|

|

|

|

|||||

|

|

Sandisk Corporation SNDK shares have surged 8.4% following the release of its second-quarter fiscal 2026 results on Jan. 29, 2026. The uptick can be attributed to revenue growth of 61% year over year to $3.03 billion, driven by robust datacenter demand from AI infrastructure builders and strengthened pricing across all end markets. Earnings reflected exceptional improvement, with SNDK reporting earnings per share of $6.20, a substantial increase from the year-ago figure of $1.23, while beating the Zacks Consensus Estimate by 75.14%.

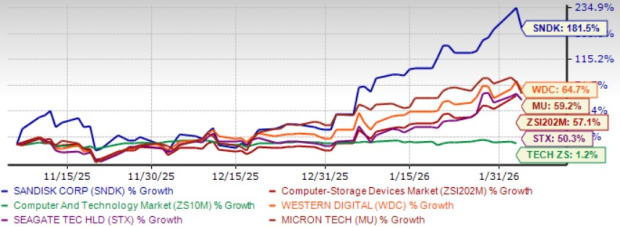

SNDK shares have appreciated 181.5% over the past three months, significantly outperforming the Zacks Computer and Technology sector's modest 1.2% return and the Zacks Computer- Storage Devices sub-industry's 57.1% advance. The stock has also far outpaced peers, with Western Digital's WDC shares advancing 64.7%, Seagate Technology's STX shares appreciating 50.3%, and Micron Technology's MU shares rising 59.2% over the same period. Let us delve deeper and find out why the stock remains a buy.

The fiscal second-quarter results demonstrate SNDK's ability to capitalize on an evolving market structure where NAND flash is becoming indispensable to AI infrastructure. Gross margin expanded to 51.1%, up from 32.5% in the prior-year quarter, reflecting both favorable pricing dynamics and operational execution during the BiCS8 technology transition. Operating income reached $1.13 billion, representing a 362% sequential increase, while adjusted free cash flow generation of $843 highlights strong cash conversion capabilities that support $750 million in debt reduction during the quarter.

SNDK maintains a positive outlook for the third quarter of fiscal 2026, expecting revenues between $4.4 billion and $4.8 billion, representing another substantial sequential increase at the midpoint, with gross margins projected to expand further to a range of 65-67%. Earnings per share guidance of $12 to $14 reflects continued pricing strength and improved product mix, suggesting that the structural improvements in the NAND market are sustainable rather than cyclical. The company plans to maintain disciplined capital expenditure supporting mid- to high-teens bit growth through the BiCS8 transition, demonstrating a strategic approach focused on serving attractive long-term demand without overextending supply. Such efforts are expected to preserve favorable pricing dynamics and support continued margin expansion as datacenter becomes the dominant end market for NAND flash products.

The Zacks Consensus Estimate for SNDK’s fiscal third-quarter EPS is pegged at $7.79, up from $3.63 pegged 30 days ago.

Sandisk Corporation price-consensus-chart | Sandisk Corporation Quote

Sandisk benefits from the structural shift toward AI computing, which requires significantly more NAND flash storage per deployment compared with traditional workloads. AI training models and inference applications generate massive data volumes that demand high-performance enterprise solid-state drives, while edge devices need greater storage capacity to support on-device AI features. This creates a favorable demand environment where Sandisk can command premium pricing for its advanced technology products while maintaining disciplined supply allocation.

The benefits materialized in the fiscal second-quarter performance, with datacenter revenues surging 76% year over year, driven by adoption across cloud hyperscalers and enterprise customers. Edge revenues climbed 63.2% year over year, as AI-enabled personal computers and mobile devices increased storage requirements per unit. Consumer revenues grew 51.7% year over year on premium product innovations and strategic brand partnerships.

Sandisk's BiCS8 quad-level cell storage product continues advancing through qualification with two major hyperscalers and is expected to generate revenues soon. The extended joint venture agreement with Kioxia Corporation through December 2034 positions Sandisk favorably against Western Digital, Seagate Technology and Micron Technology.

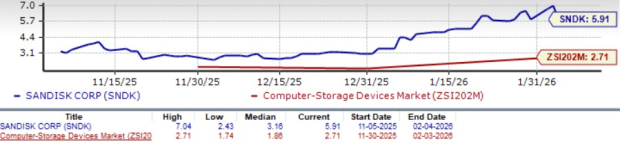

Despite the stock's impressive surge over the past three months, SNDK's valuation appears attractive relative to its growth prospects and margin expansion trajectory. The stock trades at 5.91x forward 12-month price-to-sales, below the broader sector’s multiple of 6.61 X. While SNDK commands a premium to the sub-industry average of 2.71x, this reflects superior BiCS8 technology leadership and expanding datacenter exposure to AI infrastructure spending.

Relative to peers, SNDK's valuation compares favorably with Western Digital at 6.89x and Seagate Technology at 6.95x, while trading at a modest premium to Micron Technology at 5.26x. The forward multiple appears reasonable considering the company's transition from historically volatile NAND market dynamics toward a more stable demand environment characterized by multiyear customer commitments and sustainably higher margins.

SNDK demonstrates strong execution with second-quarter fiscal 2026 results, validating its leadership in AI-driven storage demand. Accelerating datacenter revenues, expanding gross margins and robust free cash flow generation support sustainable profitability. The structural shift toward multiyear customer commitments reduces cyclicality while improving return visibility. Despite the impressive rally, attractive valuation relative to peers positions SNDK favorably as AI infrastructure spending accelerates.

Sandisk currently sports a Zacks Rank #1 (Strong Buy) and a Growth Score of A, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today's Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite