, respectively. The EPS estimates have been trending northward over the past 60 days.

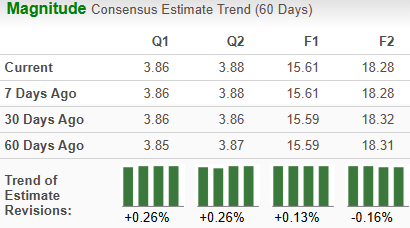

The Zacks Consensus Estimate for Microsoft’s fiscal 2026 sales and EPS indicates year-over-year growth of 15.4% and 14.4%, respectively. The EPS estimates have been trending northward over the past 60 days.

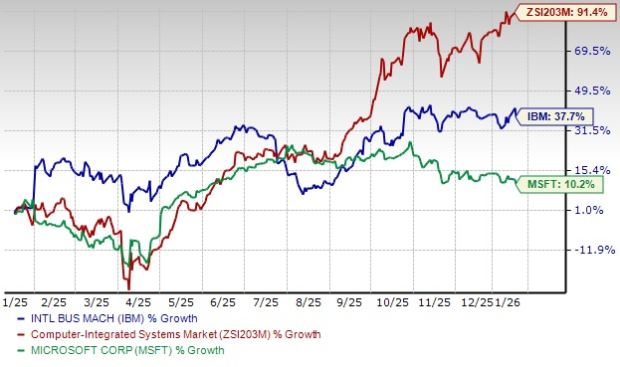

Over the past year, IBM has gained 37.7% compared with the industry’s growth of 91.4%. Microsoft has jumped 10.2% over the same period.

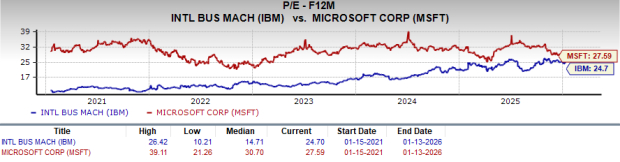

IBM looks more attractive than Microsoft from a valuation standpoint. Going by the price/earnings ratio, IBM’s shares currently trade at 24.7 forward earnings, lower than 27.59 for Microsoft.

While IBM carries a Zacks Rank #3 (Hold), Microsoft has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both companies expect their sales and profits to improve. Microsoft has shown steady revenue and EPS growth for years, while IBM has been facing a bumpy road. However, IBM has a better price performance and attractive valuation metrics. Nevertheless, based solely on Zacks Rank, Microsoft seems to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 21 min | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite