|

|

|

|

|||||

|

|

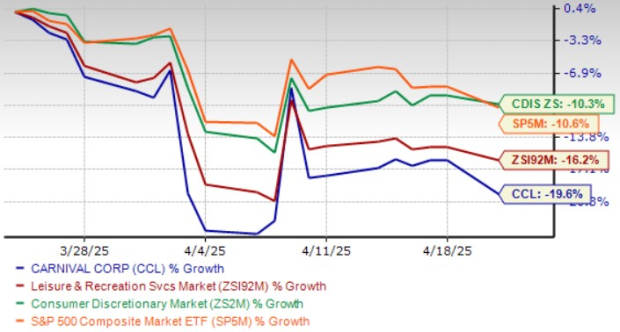

Shares of Carnival Corporation & plc CCL have declined 19.6% in the past month compared with the Zacks Leisure and Recreation Services industry’s 16.2% fall. Over the same timeframe, the stock has underperformed the Zacks Consumer Discretionary sector and the S&P 500’s decline of 10.3% and 10.6%, respectively.

Investor sentiment surrounding Carnival has been weighed down by ongoing macroeconomic uncertainty and rising political risk, particularly stemming from the renewed push by the U.S. administration to impose tariffs and close tax loopholes exploited by foreign-flagged cruise operators.

While long-term booking trends remain solid, short-term pressures from geopolitical instability, stock market volatility, and potential regulatory changes are prompting cautious investor behavior.

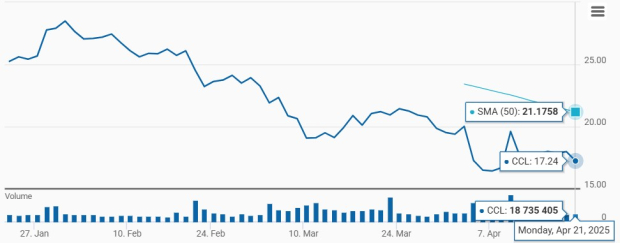

From a technical perspective, CCL stock is currently trading below its 50-day moving average, signaling a bearish trend.

Given the significant pullback in Carnival’s shares currently, investors may be tempted to snap up the stock. But is this the right time to buy CCL? Let’s find out.

Investor sentiment around Carnival has been shaken by a mix of geopolitical uncertainty, regulatory risk and macroeconomic headwinds. President Trump’s proposed tariffs on more than 90 countries, announced in early April, triggered a sharp sector-wide sell-off. Although the administration has since paused the tariffs for 90 days, the move did little to ease longer-term concerns about the industry's exposure to global trade disruptions.

Adding to the pressure, Commerce Secretary Howard Lutnick’s recent comments hinting at a potential tax crackdown on foreign-flagged cruise operators have fueled further uncertainty and driven additional weakness in cruise stocks, including Royal Caribbean Cruises Ltd. RCL, Norwegian Cruise Line Holdings Ltd. NCLH and OneSpaWorld Holdings Limited OSW.

Carnival has been witnessing higher dry-dock days and advertising expenses. In the first quarter of fiscal 2025, cruise and tour operating expenses increased year over year to $3.77 billion from $3.71 billion. Several factors drove this uptick: elevated commissions, transportation costs and other expenses linked to higher ticket pricing, and higher onboard and other costs of sales. For fiscal 2025, it now expects adjusted cruise costs, excluding fuel per ALBD (in constant currency), to increase approximately 3.8% year over year (up from the prior expectation of 3.7%).

While Carnival has raised its full-year profit guidance on the back of strong booking trends, these broader concerns continue to cloud the near-term outlook for CCL shares.

Despite the recent sell-off, Carnival remains fundamentally strong, with multiple levers to drive long-term value. The cruise giant continues to benefit from robust demand across its global fleet, with record booking volumes extending into 2026. Pent-up travel demand, particularly among younger demographics and international travelers, is helping to offset some of the near-term pressures around discretionary spending.

Carnival is executing strategic initiatives aimed at enhancing operational efficiency and guest experience. The integration of P&O Cruises Australia into the Carnival Cruise Line brand is expected to deliver synergies, streamline operations, and improve profitability. Meanwhile, brand-specific innovations, such as new culinary experiences and immersive onboard entertainment, continue to differentiate Carnival in an increasingly competitive leisure travel landscape.

Marketing and brand engagement remain a core focus. The company’s marketing efforts, along with support from travel agents and narrowing the unjustified price gap with land-based vacations, have helped attract newer and returning guests, leading to market share gains. In the fiscal first quarter, the company saw strong marketing performance from its Durable Wave campaign. Flip, Lost in Paradise gained significant traction, leading to improved marketing KPIs. The company is also increasing marketing efforts for RelaxAway, Half Moon Cay, which remains on track for the second half of 2026. Plans are in place to boost brand awareness and leverage the company’s Caribbean destinations to drive greater consideration.

A key part of Carnival’s long-term strategy is its disciplined approach to fleet expansion. With only three ships on order through 2028, the company has created room for financial flexibility, allowing it to prioritize debt reduction while investing in high-return projects like Celebration Key. The company anticipates the initiative to enhance guest experience and drive incremental revenue.

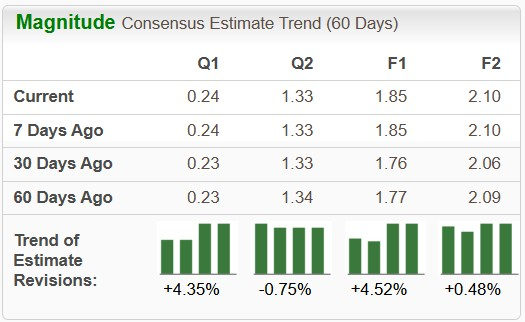

Carnival’s 2025 earnings per share estimates have been revised upward, increasing from $1.76 to $1.85 over the past 30 days. This upward trend reflects strong analyst confidence in the stock’s near-term prospects.

The company is likely to report solid earnings, with projections indicating a 30.3% jump in 2025. Conversely, industry players like Royal Caribbean, Norwegian Cruise and OneSpaWorld are likely to witness growth of 25.7%, 13.2% and 12.9% year over year, respectively, in 2025 earnings.

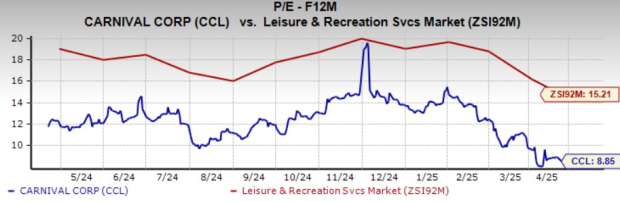

Carnival stock is currently trading at a discount. CCL is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 8.85X, well below the industry average of 15.21X, reflecting an attractive investment opportunity. Other industry players, such as Royal Caribbean, Norwegian Cruise and OneSpaWorld, have P/E ratios of 12.18X, 7.33X and 16.49X, respectively.

Analysts maintain an optimistic outlook on Carnival stock. Based on short-term price targets from 24 analysts, the average price target is $28.33, suggesting a potential upside of 64.3% from the last closing price of $17.24. Price forecasts range from a low of $14, indicating a 18.79% downside risk, to a high of $34, which represents a possible 97.2% upside. Meanwhile, Carnival carries a solid average brokerage recommendation of 1.56 on a scale of 1 (Strong Buy) to 5 (Strong Sell), reflecting a favorable consensus. Among 25 brokerage firms, 18 analysts rate the stock as a Strong Buy and one as a Buy, underscoring confidence in Carnival’s growth potential.

Carnival remains a prominent player in the global cruise industry, backed by record booking volumes, strategic brand integrations, and disciplined fleet management. Despite a challenging year-to-date performance, the company is executing well on initiatives to enhance operational efficiency, improve guest experience, and expand marketing reach. Its attractive valuation, upward earnings revisions, and long-term demand tailwinds provide a strong foundation for eventual recovery. However, near-term headwinds — including rising costs, regulatory uncertainty, and macroeconomic volatility — continue to weigh on investor sentiment.

Given these dynamics, existing shareholders may consider holding on to this Zacks Rank #3 (Hold) stock as Carnival leverages strong demand and operational improvements to navigate short-term challenges. Meanwhile, prospective investors may prefer to stay on the sidelines until clearer signs of regulatory clarity and margin stabilization emerge.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite