|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

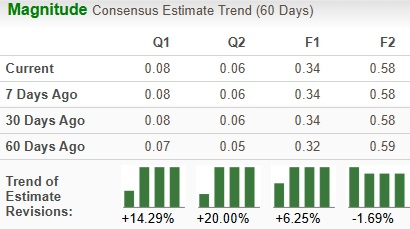

Intel Corporation INTC is scheduled to report fourth-quarter 2025 earnings after the closing bell on Jan. 22. The Zacks Consensus Estimate for sales and earnings is pegged at $13.37 billion and 8 cents per share, respectively. Over the past 60 days, earnings estimates for INTC have increased from 32 cents to 34 cents per share for 2025 but declined from 59 cents to 58 cents per share for 2026.

INTC Estimate Trend

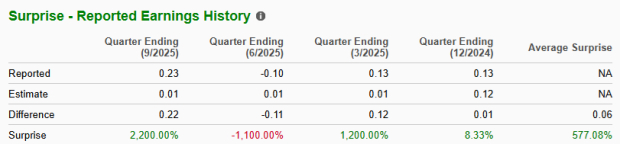

The leading semiconductor manufacturer delivered a stellar four-quarter earnings surprise of 577.1%, on average, beating estimates thrice. In the last reported quarter, the company’s earnings surprise was 2,200%.

Our proven model predicts an earnings beat for Intel for the fourth quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is perfectly the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Intel currently has an ESP of +17.39% with a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the quarter, Intel previewed the Intel Core Ultra series 3 processor (code-named Panther Lake) and Xeon 6+ (code-named Clearwater Forest). Manufactured in a new, state-of-the-art factory in Chandler, AZ, both products are built on Intel 18A, the most advanced semiconductor process in the United States. Panther Lake is designed to power a broad spectrum of consumer and commercial AI PCs, gaming devices and edge solutions. Clearwater Forest is an E-core server processor that enables business enterprises to scale workloads, reduce energy costs and power more intelligent services. These are likely to have generated more customer interest, translating into incremental revenues in the quarter.

During the to-be-reported quarter, industry grapevines were abuzz with Intel likely developing Apple Inc.’s AAPL M series chips for the latter’s MacBook Air and iPad Pro by early 2027. Although both companies’ spokespersons refused to comment on the matter, it created a renewed interest in Intel Foundry. With new management, Intel is undertaking a comprehensive review of its businesses to put the company back on its growth trajectory. Interim management has vouched to keep the core strategy unchanged despite efforts to drive operational efficiency and agility. The company is emphasizing the diligent execution of operational goals to establish itself as a leading foundry. These are likely to have generated additional revenues in the quarter.

However, Intel lagged NVIDIA Corporation NVDA on the innovation front, with the latter’s H100 and Blackwell graphics processing units being a runaway success. An accelerated ramp-up of AI PCs is likely to have affected the short-term margins of Intel as it shifted production to its high-volume facility in Ireland, where wafer costs are typically higher. Margins are also likely to have been adversely impacted by higher charges related to non-core businesses, charges associated with unused capacity and an unfavorable product mix. Consequently, Intel restructured its top management in the quarter to fuel its growth engine.

Moreover, China's supposed move to replace U.S.-made chips with domestic alternatives could significantly affect Intel as it derives a significant portion of its revenues from the communist nation. The recent directive to phase out foreign chips from key telecom networks by 2027 underscores Beijing's accelerating efforts to reduce reliance on Western technology amid escalating U.S.-China tensions. As Washington tightens restrictions on high-tech exports to China, Beijing has intensified its push for self-sufficiency in critical industries. This shift poses a dual challenge for Intel, as it faces potential market restrictions and increased competition from domestic chipmakers like Advanced Micro Devices, Inc. AMD and NVIDIA. These are likely to have adversely impacted its bottom line in the quarter under review.

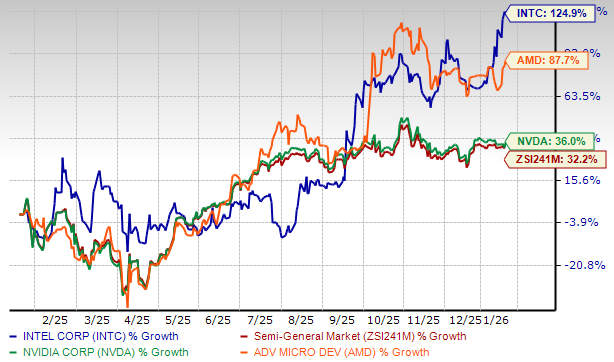

Over the past year, Intel has surged 124.8% compared with the industry’s growth of 32.2%, outperforming its peers, NVIDIA and AMD. While NVIDIA has gained 36%, AMD has soared 87.7% over this period.

One-Year INTC Stock Price Performance

From a valuation standpoint, Intel appears to be relatively cheaper than the industry but above its mean. Going by the price/sales ratio, the company’s shares currently trade at 4.25 forward sales, lower than 17.48 for the industry but higher than the stock’s mean of 2.46.

Intel's innovative AI solutions are set to benefit the broader semiconductor ecosystem by driving down costs, improving performance and fostering an open, scalable AI environment. It has secured a $5-billion investment from NVIDIA to jointly develop cutting-edge solutions that are likely to play an integral role in the evolution of the AI infrastructure ecosystem. Softbank also invested $2 billion in Intel to propel AI research and development initiatives that support digital transformation, cloud computing and next-generation infrastructure.

The company has received $7.86 billion in direct funding from the U.S. Department of Commerce for its commercial semiconductor manufacturing projects under the U.S. CHIPS and Science Act. The funds will support Intel in advancing critical semiconductor manufacturing and advanced packaging projects in Arizona, New Mexico, Ohio and Oregon, likely paving the way for innovation and growth.

However, increasing competition from other established players and emerging China-based firms is likely to adversely impact INTC’s bottom line. The communist nation’s stonewalling efforts and push for technological autonomy could reshape the dynamics of the semiconductor industry and affect Intel’s performance to a large extent. Moreover, Intel has been facing challenges due to the disruptive rise of over-the-top service providers in this dynamic industry. This has affected its margins. Price-sensitive competition for customer retention in the core business is expected to intensify in the coming days.

Intel's strategy for open, scalable AI systems extends beyond hardware, encompassing software, frameworks and tools. By fostering a broad ecosystem of AI players, including equipment manufacturers, database providers and software developers, Intel aims to offer enterprises a diverse range of solutions that cater to their unique GenAI requirements. This collaborative approach not only promotes innovation but also enhances interoperability and compatibility, empowering enterprises to leverage existing ecosystem partners with confidence.

However, it appears that the recent product launches are “too little too late” for Intel. With continued trade skirmishes and an on-and-off tariff regime, the stock is witnessing an uncertain business environment, although it is trading relatively cheaply. Intel seems to be treading in the middle of the road, and investors could be better off if they trade with caution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 52 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite