|

|

|

|

|||||

|

|

While the artificial intelligence (AI)-driven, astonishing bull run of U.S. stock markets from 2023 to 2025, continued into 2026, market participants benefited from other sectors, too. Several old-economy stocks from sectors such as industrials, finance, auto, materials and construction have surged in the past year.

Investing in these stocks with a favorable Zacks Rank should lead to profits in 2026. These old-economy stocks have transformed the ongoing rally into a broad-based one with huge opportunities for portfolio diversification.

Here, we have narrowed our search to five old-economy stocks that reported strong earnings results in their last reported quarters. Moreover, their current favorable Zacks Rank indicates near-term upside potential.

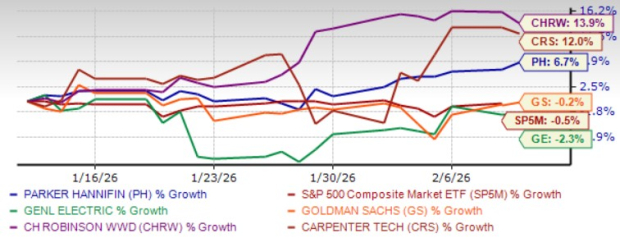

These companies are: Parker-Hannifin Corp. PH, The Goldman Sachs Group Inc. GS, GE Aerospace GE, C.H. Robinson Worldwide Inc. CHRW and Carpenter Technology Corp. CRS. Each of our picks currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The chart below shows the price performance of our five picks year to date.

Parker-Hannifin reported second-quarter fiscal 2026 (ended December 2025) adjusted earnings of $7.65 per share, which beat the Zacks Consensus Estimate of $7.15. Total sales of $5.17 billion beat the consensus estimate of $5.04 billion.

PH is benefiting from steady demand in the commercial and military end markets across both OEM and aftermarket channels within the Aerospace segment. The accretive acquisitions spark optimism in the stock. The Win strategy is driving its margins and allowing the company to continue returning value to its shareholders.

Steady demand across end markets and higher orders are supporting PH’s Aerospace Systems segment. The segment is benefiting from strong momentum in commercial and military end markets across both OEM and aftermarket channels. The growth drivers, i.e., the Win strategy, macro-CapEx reinvestment, acquisitions and secular growth trends are likely to help PH achieve 4-6% revenue growth by fiscal 2029.

PH has expanded its portfolio of aerospace, filtration and engineered materials significantly in the past few years. Also, PH is strategically shifting toward longer-cycle products (to attain stable and predictable revenue streams) supported by secular growth trends, which is improving its revenue mix.

Parker-Hannifin has an expected revenue and earnings growth rate of 6.8% and 12.9%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 2% over the last 30 days. PH has a current dividend yield of 0.74%.

The Goldman Sachs Group’s fourth-quarter 2025 earnings per share of $14.01 surpassed the Zacks Consensus Estimate of $11.77. Quarterly net revenues came in at $13.45 billion, missing the Zacks Consensus Estimate of $13.61 billion.

GS has benefited from solid revenue growth in the Global Banking & Markets and Asset & Wealth Management divisions. GS is refocusing on the core strengths of investment banking and trading businesses through restructuring and scaling back its consumer banking footprint.

The expansion of GS in the private equity credit market is expected to diversify its revenue base. Further, a solid liquidity profile will support its capital distribution activities. In November 2025, Goldman Sachs entered into an agreement with ING Bank Slaski to divest its Polish asset management firm, TFI.

The deal is targeted for completion in the first half of 2026. In 2024, GS completed the sale of GreenSky, its home improvement lending platform, to a consortium of investors. In the third quarter of 2025, GS transitioned the General Motors credit card program.

Goldman Sachs has an expected revenue and earnings growth rate of 8.6% and 10.3%, respectively, for the current year. The Zacks Consensus Estimate for the current year’s earnings has improved 2.3% over the last 30 days. GS has a current dividend yield of 1.70%.

GE Aerospace’s fourth-quarter adjusted earnings were $1.57 per share, which beat the Zacks Consensus Estimate of $1.44. Adjusted revenues were $11.87 billion, beating the consensus estimate of $11.26 billion.

GE has been witnessing strength in its businesses, driven by robust demand for commercial engines, propulsion and additive technologies. Rising U.S. & international defense budgets, geopolitical tensions, positive airline & airframer dynamics and robust demand for commercial air travel augur well for GE.

GE’s portfolio-reshaping actions are likely to unlock value for its shareholders. GE raised its dividend by 28.6% to 36 cents per share in February 2025. For 2026, GE expects organic revenues to grow in the low-double-digit range from the year-ago level.

GE Aerospace has an expected revenue and earnings growth rate of 13.8% and 17%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6% over the last 30 days. GE has a current dividend yield of 0.45%.

C.H. Robinson reported fourth-quarter 2025 adjusted earnings of $1.23 per share, outpacing the Zacks Consensus Estimate of $1.12. Total revenues of $3.91 billion narrowly missed the Zacks Consensus Estimate of $3.95 billion.

CHRW’s consistent initiatives to reward shareholders through dividends and share repurchases are encouraging. Such shareholder-friendly moves instill investor confidence and positively impact the company's bottom line. A decrease in operating expenses aids CHRW's bottom-line growth.

CHRW’s AI integration drives real-time pricing, costing, and automation through a powerful mix of machine learning, large language models, and autonomous agents. By acting on live supply-demand signals with humans in the loop, CHRW boosts margins, speeds execution, and strengthens its competitive edge across quoting, booking, tracking, and payments.

C.H. Robinson has an expected revenue and earnings growth rate of 3.9% and 15.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 30 days. CHRW has a current dividend yield of 1.26%.

Carpenter Technology reported adjusted earnings of $2.33 per share in second-quarter fiscal 2026 (ending December 2025), beating the Zacks Consensus Estimate of $2.20. Net revenues were $728 million, marginally below the Zacks Consensus Estimate of $729 million.

CRS has been experiencing strong booking growth for the past few quarters, indicating robust demand. CRS’ fiscal 2026 results are expected to reflect the impacts of the ongoing momentum across its end-use markets.

CRS’ financial position has been strong, providing it the flexibility to invest in the emerging technologies of additive manufacturing and soft magnetics. CRS’ cost-reduction initiatives are also anticipated to boost its margins.

CRS has been witnessing broad-based demand recovery in Aerospace and Defense, which will continue through fiscal 2026.Backed by solid backlog levels, CRS’ near and long-term outlooks for each end-use market remains positive. Its strategic acquisitions should boost its performance in the coming quarters.

CRS has an expected revenue and earnings growth rate of 6.6% and 36.5%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 1.4% over the last 30 days. CRS has a current dividend yield of 0.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 50 min | |

| 2 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite