|

|

|

|

|||||

|

|

According to one estimate, quantum computing can create up to $1 trillion in global economic value by 2035.

The prospect of future investments and early-stage partnerships has lit a fire under the shares of pure-play quantum computing stocks IonQ and Rigetti Computing.

However, investors are ignoring a competitive risk that can pull the rug out from beneath IonQ, Rigetti, and its pure-play peers.

For the better part of the last three decades, Wall Street and investors have had a game-changing technology or innovative trend to capture their attention and capital. Although artificial intelligence (AI) sports the highest addressable opportunity of any trend in recent memory, it was quantum computing stocks that took center stage in 2025.

Over the trailing 12-month period, as of mid-October 2025, shares of IonQ (NYSE: IONQ) were up by 670%, while Rigetti Computing (NASDAQ: RGTI) had soared by over 6,200%! These are potentially life-altering gains that occurred in the blink of an eye and speak to the long-term potential of quantum computers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

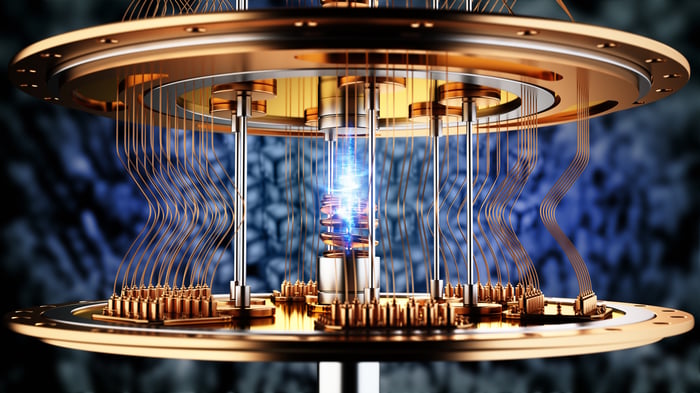

Image source: Getty Images.

However, every next-big-thing technology carries risks -- and quantum computing is no exception. While there are several reasons for investors to be excited about the future, one monumental headwind threatens to completely upend the near-parabolic rally for shares of IonQ and Rigetti Computing.

One of the easiest ways to garner attention on Wall Street is to dangle a large addressable opportunity in front of investors.

Quantum computing, which uses specialized computers to perform rapid, simultaneous calculations to solve complex problems that can't be tackled by classical computers, is viewed as a $450 billion to $850 billion addressable opportunity by 2040, according to analysts at Boston Consulting Group. Online publication The Quantum Insider sees the global value created by this technology reaching $1 trillion by 2035. Figures this robust suggest early innings investors could be big winners.

Quantum Computing 1 Year Returns 🤯$RGTI +6,217% $QBTS +3,912%$QUBT +2,798%$IONQ +670% pic.twitter.com/tzSN5ZqVjj

-- Connor Bates (@ConnorJBates_) October 13, 2025

Investors are also opening their eyes to the real-world use cases for quantum computers. While this is by no means a comprehensive list, this technology can be used to:

Perhaps the leading catalyst for the likes of IonQ and Rigetti Computing is the prospect of significant future investment(s). For example, JPMorgan Chase unveiled its $1.5 trillion Security and Resiliency Initiative in mid-October, which coincides with the parabolic move higher in most pure-play quantum computing stocks. JPMorgan Chase identified 27 sub-areas for future investment/financing, including quantum computing.

Lastly, we've observed early stage adoption of this technology by some of Wall Street's most influential companies. This includes Amazon and Microsoft (NASDAQ: MSFT), both of which are allowing subscribers of their respective quantum-cloud services (Braket for Amazon and Azure Quantum for Microsoft) to access IonQ's and Rigetti's quantum computers.

Image source: Getty Images.

However, the deck is stacked against early stage innovations. While some have gone on to be wildly successful, such as the internet, they've all shared a similar (and well-known) early trajectory that's involved bubble-bursting events.

Every hyped trend for more than three decades has required time to mature and develop. Even when new technologies were adopted early, it took businesses years to figure out how to optimize them to maximize sales and profits. This is what we observed with the advent of the internet and every subsequent hyped trend.

Quantum computing hasn't even hit broad-based commercialization yet. Although IonQ, Rigetti Computing, and other pure-play peers have announced a few brand-name clients and collaborations, quantum computers remain years away from tackling practical problem-solving more cost-effectively than classical computers.

But investors overestimating the early adoption, utility, and/or optimization rate of a game-changing technology is nothing new. There's a far more monumental risk for pure-play quantum computing stocks that investors seem oddly content to ignore. Namely, the barrier to entry is minimal.

For the time being, IonQ and Rigetti have the early mover advantage. Their unique quantum computers are light-years faster than classical computers and can be used to run simulations or to test quantum hardware. But sustaining this early mover advantage may prove impossible when stacked up against the "Magnificent Seven."

For instance, Google parent Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) unveiled the Willow quantum processing unit (QPU) in December 2024. This past October, the company announced that Willow successfully ran a quantum algorithm that was approximately 13,000 times faster than the world's quickest supercomputer.

Alphabet was sitting on $98.5 billion in combined cash, cash equivalents, and marketable securities as of Sept. 30 and generated over $112 billion in net cash from its operating activities through the first nine months of 2025. It has a virtual monopoly in internet search market share through Google and a desire to have its proverbial hand in every high-growth cookie jar. While IonQ and Rigetti Computing are just getting their feet wet and burning through their available capital, Alphabet has a solid floor and the cash flow to aggressively invest in quantum computing initiatives.

Alphabet isn't alone, either. Microsoft debuted its Majorana 1 QPU in February of last year, which the company claims can scale to 1 million qubits on a single chip. Microsoft has several highly profitable cloud and software segments, as well as ample cash on its balance sheet to invest in the quantum computing revolution.

Meanwhile, IonQ and Rigetti Computing haven't even demonstrated that their operating models are sustainable or that they'll have sufficient cash to reach recurring profitability. One or more members of the Magnificent Seven could very easily pull the rug out from beneath IonQ and Rigetti and steal their early thunder. Without a sustainable moat, both of these high-flying pure-play stocks are risky investments.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $470,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,091,605!*

Now, it’s worth noting Stock Advisor’s total average return is 930% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 22, 2026.

JPMorgan Chase is an advertising partner of Motley Fool Money. Sean Williams has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, IonQ, JPMorgan Chase, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 1 hour | |

| 1 hour | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite