|

|

|

|

|||||

|

|

The Cooper Companies, Inc.’s COO growth is fueled by CooperVision’s premium lens migration and MiSight’s myopia-management leadership, supported by CooperSurgical’s women’s health and fertility portfolio. However, channel volatility, private-label transition risks, Asia-Pacific softness and tariff/FX pressures weigh on near-term performance. Long-term opportunities remain strong, but execution and regional challenges could affect margin resilience and growth trajectory.

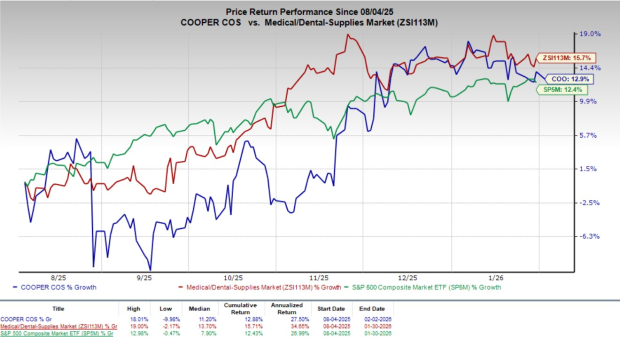

Shares of this Zacks Rank #2 (Buy) company have gained 12.9% in the past six months compared with the industry's 15.7% growth and the S&P 500 Index’s 12.4% rise.

Cooper Companies, with a market capitalization of $15.95 billion, is a global specialty medical device company.

COO’s bottom line is estimated to improve 7.8% over the next five years. Its earnings beat estimates in three of the trailing four quarters and met in one, delivering an average surprise of 2.41%.

Strong MyDay & Premium Lens Momentum: COO expects strong momentum in CooperVision to be driven by the continued global expansion of its MyDay premium daily silicone hydrogel portfolio, with strength building in first-quarter fiscal 2026 and the strongest results anticipated in the third and fourth quarters of fiscal 2026 as MyDay reaches full traction. The company has accelerated the global rollout of MyDay, improving product availability and expanding adoption across key markets. Management highlighted that accelerating adoption supported by improved manufacturing capacity, increased fitting activity and multiple new private-label contract wins secured in the third and fourth quarters of fiscal 2025 across the United States, Europe and Asia-Pacific will contribute during fiscal 2026.

CooperVision has guided 3.5%-4.5% organic growth for the first quarter of fiscal 2026, reflecting ongoing execution on contract ramps and some continued regional noise, particularly in Asia-Pacific. Growth is expected to step higher, driven by double-digit growth in MyDay, strength in torics, multifocals and Energys, and upcoming launches including MyDay Energys in Europe, continued APAC rollout of MyDay Multifocal and further global expansion of MyDay Toric parameters. Together, these factors favor MyDay, supporting sustained share gains, pricing resilience and accelerating revenue growth through fiscal 2026.

Meaningful Margin & Free Cash Flow Expansion: COO expects meaningful margin and free cash flow expansion for fiscal 2026, driven by operating discipline, restructuring benefits and a declining capital intensity profile. The reorganization completed in the fourth quarter of fiscal 2025 will deliver $50 million of annual pretax cost savings, equivalent to about 19 cents per share, beginning in fiscal 2026, with operating expenses expected to remain controlled across all quarters. Operating margins are expected to improve throughout fiscal 2026, driven by cost savings and operating expense leverage.

Free cash flow is projected to rise to $575-$625 million for the full year fiscal 2026, supported by higher earnings, working capital improvements, lower one-time costs and reduced capital expenditures as CooperVision’s investment cycle winds down. Despite some remaining reorganization and facility-related cash outflows, free cash flow is expected to strengthen throughout the year, positioning fiscal 2026 as a key step-up year toward the company’s $2.2 billion-plus cumulative free cash flow target through fiscal 2026-2028.

Aggressive Shareholder Returns & Capital Allocation: For fiscal 2026, the company emphasized aggressive shareholder returns and disciplined capital allocation as core priorities, building on $300 million of share repurchases completed in fiscal 2025, including almost $200 million in the fourth quarter alone. Management expects to allocate approximately two-thirds of fiscal 2026 free cash flow to share repurchases, with the remaining cash directed toward debt reduction. To reinforce the long-term commitment to returning capital, COO expanded the share repurchase authorization to $2 billion.

In parallel, the company launched a strategic review, with updates expected at the first quarter of fiscal 2026 earnings call, signaling openness to actions that could unlock shareholder value. Governance and incentive alignment were also strengthened with the addition of Total Shareholder Return to executive performance share plans beginning in fiscal 2026. As capital expenditures at CooperVision normalize, management expects accelerating free cash flow in fiscal 2027 to fund ongoing buybacks and balance sheet improvement, supporting EPS growth and valuation beyond fiscal 2026.

Gross Margin Pressure From Mix, Tariffs & Daily SiHy Growth: Despite improvement in earnings and operating margins, COO faces gross margin pressure driven by product mix and tariffs. Management explained that the increasing mix of daily silicone hydrogel lenses, including the growing MyDay portfolio, carries lower gross margins than CooperVision’s average, and this mix shift will remain a headwind throughout fiscal 2026 and across quarters. Tariffs are expected to continue weighing on gross margins in each quarter, partially offset by favorable foreign exchange at times.

Looking ahead to fiscal 2027, COO highlighted a positive inflection as CooperVision’s capital expenditures normalize and operating leverage improves, which should help offset ongoing mix-related gross margin pressure and support stronger free cash flow and overall profitability despite lower reported gross margin percentages.

Asia-Pacific Weakness & Fertility Market Uncertainty: The weakness in the Asia-Pacific market and uncertainty in the fertility market remain as key near-term headwinds. Sales in China declined 28% in fourth-quarter fiscal 2025 as the company pulled back from low-margin pure play e-commerce channels, a trend that weighed on APAC performance and is expected to create regional noise in first-quarter fiscal 2026. As a result, Asia-Pacific growth is projected to lag historical levels, contributing to more modest CooperVision growth early in the year.

In the CooperSurgical segment, fertility growth is guided conservatively, reflecting continued consumer spending pressure and uncertainty around competitive dynamics, including potential new IUD launches that could affect PARAGARD. Despite these challenges, e-commerce exposure is becoming a smaller part of the business, and year-over-year comparisons ease as fiscal 2026 progresses. Looking at fiscal 2027, the company highlighted improving fertility cycle trends in the United States and stabilizing regional conditions, which should support a more balanced growth profile.

The Zacks Consensus Estimate for fiscal 2026 revenues is pegged at $4.31 billion, implying growth of 5.4% from the year-ago reported figure. The consensus mark for adjusted EPS is pinned at $4.51, indicating an improvement of 9.5% from the previous year’s recorded level.

In the past 60 days, COO’s earnings estimate for fiscal 2026 has moved north 13 cents.

The Cooper Companies, Inc. price | The Cooper Companies, Inc. Quote

Some other top-ranked stocks in the broader medical space are Intuitive Surgical ISRG, Cardinal Health CAH and West Pharmaceutical Services WST.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 15.7%. ISRG’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical’s shares have gained 2.8% compared with the industry’s 2.5% growth over the past six months.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 14.7%. CAH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 9.4%.

Cardinal Health’s shares have rallied 38.1% compared with the industry’s 15.7% growth over the past six months.

West Pharmaceutical Services, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.5%.

West Pharmaceutical Services’ shares have lost 0.3% against the industry’s 15.8% growth over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite