|

|

|

|

|||||

|

|

The convergence of quantum computing, artificial intelligence (AI) and high-performance computing (HPC) is rapidly becoming the backbone of next-generation innovation across sectors like healthcare, automotive and finance, capturing the growing attention of forward-looking investors. Two companies riding this wave from very different angles are D-Wave Quantum Inc. QBTS and NVIDIA Corporation NVDA.

While NVIDIA, the AI-dominant heavyweight, has become synonymous with GPU-driven AI acceleration, D-Wave Quantum, the quantum-focused challenger, is gaining attention in commercial quantum computing, offering annealing-based systems that address optimization problems traditional computers struggle to solve.

In recent months, QBTS has gained significant momentum, largely influenced by NVIDIA’s shift in stance from earlier skepticism to recognizing the “extraordinary impact” of quantum computing. NVIDIA, on the other hand, has been grappling with Trump’s hefty retaliatory tariff episode.

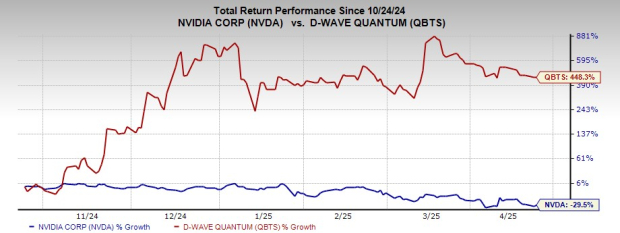

In the past six months, shares of QBTS have soared 448.3% in contrast to NVDA’s 29.5% dip.

Does this signal a long-term shift in momentum? Could QBTS truly outperform a tech heavyweight like NVIDIA and emerge as the smarter buy today? Let’s find out.

Data Center Dominance: NVIDIA’s top growth driver is its Data Center business, which hit $47.5 billion in revenues in fiscal 2024, more than triple the previous year. In the fourth quarter alone, revenues surged 409% year over year to a record $18.4 billion, driven by strong demand for its Hopper GPUs and InfiniBand networking.

Expansion Across Vertical Markets: NVIDIA’s impact now spans key industries like automotive, healthcare, and finance. Over 80 automakers use its AI platforms, such as DRIVE and DRIVE Thor. Together, these contributed more than $1 billion in automotive-related data center revenues in 2024. In healthcare (an estimated $10 trillion industry globally), platforms like Clara and BioNeMo support AI-driven drug discovery and diagnostics, with partners like Recursion Pharmaceuticals. Financial firms, including American Express, use NVIDIA’s AI to boost fraud detection and risk management. NVIDIA’s AI is delivering real-world results across sectors.

Solid Financials and Shareholder Returns: NVIDIA delivered a strong fourth-quarter non-GAAP gross margin of 76.7%, driven by a favorable Data Center product mix and ongoing cost efficiencies. NVIDIA expects gross margin to normalize to the mid-70s range for 2025. The company also demonstrated solid capital discipline by returning $9.9 billion to shareholders through buybacks and dividends in 2024, reflecting robust free cash flow and confidence in its long-term growth strategy.

First-to-Market Advantage in Quantum Supremacy: D-Wave recently became the first to achieve quantum supremacy on a real-world problem—simulating a complex material science scenario using its 1,200-qubit Advantage2 system. This milestone sets D-Wave apart from rivals like Google GOOGL and IBM IBM, whose supremacy claims remain largely academic.

Revenue Momentum: D-Wave’s commercial momentum is accelerating fast. In the fourth quarter of 2024, bookings surged 502%, driven by the first full Advantage system sale to Germany’s Jülich Supercomputing Centre. Meanwhile, its Quantum Compute-as-a-Service (QCaaS) model is gaining traction across sectors like insurance, telecom and public safety.

Strong Financial Position and Path to Profitability: D-Wave Quantum now boasts a cash position exceeding $300 million. Further, despite a GAAP net loss driven by non-operational warrant revaluations, D-Wave’s adjusted net loss shrank year over year and gross margin climbed to 72.8% on a non-GAAP basis, highlighting improving operational efficiency.

D-Wave's recent Science paper marked a major leap. Its 1,200-qubit Advantage2 prototype solved a real-world materials science problem in minutes, a task that would take classical supercomputers over a million years. This not only challenges traditional computing but also questions the long-term dominance of GPU giants like NVIDIA.

D-Wave offers both system sales (as with Jülich Supercomputing Center) and quantum computing-as-a-service (QCaaS) via its Leap platform, which also contrasts with NVIDIA’s strategy. While NVDA enjoys supremacy in creating silicon and AI tools, it still relies on partnerships to explore quantum, with no standalone commercial quantum offering of its own yet.

D-Wave Quantum is trading at a forward 12-month price-to-sales of 67.86X, above its 1-year median of 12.98X. Meanwhile, NVIDIA is presently trading at a forward 12-month price-to-sales of 11.79X, which is below its 1-year median of 12.98X.

This suggests that NVIDIA remains attractively valued when compared with D-Wave, as well as its own historical average.

Based on short-term price targets by 42 analysts, NVIDIA's average price target of $177.43 implies a 76.3% upside from the last close.

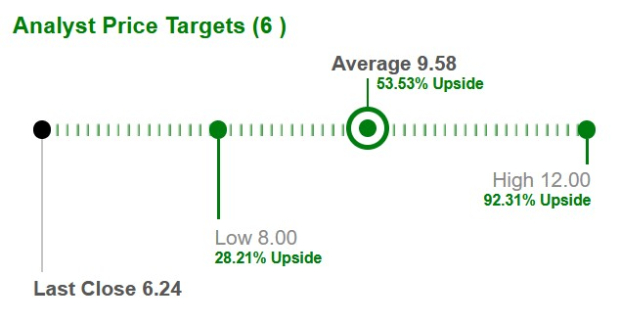

Based on short-term price targets by seven analysts, the average price target for D-Wave Quantum of $6.71 implies a .5% upside from the last close.

NVIDIA’s $2.4 trillion market cap, deep software ecosystem (CUDA, AI stacks) and industry leadership remain unmatched. It also boasts strong liquidity and currently holds a Zacks Rank #3 (Hold).

Meanwhile, D-Wave is emerging as a serious contender for the future of computing. If it maintains its current momentum, it could become to quantum what NVIDIA is to AI today. While the two may ultimately prove complementary rather than directly competitive, D-Wave’s strong execution, rapid growth and quantum-first approach position it as a standout in the space. For investors looking to get in early on quantum commercialization, QBTS, currently a Zacks Rank #2 (Buy) stock, offers a compelling opportunity. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite