|

|

|

|

|||||

|

|

Alphabet is a leader in both quantum and artificial intelligence.

Microsoft created a new state of matter for its quantum technology.

Nvidia is bridging the gap between traditional and quantum computing.

Quantum computing investing is something that's on the horizon for many investors. Artificial intelligence (AI) is the big theme right now, and investors are focused on this area, with quantum computing potentially becoming relevant a few years down the road.

With that in mind, I believe the smartest move for investors is to focus on the AI aspect of some companies that are also competing in the quantum computing realm. There are a handful of companies that are doing this, and I think they make for the best quantum computing buys in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

On my shopping list are Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA), as all of these companies are excelling in AI, but also have significant quantum computing exposure.

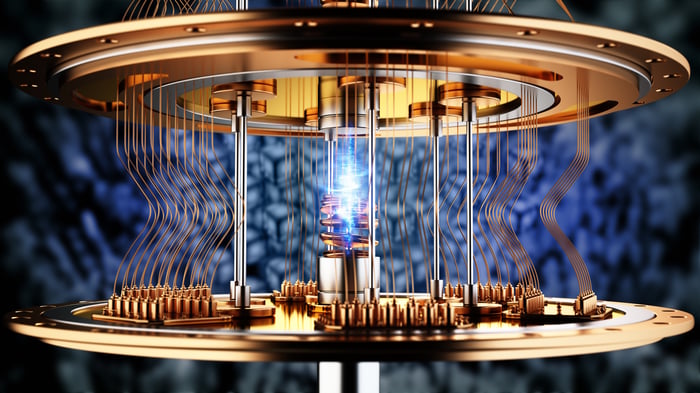

Image source: Getty Images.

Alphabet, the parent company of Google, has been heavily investing in creating an in-house quantum computing solution. This has several benefits, but it will all be for nothing if it can't produce viable results. The biggest hurdle quantum computing is facing in going mainstream is its accuracy, as it's incredibly difficult to control a particle's mechanics to utilize it for quantum computing. However, Alphabet is starting to see some positive results.

Back in October, Alphabet announced that it had delivered the first verifiable quantum advantage. It ran an algorithm 13,000 times faster than a traditional supercomputer. This algorithm has applications in multiple areas, but its biggest use case would be for MRI technology.

By taking a step toward commercial viability, it shows that Google's efforts are not in vain, and with the massive resources Alphabet has as a company, it can continue to fund Google's quantum computing research. Even if Google's quantum computing pursuits fall flat on their face, Alphabet is still a strong company in the generative AI realm, making it a great stock to own in general.

Microsoft has a similar backdrop to Alphabet, as it has nearly unlimited resources to sink into quantum computing. The reason both companies want to develop in-house solutions is so they don't need to pay an outside computing vendor for their computing hardware. This has become very expensive for AI, as Nvidia is making a huge profit from cloud computing providers like Microsoft and Alphabet. If each can develop its own solution in-house, it can cut out the middleman and make its cloud computing segment more profitable.

Microsoft's quantum computing pursuits have taken science to new levels, as it claims to have created a new state of matter as a byproduct of its quantum computing pursuits. There is a lot of new technology that's being developed by this industry, and Microsoft is a huge part of it.

Similar to Alphabet, if its quantum computing pursuits don't pan out, the stock will still be a great option to invest in, as its platforms have become a top option to build AI models on.

Last is Nvidia. The semiconductor giant may seem like an odd inclusion in this list because it isn't pursuing building a quantum processing unit (QPU) like the others. Instead, it's focusing on the most powerful traditional computing units available, its graphics processing units (GPUs).

However, it is aware of the effect quantum computing could have on the industry. It believes quantum computing will be most useful in a hybrid approach, where quantum and traditional computing methods are used in tandem to accelerate the computing process.

Quantum computing systems don't readily interface with the massive computing infrastructure that's been built out for AI and other computing methods. So, Nvidia launched its NVQLink, which allows quantum computers to plug into this interface to network into traditional computing stacks.

If Nvidia is right about the hybrid approach, it will be in great shape by selling the best traditional computing unit alongside the access port technology. However, it could be missing a huge market if QPUs start to replace more workloads than expected. We'll see if Nvidia's bet pays off, but as of right now, it appears to be going just fine for the world's largest company.

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $474,578!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,628!*

Now, it’s worth noting Stock Advisor’s total average return is 955% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 18, 2026.

Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 36 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite