|

|

|

|

|||||

|

|

Swiss pharma giant Roche Holding AG RHHBY posted strong growth in the first quarter of 2025. Sales increased 7% year over year to CHF 15.4 billion and were up 6% at constant exchange rates (CER).

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

The company reports under two divisions — Pharmaceuticals and Diagnostics. All growth rates mentioned below are on a year-over-year basis and at CER.

Sales in the Pharmaceuticals Division were up 8% in the first quarter to CHF 11.9 billion, owing to strong growth in demand for key drugs like Phesgo (breast cancer), Vabysmo (severe eye diseases), Xolair (allergies) and Hemlibra (haemophilia A).

The Diagnostics division’s sales were stable at CHF 3.5 billion, with growth in demand for immunodiagnostic products and pathology solutions offsetting the impact of the recent healthcare pricing reforms in China.

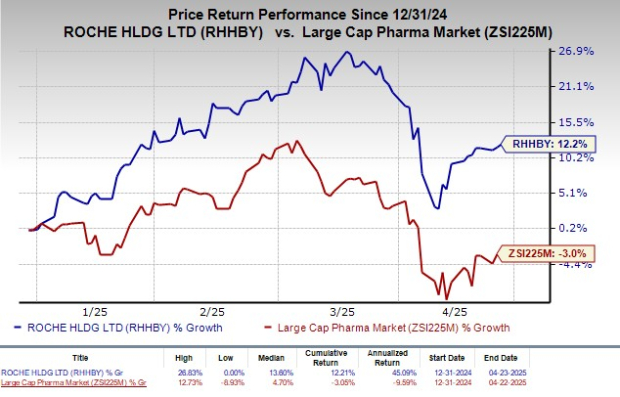

Roche’s shares have rallied 12.2% year to date against the industry’s decline of 3%.

The company’s top growth drivers were Phesgo, Vabysmo, Xolair, Hemlibra and Xofluza (influenza). These five drugs (in unison) generated sales of CHF 3.6 billion, reflecting an increase of CHF 0.7 billion from that recorded in the corresponding period of 2024.

Sales of Ocrevus, used to treat two types of multiple sclerosis, increased 6% year over year to CHF 1.8 billion.

Sales of hemophilia A drug Hemlibra surged 11% year over year to CHF 1.2 billion.

Vabysmo sales surged 18% to CHF 1 billion on strong demand.

Sales of immuno-oncology drug, Tecentriq (for advanced lung cancer, urothelial cancer and breast cancer), remained stable at CHF 870 million.

Perjeta’s sales were down 10% year over year to CHF 840 million.

Actemra/RoActemra’s (rheumatoid arthritis and COVID-19) sales were down 1% year over year to CHF 619 million.

Asthma drug Xolair generated sales of CHF 645 million, up 26% year over year.

Breast cancer drug Kadcyla generated sales of CHF 506 million, up 5% year over year.

Breast cancer drug Phesgo’s (a fixed-dose combination of Perjeta and Herceptin for subcutaneous injection) sales surged 52% year over year to CHF 593 million.

Spinal muscular atrophy drug Evrysdi generated sales of CHF 420 million, up 18% year over year.

Sales of the lung cancer drug Alecensa were up 11% to CHF 397 million.

Blood cancer drug Polivy generated sales of CHF 358 million, up 42% year over year.

Sales of Rituxan/MabThera (for blood cancer and rheumatoid arthritis) declined 16% on a year-over-year basis to CHF 298 million due to biosimilar erosion.

Herceptin sales were down 20% on a year-over-year basis to CHF 292 million due to biosimilar uptake in various countries.

Sales of Avastin, approved for multiple oncology indications, were down 15% to CHF 274 million due to biosimilar competition in the United States and Europe.

Sales of Avastin, Herceptin, MabThera/Rituxan, Esbriet, Lucentis and Actemra/RoActemra decreased by a combined CHF 0.2 billion due to the impact of the loss of exclusivity.

Blood cancer drug Gazyva/Gazyvaro’s sales totaled CHF 249 million, up 15% year over year.

Pulmozyme (cystic fibrosis) sales were up 10% year over year to CHF 123 million.

Activase/TNKase sales came in at CHF 297 million, down 2%.

Roche expects total sales to grow in the mid-single-digit range (at CER) in 2025. Core earnings per share are expected to grow in the high single-digit range. Roche expects to increase its dividend in Swiss francs further.

Last month, Roche in-licensed co-development and co-commercialization rights from Denmark’s Zealand Pharma for the latter’s long-acting amylin analog, petrelintide. The company plans to develop petrelintide as a monotherapy as well as a fixed-dose combination with its lead incretin candidate CT-388, a dual GLP-1/GIP receptor agonist, as a potential foundational therapy for obese and overweight people.

We note that Roche is a pretty late entrant in the obesity market, which is currently one of the most lucrative spaces in the healthcare sector. The market is dominated by Novo Nordisk NVO and Eli Lilly LLY. The stupendous success of Eli Lilly’s Zepbound and Novo Nordisk’s obesity drug, Wegovy, puts the spotlight on the obesity space.

Eli Lilly’s Zepbound witnessed a phenomenal uptake owing to solid demand.

The FDA approved NVO’s Weogovy in 2021 for chronic weight management in obese or overweight adults. Since the approval, sales of the drug have been rising consistently, driven by increased demand.

Earlier this month, the European Commission approved Columvi (glofitamab) in combination with gemcitabine and oxaliplatin (GemOx) for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma not otherwise specified who are ineligible for autologous stem cell transplant.

Roche’s performance in the first quarter of 2025 was good as high demand for key drugs offset the decline in sales of legacy drugs. Multiple sclerosis drug Ocrevus was the biggest contributor.

Ophthalmology drug Vabysmo continued its stellar performance. The drug posed stiff competition to Regeneron’s REGN ophthalmology drug Eylea.

Regeneron has co-developed Eylea with Bayer.

Growth in hemophilia treatment Hemlibra also boosted Roche’s top line.

Roche is planning to expand its foothold in the United States. The company plans to invest $50 billion in pharmaceuticals and diagnostics in R&D and manufacturing over the next five years in the country.

Roche currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 12 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Eli Lilly builds orforglipron cache to avoid previous GLP-1RA shortages

LLY

Pharmaceutical Technology

|

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite