|

|

|

|

|||||

|

|

Micron Technology, Inc. MU shares have plunged 27.8% over the past month and underperformed the Zacks Computer and Technology sector, which is down 13.9%. MU stock has also underperformed major semiconductor players, including Broadcom AVGO, NVIDIA NVDA and Advanced Micro Devices AMD.

This steep decline raises the question: Should investors cut their losses and exit, or is the stock worth holding onto? While the near-term headwinds are real, MU’s long-term growth story remains intact, making a strong case for holding the stock.

The company’s recent slump is part of a larger tech pullback triggered by fears of an escalating tariff war and slowing economic growth. The situation is compounded by a growing concern over its deteriorating gross margin.

In its latest financial results for the second quarter of fiscal 2025, the company’s non-GAAP gross margin declined to 37.9% from 39.5% in the previous quarter, marking a sharp sequential fall. This deterioration was driven by weaker NAND flash pricing and ongoing startup costs at its new DRAM production facility in Idaho.

More concerning for the investors was the company’s margin outlook. For the third quarter, Micron guided for a gross margin of 36.5% at the midpoint, signaling further compression. This dim outlook indicates that margin pressures are likely to persist in the near term.

Despite these challenges, Micron’s dominant market position and promising long-term outlook make it a stock worth holding onto.

While near-term profitability guidance is uninspiring, Micron’s long-term prospects are bright. Should the company hit its third-quarter targets, it would still reflect impressive year-over-year revenue growth of 29% and a 153% jump in EPS.

The Zacks Consensus Estimate for fiscal 2025 and 2026 revenues indicates year-over-year growth of 41% and 30%, respectively. The consensus mark for EPS suggests a robust year-over-year improvement of 427% for fiscal 2025 and 58% for fiscal 2026.

Micron also has a strong history of beating earnings estimates. The stock has surpassed the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 10.7%.

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

Micron’s strategic position in the memory and storage chip market, a critical component for artificial intelligence (AI) workloads, positions it to capitalize on an expected surge in AI-related capital expenditures over the coming years.

Micron’s position in high-demand segments such as AI, data center, automotive and industrial IoT places it at the forefront of the semiconductor industry's evolution. The explosion of AI applications has significantly increased demand for advanced memory solutions, such as DRAM and NAND. Micron’s investments in cutting-edge DRAM and 3D NAND technologies ensure it remains competitive and poised to capitalize on these trends.

Micron’s diversification strategy is noteworthy. By reducing reliance on consumer electronics, which are more susceptible to demand swings, and focusing on stable sectors like automotive and data centers, Micron mitigates revenue volatility. This balance reinforces its resilience in an industry often impacted by cyclical trends.

Additionally, Micron is riding a powerful wave of demand for high-bandwidth memory (HBM) products, especially as AI workloads surge. The company has made significant strides in AI-optimized memory solutions, with its HBM3E products gaining attention for their superior power efficiency and bandwidth.

In January 2025, NVIDIA revealed that Micron is a key supplier for its GeForce RTX 50 Blackwell graphics processing units (GPUs), solidifying Micron’s positioning in the HBM market. Earlier this year, MU revealed plans for a new HBM advanced packaging facility in Singapore, set to begin operations in 2026, with further expansions by 2027. This move aligns with Micron’s AI-driven growth strategy, ensuring diversified supply chains and increased packaging capacity for high-performance memory chips.

Valuation-wise, Micron is undervalued, as suggested by the Zacks Value Score of B.

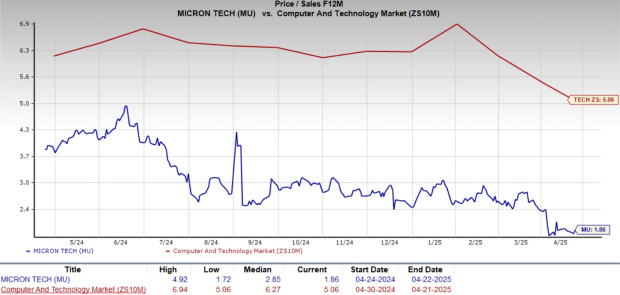

In terms of forward 12-month Price/Sales (P/S), MU shares are trading at 1.86X, significantly lower than the sector’s 5.06X.

The stock’s P/S ratio is also lower than major semiconductor players, including Broadcom, NVIDIA and Advanced Micro Devices. At present, Broadcom, NVIDIA and Advanced Micro Devices have forward 12-month P/S multiples of 11.88X, 11.79X and 4.17X, respectively.

Micron’s recent sell-off reflects short-term headwinds, but the long-term growth story remains compelling. With its strong positioning in AI and data center markets, along with an attractive valuation, holding Micron stock is the prudent choice for investors willing to navigate near-term volatility.

Currently, Micron carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 28 min | |

| 34 min | |

| 41 min | |

| 44 min | |

| 44 min | |

| 51 min | |

| 51 min | |

| 52 min | |

| 1 hour | |

| 1 hour |

Riot Rises On Activist Data Center Proposal, ARK Resumes Coinbase Buys

AMD

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite