|

|

|

|

|||||

|

|

Amgen (AMGN) is having a moment. The biotech bellwether is trading near fresh 52-week highs, up roughly 8% in the latest session, and the tape is sending a clear message: institutions are leaning in. When a mega-cap healthcare name breaks out while the broader market debates growth versus defensives, investors should pay attention. The numbers tell a compelling story.

At yesterday afternoon’s earnings report, Amgen reported solid growth in the fourth quarter and full year 2025, with total revenues rising roughly 9% in Q4 to about $9.9 billion and 10% for the full year to approximately $36.8 billion, driven by volume gains across its diversified product portfolio.

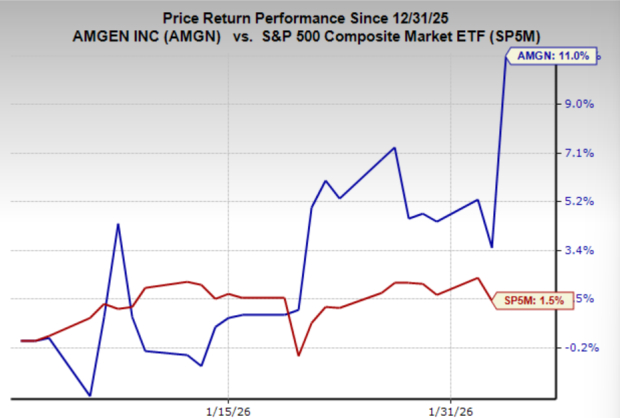

Zooming out, AMGN has quietly put together a strong run: up about 13.7% over the last three months and roughly 11% year-to-date. This is steady accumulation in a $193 billion leader with a deep commercial portfolio and a pipeline that’s starting to get more credit. The key question is whether this move is just a “safe haven” bid, or the start of a higher valuation regime driven by earnings power and catalysts.

A 52-week high is more than a headline, it’s a signal. New highs tend to attract momentum capital, force underweight managers to chase, and create a self-reinforcing setup as technical buyers step in. For AMGN stock, the breakout is also happening with fundamental backing: revenue growth is running at 10%, which is a notable pace for a mature biopharma franchise.

AMGN’s durability comes from a broad portfolio of cash-generating therapies across inflammation, oncology, bone health, and rare disease. Products like Enbrel, Otezla, Prolia/XGEVA, Repatha, and KYPROLIS anchor the base, while newer and partnered assets add incremental growth vectors. That breadth matters in 2026’s market, where single-product stories routinely get rerated on one trial readout.

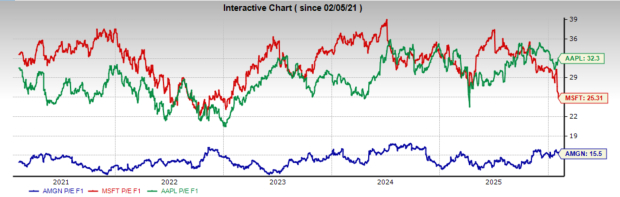

Just as important, the breakout is happening without “story stock” valuation excess. AMGN trades around 25.2x trailing earnings, but the forward P/E of 15.6x is the number that jumps off the screen. That multiple is not pricing in blue-sky outcomes. And when a stock pushes to highs on a reasonable forward multiple, it often indicates the market is starting to believe the forward earnings path is sturdier than previously assumed.

Looking at the fundamentals, AMGN’s earnings profile remains the backbone of the bull case. Current-year EPS is about $22.33, with next-year EPS expected near $22.92. That’s not a “hypergrowth” curve, but in large-cap pharma, consistency is the feature. A stock doesn’t need explosive EPS growth to outperform if the market is underestimating durability, margin resilience, or the contribution from new launches.

Consensus expects continued execution from Amgen’s diversified lineup, and the valuation suggests skepticism remains. Put differently: the market is paying a mid-teens forward multiple for a company delivering double-digit revenue growth. That mismatch is exactly what tends to show up in breakout charts.

Wall Street’s price target tape also reflects improving sentiment. Recent target moves include RBC lifting its target to $360 (Outperform) and Goldman Sachs reiterating a Buy while raising its target to $415. Cantor Fitzgerald moved its target to $350 while staying Neutral—an important detail because even the more cautious firms have been forced to lift numbers as the stock grinds higher. Whisper numbers suggest the next leg higher comes from evidence that newer assets and the pipeline are translating into durable, multi-year revenue streams.

For investors chasing a 52-week high, the right move is not to stare at the chart, but to define the catalysts that keep the bid under the stock.

Key catalysts ahead include continued portfolio expansion and pipeline progress. Amgen has been active in building a broader growth engine beyond legacy blockbusters, and the market tends to reward large biopharma when it proves it can refresh the franchise without sacrificing profitability. The pipeline is the optionality, but commercial execution is the cash register.

The segment/metric that is the number to watch is forward EPS progression versus the current valuation. If AMGN can keep next-year EPS expectations firm (or nudging higher) while maintaining its double-digit revenue growth trajectory, the market has room to re-rate the multiple. That’s how a “defensive” becomes a “defensive growth” compounder—and those are scarce.

Another underappreciated catalyst: relative attractiveness versus mega-cap tech stocks. Apple (AAPL) trades around 32.1x earnings, and Microsoft (MSFT) trades near 24.3x. Both are elite businesses, but their valuations already reflect premium expectations. By contrast, AMGN stock at a 15.6x forward P/E offers a different risk/reward profile, less dependent on multiple expansion and more tied to execution and cash generation. In a market where rates and risk appetite can change quickly, that valuation gap matters.

AMGN stock hitting 52-week highs is a bullish tell, and it’s supported by fundamentals, not hype. A near-$360 price with strong recent momentum, ~10% revenue growth, and a forward P/E around 15.6x creates a setup where investors get quality, scale, and catalysts without paying a tech-style premium. The numbers tell a compelling story.

The clean takeaway for investors: treat the breakout as confirmation that Amgen may be back in leadership mode. With reasonable valuation, improving sentiment, and multiple fundamental levers, AMGN looks positioned to remain a core large-cap healthcare winner, even as Apple and Microsoft and other big tech/AI names continue to dominate the conversation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 43 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Microsoft Gains On Hopes It Is Not AI's Lunch; But Is Microsoft A Buy Now?

MSFT

Investor's Business Daily

|

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite