|

|

|

|

|||||

|

|

Celestica, Inc. CLS and Jabil, Inc. JBL are leading electronics manufacturing services (EMS) providers, offering design, supply chain, and manufacturing solutions to major technology and industrial companies worldwide.

The EMS industry is highly competitive and rapidly evolving. Hyperscalers’ push for quick expansion of AI data centers, growing trends of outsourcing of engineering, system integration, assembly by original equipment manufacturers across the industry, rising emphasis on automation, investment in industry 4.0 standards, and the strategy of localizing manufacturing to avert geopolitical risks are major drivers of the EMS industry.

With domain-specific expertise in core areas, both Celestica and Jabil are strategically positioned in this evolving EMS landscape. Let us dive deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

Celestica is benefiting from solid momentum in the Connectivity & Cloud Solutions segment. Enterprises across industries are rapidly expanding their AI capabilities. This is pushing hyperscalers to quickly expand their AI data center footprint to support this surging demand. This market trend is driving demand for Celestica’s 800G switches. Demand for 400G switches remained strong.

Management expects the rapid AI buildouts will create a strong demand for 1.6 T switches in the upcoming years. It has already introduced 1.6T switches that capitalize on this emerging market trend. The company has secured a design and manufacturing award for the 1.6T networking switch platform with several hyperscalers.

Celestica is extending its collaboration with major hyperscalers like Google. Leveraging CLS’ expertise, Google is developing advanced data center hardware and systems. Celestica is the preferred manufacturing partner for Google’s Tensor Processing Unit (TPU). The company is steadily expanding its capacity and capabilities in the United States and globally to support the growing adoption of Google’s custom silicon TPU systems.

Celestica generated $458 million in free cash flow in 2025, exceeding its annual outlook. The company reported 43% return on invested capital, up 14% year over year. This is the result of disciplined working capital management and a strong focus on profitability. Investment in growth initiatives is not taking up excessive working capital. Such an approach allows it to gain a competitive edge against other major EMS players, such as Jabil and Flex Ltd. FLEX.

Jabil is betting big on the AI data center market. The company’s innovation strategy is focused on becoming full stack AI infrastructure partner for hyperscalers. Hence, the company is expanding its portfolio to cater to all critical aspects of AI infrastructure, including compute, networking, power distribution and thermal cooling capabilities.

Over the past few years, the company has strengthened its capabilities in liquid cooling and thermal management with strategic acquisitions. The company has developed a strong capability in chip-level cooling, rack-level cooling and network cooling that can support increasing AI power density in data centers. The company offers fully integrated systems that incorporate compute, networking, power distribution and advanced cooling, streamlining deployment time and reducing total cost of ownership for hyperscalers. These factors are driving demand for its reliability among hyperscalers.

Jabil’s free cash flow was $1.3 billion in fiscal 2025, and it remains committed to generating more than $1.3 billion in free cash flow in fiscal 2025. A higher free cash flow indicates efficient financial management practices, optimum utilization of assets and improved operational efficiency.

However, the company faces stiff competition from both domestic and international electronic manufacturers, manufacturing service providers and design providers. Flex is aggressively moving into the high-growth data center market. Flex announced a partnership with LG Electronics to co-develop integrated modular cooling systems designed to tackle the growing thermal challenges of AI-driven data centers. Also, Flex announced a collaboration with NVIDIA to build modular, high-performance, energy-efficient AI data centers at scale. Such initiatives can pose a threat to Jabil’s AI data center expansion initiative. Supply chain disruptions and elevated variable costs have hurt the company’s profitability. Moreover, its global presence exposes it to forex volatility.

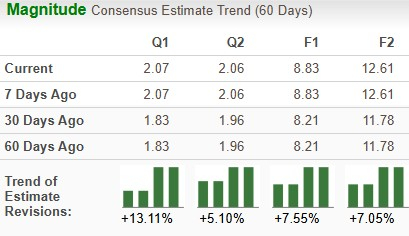

The Zacks Consensus Estimate for Celestica’s 2025 sales and EPS implies year-over-year growth of 51.16% and 72.5%, respectively. The EPS estimates have been trending northward (7.55%) over the past 60 days.

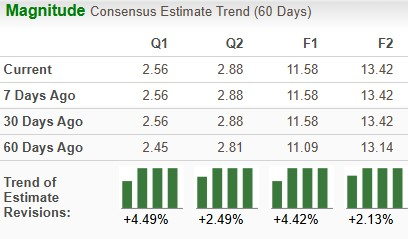

The Zacks Consensus Estimate for Jabil’s 2025 sales implies year-over-year growth of 15.21%, while that of EPS suggests growth of 31.96%. The EPS estimates have been trending northward (4.42%) over the past 60 days.

Over the past year, Celestica has gained 112.5% compared with the industry’s growth of 71.9%. Jabil has gained 50.1% over the same period.

Jabil looks more attractive than Celestica from a valuation standpoint. Going by the price/earnings ratio, Jabil’s shares currently trade at 20.47 forward earnings, lower than 30.09 for Celestica.

While Jabil carries a Zacks Rank #3 (Hold), Celestica carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Celestica and Jabil are both set to benefit from hyperscalers’ AI infrastructure spending in the upcoming quarters. However, Jabil is affected by weakness in the Connected Living and Digital Commerce segment. The outlook in the automotive and renewable energy markets remains muted. Its strategic acquisition raises integration risks. Consequently, with growing collaboration with hyperscalers and growing demand for its next-generation 800G and 1.6T switches, Celestica is better positioned to get an upper hand in the AI data center market. Unlike Jabil, Celestica has much less exposure to the consumer electronics market, which has substantial volatility. Celestica’s EPS estimates show stronger upward movement than Jabil. Hence, with a better price performance and a Zacks Rank #2, Celestica appears to be a better investment option right now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite