|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Home Depot, Inc. HD and Lowe’s Companies, Inc. LOW are two dominant players in the U.S. home improvement sector, serving both do-it-yourself (DIY) customers and professional (Pro) contractors. While both are navigating the same macro backdrop — cautious consumer spending, slower housing turnover and delayed big-ticket remodeling — each is pursuing distinct strategies to gain market share.

Home Depot, with a market capitalization of about $381.8 billion, remains the industry leader. It operates more than 2,300 stores across the United States, Canada and Mexico. Its key strengths are a strong hold on professional customers, solid relationships with suppliers, and an efficient delivery and distribution network.

Lowe’s, valued at around $158.3 billion, operates more than 1,700 stores, primarily in the United States. The company has sharpened execution through stronger merchandising discipline, store productivity initiatives, and a “total home” strategy aimed at becoming a more complete solution provider for homeowners and Pros. Lowe’s is also boosting engagement through loyalty programs and technology-driven enhancements.

With both companies navigating an uneven demand environment, the key question for investors is which stock is better positioned to deliver greater upside as housing and renovation trends gradually normalize.

Home Depot’s long-term growth strategy is shaped by its expanding Pro ecosystem, strengthened through the additions of SRS and GMS. These platforms give the company a deeper reach into specialty building materials and create natural cross-sell pathways between retail and wholesale channels. As SRS demonstrates resilience in challenging categories and GMS broadens access to drywall, ceilings and framing products, the combined network serves as a powerful engine for market-share gains.

The company is also enhancing its focus on professional contractors by introducing a new AI-powered tool designed to reshape how Pro customers plan and execute complex projects. Home Depot highlighted that its blueprint takeoffs tool utilizes advanced AI and proprietary algorithms to analyze construction plans and generate material estimates with far greater speed and accuracy than traditional methods. This technology replaces the labor-intensive process that earlier took Pro customers weeks to complete.

Home Depot’s Material List Builder AI tool helps professional renovators, remodelers, builders and specialty tradespeople generate detailed material lists for projects much faster. The tool interprets project requirements and generates a precise, comprehensive list of materials for the entire job, helping professionals stay on schedule and within budget. The feature is available free to all Pro Xtra members through Home Depot’s Project Planning platform, a digital solution that simplifies how professionals plan, manage, and execute complex construction and remodeling projects.

By incorporating advanced technology, Home Depot is reinforcing its position as the go-to destination for all project requirements, from initial planning to material delivery. This development marks a significant step forward in catering to the Pro category. This progress allows Home Depot to differentiate its Pro offerings not only through product assortment but also through digital infrastructure. Exclusive brands, curated assortments and elevated seasonal offerings reinforce customer loyalty while maintaining the company’s competitive edge in categories where product leadership and brand preference matter.

That said, Home Depot is facing structural headwinds, soft demand and margin pressure. The company faces a challenging fourth quarter of fiscal 2025 as year-over-year weather comparisons intensify. Management had earlier guided fiscal 2025 comparable sales to be slightly positive.

Lowe’s is another formidable player in the home improvement sector, supported by a "Total Home Strategy" that addresses the diverse needs of both professional contractors and do-it-yourself homeowners. By combining specialized services with a robust digital infrastructure, LOW has redefined itself as not merely a retail destination but a comprehensive solution provider.

A key aspect of this strategy is the expansion into the high-value Professional market, which was accelerated by the acquisition of Foundation Building Materials. This buyout has expanded Lowe's product portfolio in interior building materials and enhanced its distribution capabilities. By integrating supplier systems into its sales interface, Lowe’s enables its associates to offer an "extended aisle" of specialized inventory for large-scale professional projects.

Technological innovation, specifically the adoption of artificial intelligence, is a significant competitive advantage for Lowe’s. Through advanced virtual assistants, the company has simplified complex project planning for consumers and provided store associates with real-time expertise, resulting in customer satisfaction and conversion. AI in demand planning and inventory management has enabled more efficient resource allocation, ensuring that the right products are available to meet shifting consumer demands without the burden of excessive inventory.

Lowe’s focus on high-growth categories, such as major appliances, home services and exclusive private brands, further solidifies its position. Lowe’s has developed a unique market delivery network that provides installation capabilities in virtually every domestic zip code. With record levels of home equity encouraging homeowners to invest in their current properties rather than relocate, Lowe’s is uniquely positioned to benefit from the "lock-in effect" within the housing market.

Backed by prudent capital allocation and a strong focus on efficiency, Lowe’s demonstrates the discipline and strategic clarity needed to deliver steady long-term returns. However, still higher interest rates, cautious homeowners and slower housing turnover continue to pressure demand for large, discretionary home improvement projects, making it difficult for the company to generate strong volume growth.

The Zacks Consensus Estimate for Home Depot’s current fiscal year projects a 3.3% increase in sales but a 4.9% decline in EPS compared to last year's results. For the next fiscal year, the consensus estimate indicates a 4.2% rise in sales and 4.3% growth in earnings. The consensus estimate for EPS for the current fiscal year has been stable at $14.50 over the past 30 days, while for the next fiscal year, it has fallen by a penny to $15.13.

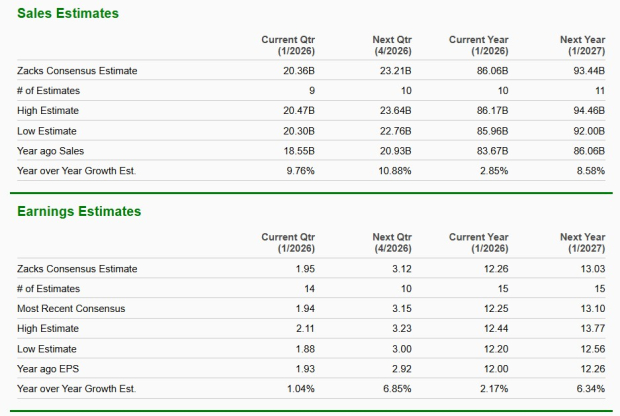

The Zacks Consensus Estimate for Lowe’s current financial-year sales and EPS implies growth of 2.9% and 2.2%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates an 8.6% rise in sales and 6.3% growth in earnings. The consensus estimate for EPS for the current fiscal year has been stable at $12.26 over the past 30 days, while for the next fiscal year, it has improved by 3 cents to $13.03.

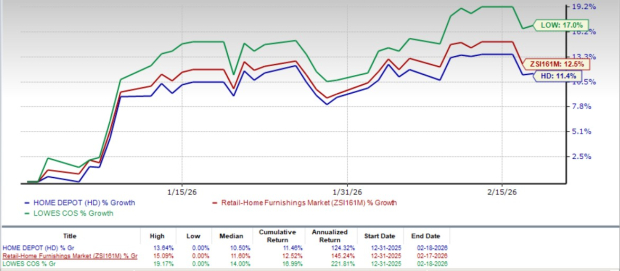

Home Depot shares have advanced 11.4% so far in the year, trailing Lowe’s, which has rallied 17% over the same period.

Home Depot is trading at a forward 12-month price-to-earnings (P/E) ratio of 25.23, above its one-year median of 23.83. Meanwhile, Lowe’s forward P/E ratio stands at 21.55, above its median of 18.62.

Both Home Depot and Lowe’s are strengthening their Pro capabilities and leveraging technology to navigate a challenging demand backdrop, but Home Depot appears better positioned for investors at this point. Its broader scale, deeper integration across retail and specialty distribution and more advanced digital tools for professional customers create a more defensible competitive moat. Although near-term pressures remain for both players, Home Depot’s more comprehensive ecosystem and leadership in the Pro segment give it an edge for now.

While Home Depot carries a Zacks Rank #3 (Hold), Lowe’s has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite