|

|

|

|

|||||

|

|

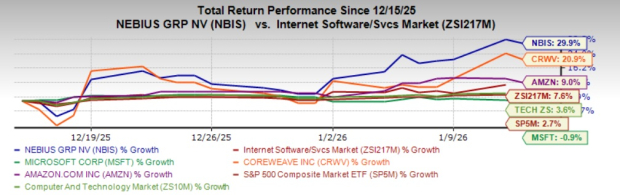

Nebius Group N.V. NBIS stock has gained 29.9% in the past month, outperforming the Zacks Computer & Technology sector and the Zacks Internet Software Services industry’s growth of 3.6% and 7.6%, respectively. The S&P 500 composite is up 2.7% over the same time frame. The company’s shares have surged 97% in the past six months.

NBIS has outpaced its peers, Microsoft Corporation MSFT, Amazon.com, Inc. AMZN and CoreWeave, Inc. CRWV, with MSFT falling 0.9% but AMZN and CRWV climbing 20.9% and 9%, respectively, during the same interval.

Following a strong rally, investors may wonder whether NBIS still has upside or if expectations have outpaced fundamentals. Let’s break down to see what’s driving the rally, the bull and bear cases, and a practical approach to managing risk and position size.

Nebius operates in a supply-constrained AI infrastructure market, where demand for GPU capacity significantly outstrips available power and data-center readiness. To capitalize on this imbalance, the company is aggressively expanding its infrastructure footprint, raising its contracted power target to 2.5 gigawatts by 2026 from an earlier projection of 1 gigawatt. By the end of 2026, Nebius expects 800 megawatts to 1 gigawatt of fully connected capacity to be operational.

Nebius continues to gain momentum with AI-native startups such as Cursor and Black Forest Labs, viewing these partnerships as essential to building its long-term growth engine. Its multi-billion-dollar agreements with Microsoft of contract value between $17.4 billion and $19.4 billion and Meta of up to $3 billion further underscore the confidence major tech players are placing in Nebius. The company’s deals with Microsoft and Meta are expected to have begun contributing late in the fourth quarter of 2025, with the bulk of revenue estimated through 2026.

Also, Nebius is deepening its enterprise offerings with the launch of the Aether 3.0 cloud platform and the Nebius Token Factory, an inference solution built to run open-source models at scale. In December 2025, Nebius announced the launch of Nebius AI Cloud 3.1, the latest version of its full-stack AI cloud platform designed to address these needs. Built on the Nebius AI Cloud “Aether” framework, version 3.1 integrates next-generation NVIDIA Blackwell Ultra infrastructure, offers transparent GPU capacity management, expands AI/ML developer tools and enhances enterprise-grade security and compliance features.

Recently, Nebius announced the deployment of the NVIDIA Rubin platform across Nebius AI Cloud and Token Factory, which will start in the second half of 2026. This move positions it at the forefront of next-generation reasoning and agentic AI transition. As an NVIDIA Cloud Partner and Exemplar Cloud Partner, NBIS will be among the first AI cloud providers globally to offer NVIDIA Vera Rubin NVL72, unlocking advanced AI capabilities for customers in the United States and Europe.

Apart from these, the company is investing aggressively in expanding its global data center footprint, with a strong focus on securing power capacity well ahead of deployment. In third-quarter 2025, Nebius launched its Israel data center with B200 GPUs and its U.K. facility with B300s, with much of this capacity presold ahead of opening.

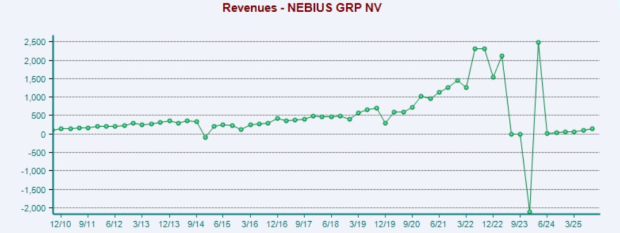

In 2026, Nebius plans to further expand its existing data centers in the U.K., Israel and New Jersey, while bringing new facilities online across the United States and Europe in the first half. Nebius is also securing multiple large-scale sites, each capable of delivering hundreds of megawatts, with several expected to become operational before the end of 2026. The company is targeting $7–$9 billion in ARR by 2026 and is likely to have generated $900 million-$1.1 billion in ARR by the end of 2025.

Nebius Group N.V. price-consensus-chart | Nebius Group N.V. Quote

However, no investment is without risk, and NBIS operates in a dynamic environment. The company continues to navigate macroeconomic uncertainty alongside rising operating expenses and heavy capital spending. Nebius raised its capital expenditure outlook from roughly $2 billion to about $5 billion for 2025. Such elevated capex levels increase risk if revenue growth does not keep pace with the company’s capital-intensive strategy, especially as AI demand could fluctuate amid competitive pricing pressures and evolving regulatory conditions. Moreover, scaling aggressively (multiple data centers in various regions) involves execution risk.

CRWV is also facing increasing supply-chain pressures, where demand for its AI cloud platform greatly exceeds available capacity, limiting its ability to serve customers fully. CoreWeave expects revenues of $5.05–$5.15 billion in 2025, down from the earlier estimated $5.15–$5.35 billion. On the other hand, Amazon’s heavy spending on AI and data center expansion is pressuring its finances. AMZN expects its capital expenditure to reach around $125 billion in 2025, with further increases planned for 2026.

In terms of Price/Book, NBIS shares are trading at 5.52X, higher than the Internet Software Services industry’s 3.99X.

Despite near-term headwinds, such as unfavorable macroeconomic conditions, heavy capital spending, increasing costs and stiff competition, the company continues to benefit from strong long-term tailwinds.

Investors could view the stock as a potential buy, particularly with a long-term investment horizon.

At present, NBIS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite