|

|

|

|

|||||

|

|

Shares of Target Corporation TGT have risen 22% over the past three months, outperforming the Zacks Retail - Discount Stores industry's growth of 9.4%. The company also outpaced the Retail-Wholesale sector’s return of 7.8% and the S&P 500's rally of 6.4% during the same period.

TGT’s Past 3-Month Performance

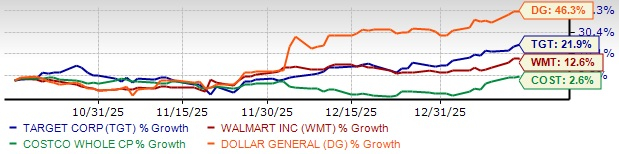

Target has also outperformed its peers, including Walmart Inc. WMT and Costco Wholesale Corporation COST, while underperforming Dollar General Corporation DG over the past three months.

Shares of Walmart, Costco and Dollar General have rallied 12.6%, 2.6% and 46.3%, respectively.

TGT vs. Peer Performances

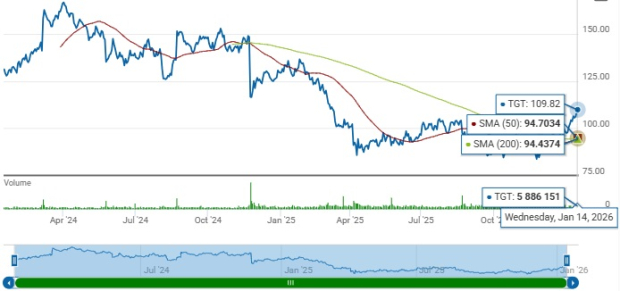

Closing at $109.82 yesterday, the TGT stock stands 24.3% below its 52-week high of $145.08 reached on Jan. 28, 2025. Target is trading above its 50 and 200-day simple moving averages of $94.70 and $94.44, respectively, indicating a favorable technical setup for the stock.

TGT Trades Below 50 & 200-Day Moving Averages

Despite the recent price appreciation, this leading general merchandise retailer is currently trading at a compelling discount relative to its industry. The TGT stock trades at a forward 12-month price-to-earnings (P/E) ratio of 14.24, lower than the industry’s average of 31.63.

TGT’s Valuation Snapshot

Walmart, Costco and Dollar General are all trading at higher forward P/E ratios of 40.89, 45.75 and 21.47, respectively, than Target. The key issue for investors is whether this discounted valuation reflects underlying business challenges or presents a buying opportunity.

The Zacks Consensus Estimate for Target’s fiscal 2025 projects a 1.6% year-over-year decrease in sales and a 17.7% decline in EPS. For fiscal 2026, the consensus estimate indicates a 2.3% rise in sales and 5.9% growth in earnings. The consensus estimate for EPS for the current and next fiscal years has increased by 1 cent to $7.30 and has been unchanged at $7.73, respectively, over the past 30 days.

Target is moving through a pivotal phase of transformation as design-led merchandising, elevated guest experience and technology initiatives gain momentum. The repositioning emphasizes curated assortments, trend-forward products and distinctive owned brands, supporting its role as a style-and-value destination. Digital channels continue to strengthen in the third quarter of fiscal 2025, helped by the growing adoption of convenience-led services such as same-day delivery and pickup.

Target Plus continues to expand as a marketplace offering, supported by a broader third-party assortment and higher engagement. Roundel, Target’s internal retail media network, is gaining influence, and is monetizing traffic and data with increasing efficiency. These platforms strengthen profitability and build higher-margin revenue streams that complement Target’s traditional merchandising model.

Technology-led innovation remains a key differentiator for Target. The company is extending its leadership in AI-enabled retail through a first-of-its-kind conversational shopping experience integrated with ChatGPT. This capability allows guests to browse curated assortments, complete multi-item purchases, shop fresh food, and select Drive Up, Pickup or shipping options in a single, seamless journey. Personalized recommendations enhance engagement, supporting Target’s strategy to blend convenience, discovery and value across touchpoints.

Operational execution is improving as advanced analytics enhance demand forecasting, assortment planning and speed to market. Tools like Target Trend Brain and synthetic audiences help identify trends early and test consumer response before launch. On-shelf availability for key items improved more than 150 basis points year over year in the fiscal third quarter, reflecting stronger inventory forecasting and in-stock execution.

Target plans to increase its capital expenditure 25% to $5 billion in fiscal 2026 to support store remodels, larger-format locations, expanded fulfillment and major floor-pad upgrades. Collectively, these efforts position Target to build a stronger foundation for sustained relevance and long-term growth.

Target continues to face a slow recovery in consumer demand as economic pressures weigh on discretionary spending. Fiscal third-quarter results met internal expectations, but overall performance remained under pressure. Comparable-store sales and foot traffic were weak, highlighting ongoing challenges across physical stores.

Management expects low-single-digit declines in net sales and comparable sales for the fourth quarter of fiscal 2025. In response to a volatile operating environment, Target tightened its full-year adjusted earnings view of $7.00-$8.00 per share versus the prior mentioned $7.00-$9.00. The current earnings projection indicates a sharp fall from adjusted earnings of $8.86 reported in fiscal 2024.

Target’s recent stock price increase shows that investors are encouraged by the company’s efforts to refresh its business and improve the shopping experience, but the turnaround is not complete yet. While long-term initiatives are moving in the right direction, near-term challenges like softer consumer demand and weaker store traffic are still holding back its performance.

Existing investors may consider staying invested, while new investors may want to wait for clearer signs of consistent improvement before buying the stock.

At present, TGT carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Retail customers file lawsuits over tariffs against FedEx and Ray-Bans maker

COST

Associated Press Finance

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite