|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The consumer discretionary sector has witnessed moderate growth in the past year, despite a strong rally in U.S. stock markets. The situation has aggravated as the sector is in the negative year-to-date.

Structurally, the consumer discretionary sector is growth-oriented. The share prices of these companies grow over a long time period. Growth sectors are sensitive to the movement of market interest rates and are inversely related.

Over the last two years, the Fed opted for easy monetary policies with a significant cut in the benchmark lending rate. However, market participants are uncertain about the trajectory of interest rates this year. Moreover, concerns about artificial intelligence (AI)-led corporate profits also affected growth-oriented stocks.

Despite these negatives, we have selected five consumer discretionary stocks with a favorable Zacks Rank for investment. These stocks have double-digit price upside potential in the short term.

These stocks are: Ralph Lauren Corp. RL, Roku Inc. ROKU, Airbnb Inc. ABNB, FOX Corp. FOX and Carnival Corporation & plc CCL. Each of our picks currently carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

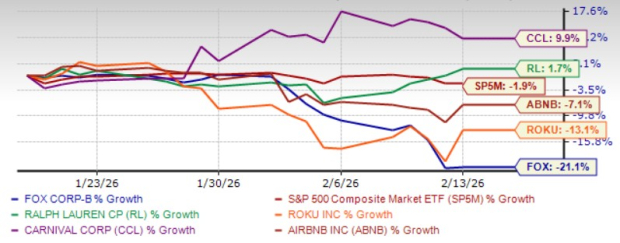

The chart below shows the price performance of our five picks in the past month.

Zacks Rank #2 Ralph Lauren has benefited from the execution of its “Next Great Chapter: Drive Plan” and robust financial performance. The plan focuses on brand elevation, consumer centricity and operational agility. RL’s digital transformation drives growth, with investments in personalization, mobile, omnichannel and fulfillment enhancing consumer engagement.

Retail and wholesale remain the key pillars of RL, with flagship stores, premium distribution and partnerships boosting comparable sales across North America, Europe and Asia. For fiscal 2026, RL expects revenues to increase in the high-single to low-double digits on a constant currency basis. While gross margin is likely to increase 40-80 bps, operating margin is expected to expand 100-140 bps in constant currency.

Ralph Lauren has an expected revenue and earnings growth rate of 11.7% and 30.5%, respectively, for the current year (ending March 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 5% over the last 30 days.

The short-term average price target of brokerage firms for the stock represents an increase of 11.8% from the last closing price of $369.18. The brokerage target price is currently in the range of $341-$477. This indicates a maximum upside of 29.2% and a downside of 7.6%.

Zacks Rank #1 Roku demonstrates strong platform revenue expansion driven by innovative advertising capabilities and accelerating streaming services distribution. The Roku Channel maintains its position as the second most-engaged app on the platform and captures a significant share of U.S. television streaming time.

ROKU has achieved substantial household penetration while demonstrating improved profitability through strong free cash flow generation and positive operating leverage. Strategic initiatives including the Ads Manager platform are attracting new advertiser categories, while premium subscription growth represents the fastest-growing revenue segment. ROKU maintains a solid balance sheet with no meaningful debt.

The home screen represents a critical strategic asset, serving as the starting point for entertainment discovery across more than half of U.S. broadband households. ROKU has systematically enhanced this experience with AI-driven content recommendations, improved search functionality and strategic content placement.

Streaming services distribution represents Roku's fastest-growing revenue category, with premium subscriptions leading growth. ROKU’s content discovery improvements, including AI-generated viewing recommendations and subscription-aware content details pages, are reducing cancellation rates and improving conversion.

ROKU has an expected revenue and earnings growth rate of 15.4% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for the current year’s earnings has improved 2.4% over the last 60 days.

The short-term average price target of brokerage firms for the stock represents an increase of 35.7% from the last closing price of $90.06. The brokerage target price is currently in the range of $90-$160. This indicates a maximum upside of 77.8% and no downside.

Zacks Rank #2 Airbnb is benefiting from continuous improvements in Nights and Experiences Booked, enabling it to witness a positive trend in its Gross Booking Value. ABNB’s growing gross nights booked, owing to solid momentum across high-density urban areas and first-time bookers is a tailwind.

Increasing guest demand and continuous recovery in cross-border travel are major positives for ABNB. Strong momentum in active listings, owing to supply growth across all regions, particularly in Asia Pacific and Latin America, is benefiting ABNB’s top line. Moreover, growing awareness around hosting and new features introduced for hosts is a plus.

Airbnb has an expected revenue and earnings growth rate of 10.8% and 18.1%, respectively, for the current year. The Zacks Consensus Estimate for the current year’s earnings has improved 0.6% over the last seven days.

The short-term average price target of brokerage firms for the stock represents an increase of 20.4% from the last closing price of $121.35. The brokerage target price is currently in the range of $105-$200. This indicates a maximum upside of 64.8% and a downside of 13.5%.

Zacks Rank #1 FOX produces and distributes news, sports and entertainment content. The company's brand includes FOX News, FOX Sports, the FOX Network, the FOX Television Stations and sports cable networks FS1, FS2, Fox Deportes and Big Ten Network.

FOX has an expected revenue and earnings growth rate of -0.9% and -2.3%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 6.9% over the last 30 days.

The short-term average price target of brokerage firms for the stock represents an increase of 36.1% from the last closing price of $51.56. The brokerage target price is currently in the range of $48-$87. This indicates a maximum upside of 68.7% and a downside of 6.9%.

Zacks Rank #1 Carnival is benefiting from sustained demand strength, increased booking volumes, an ongoing fleet optimization initiative, and the destination strategy. Management emphasized the role of marketing in attracting new-to-cruise customers while deepening relationships with repeat guests.

CCL also emphasized the expanding role of digital marketing and artificial intelligence in enhancing marketing effectiveness, enabling greater personalization and driving efficiency gains across the organization. CCL has achieved record booking volumes for both 2026 and 2027, including an unprecedented early start to 2027 sales, highlighting strong long-term demand visibility.

CCL has an expected revenue and earnings growth rate of 4.6% and 12.9%, respectively, for the current year (ending November 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 5.8% over the last 60 days.

The short-term average price target of brokerage firms for the stock represents an increase of 19.1% from the last closing price of $31.77. The brokerage target price is currently in the range of $31-$46. This indicates a maximum upside of 44.8% and a downside of 2.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 14 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Ralph Lauren, IBD's Stock Of The Day, Rebounds After Fears Of Slower Sales Growth

RL

Investor's Business Daily

|

| Feb-19 |

Ralph Lauren, IBD Stock Of The Day, Rebounds After Fears Of Slower Sales Growth

RL

Investor's Business Daily

|

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite