|

|

|

|

|||||

|

|

After dominating Wall Street for more than a decade, the software trade is now suffering one of its worst and rapid drawdowns in years — and the numbers are staggering.

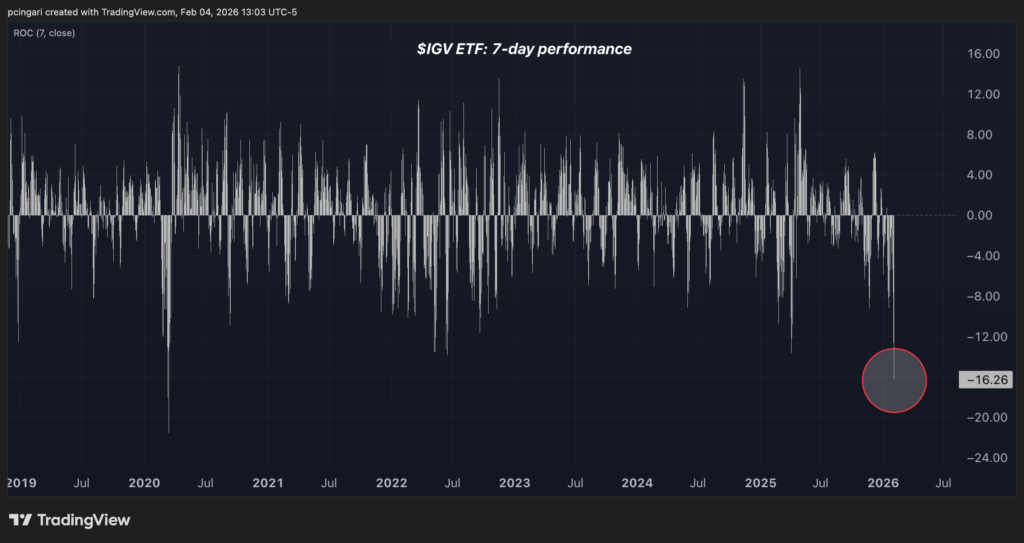

The iShares Expanded Tech-Software Sector ETF (NYSE:IGV), a bellwether for the space, has fallen for seven consecutive sessions, its worst streak since January 2024.

The index is now down 16% in those seven days, a collapse not seen since the COVID panic of March 2020.

Year to date, the software sector is deeply in the red, with 100 of its 110 constituents posting negative returns.

More than 20 stocks have dropped over 30%, underscoring the violent nature of the selloff and the growing pressure on software business models in the age of AI disruption.

Among the worst performers, Intapp Inc. (NASDAQ:INTA) leads the plunge, down 49.7% year to date.

It's followed closely by Braze Inc. (NASDAQ:BRZE), off 45.7%, and Unity Software Inc. (NYSE:U), which has fallen 45.3%.

Other major names suffering brutal declines include:

Even more established names like Intuit Inc. (NASDAQ:INTU) and DocuSign Inc. (NASDAQ:DOCU) have dropped more than 30% year to date, joining a growing list of once-dominant platforms now underperforming the broader market.

The software selloff is now also deeply technical.

A striking 97 of the IGV ETF's 110 constituents are now trading below their 200‑day moving average, highlighting a broad and worsening breakdown in technical momentum.

Some of the steepest divergences from this key trend level include:

Some widely-followed momentum indicators also show signs of panic. The 14-day RSI (Relative Strength Index) on the broader IGV ETF fell to the 16 levels – the lowest since September 2001.

19 stocks in the IGV ETF have 14-day RSI values below 20, a deeply oversold threshold

HubSpot Inc.: RSI 19.7

Open Text Corp. (NASDAQ:OTEX): RSI 11.8

Electronic Arts Inc. (NASDAQ:EA): RSI 12.1

Unity Software Inc.: RSI 17.1

Salesforce Inc. (NYSE:CRM): RSI 18.9

Intuit Inc.: RSI 19.3

As previously reported, macro strategists like Andreas Steno Larsen have tied the collapse to an underlying shift in business models. With AI tools replacing expensive SaaS platforms, software vendors are facing pricing pressure, slower renewals, and weaker customer retention.

"The services economy will die because of AI," Larsen said.

Still, not everyone agrees. Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang rejected fears of software obsolescence at the Cisco AI Summit this week, calling the idea "illogical" and arguing that AI depends on software tools, not their replacement.

Regardless of which view proves right, the current reality is harsh: software's decade-long supremacy in equity markets has been violently disrupted, and investors are rethinking what growth and value mean in the AI age.

Image: Shutterstock

| 3 min | |

| 3 min | |

| 3 min | |

| 7 min | |

| 11 min | |

| 12 min | |

| 32 min | |

| 35 min | |

| 41 min | |

| 43 min | |

| 46 min | |

| 46 min | |

| 48 min | |

| 50 min | |

| 54 min |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite