|

|

|

|

|||||

|

|

“The long wait to cross a round number bears thinking about as the Dow sits on the cusp of 50000. While there’s nothing magical about them, milestones exert a psychological pull and often seem to be breached when stocks are frothy.”

- The Wall Street Journal, Jan. 13, 2026

January expiration week is behind us, and there was only one weak attempt at the S&P 500 Index (SPX – 6,940.01) 7,000 level, a strike with a plethora of call and put open interest (OI) that could have created pinning action on expiration Friday. However, Monday’s intraday high of 6,986 is as close as the index got to 7,000 last week, a level that has never been touched.

Round number awareness has surfaced as another benchmark, the Dow Jones Industrial Average (DJI – 49,359.33), is approaching a new milestone of its own, the 50,000 mark. But it too fell short of this achievement last week, with the high just under 300 points below this level.

As attention has turned toward overhead psychological levels on large-cap benchmarks such as the DJI and SPX, small-caps, as measured by the Russell 2000 Index (RUT – 2,677.74), have stood out.

After an early December breakout above the twin peak all-time highs from 2021 and 2024 at the 2,462 level, followed by a retest of this level to end 2025, the RUT has surged off its 50-day moving average, which was sitting at the old all-time highs when it retested these levels in late December.

Not only has the RUT distanced itself above its 2021 and 2024 all-time highs, but it closed out Friday comfortably above psychological resistance at the round 2,500 mark, after three separate head-fake moves above this level beginning in October. The RUT’s 8% return in 2026 has trounced the larger-cap SPX return of 1.5%, which is not off to a bad start either.

Investors should note this development, as the large dollars invested in large caps – specifically mega-cap technology names – may continue to shift into smaller-cap names and other non-technology stocks within the SPX in the future. If this occurs, the rotation could take months to play out, even though some may view the large performance gap to start the year as too late in the game.

“Amid multiple calls for a pullback that began in early August, we saw a range of valuation concerns. This included technical worries such as narrow breadth.”

- Monday Morning Outlook, Oct. 20, 2025

“Predictions of an up to 20% equity market drawback coming from big bank executives added fuel to the fire, as others fear limited market breadth and high tech concentration.”

- Schaeffer's Investment Research, Nov. 4, 2025

It should be noted, according to the excerpts above, that narrow breadth has long been a concern of market participants as a sign of a potential retreat in stocks. To the extent those same participants were short lagging names or sitting on the sidelines, the rotation caught them flat-footed.

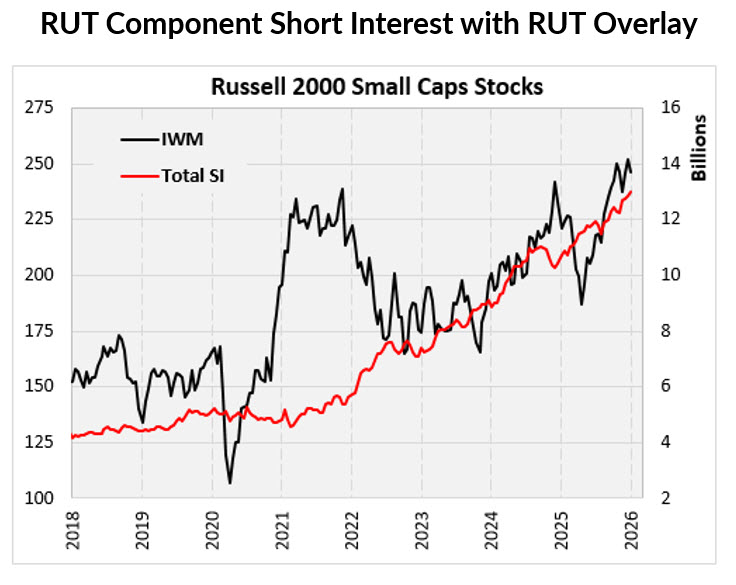

This is potentially bullish as improving breadth moves bears off the sidelines or short covering occurs among those playing the narrow breadth theme. In fact, per the graph below, many seem to be playing that theme, as is evident by the steady growth of short interest on RUT components. To a contrarian, the RUT all-time high combined with a multi-year high in short interest on its component stock is bullish, unless and until there is technical deterioration of note.

“... potential overhead resistance is at 7,000, which is not only important from a psychological perspective, but also has options-related significance. Multiple support levels are below, too, which adds pressure on the shorts. The first potential support level is at 6,920, which has acted mostly as resistance since late October… another area of support is between 6,845 (the 2025 close) and the upward-sloping 30-day moving average, currently situated at 6,865.”

- Monday Morning Outlook, Jan. 12, 2026

Even though the SPX is trailing the RUT early in 2026, there has not been technical deterioration of note, thanks to other stocks picking up the slack as investors rotate out of mega-cap names like Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA), Nvidia (NVDA) and Apple (AAPL), all of which are negative in 2026.

After the SPX took a run at 7,000 but fell short early last week, a pullback ensued. But levels that I discussed last week as potential support acted as such. The intraday low was just above its 30-day moving average, which was sitting at the October closing high. And the close on the day of the intraday low was at the site of the October 2025 intraday high. Judging by the price action to start 2026, and the fact that option buyers are extremely bullish on SPX component stocks, we could be in for more choppy action or even a retest of the 2025 close at 6,844, if last week’s lows are breached.

Consider small caps as part of your portfolio, in addition to focusing on leadership areas within the SPX that might fall outside the mega-cap technology group.

Todd Salamone is Schaeffer's Senior V.P. of Research

Continue Reading:

| 51 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite