|

|

|

|

|||||

|

|

Roku ROKU has unveiled new streaming devices and software updates, improving the “Roku Experience” for more than 90 million households. Innovations include personalized content discovery, a new “Coming Soon to Theaters” row, and streamlined sports highlights, making TV more tailored to each viewer.

The company also introduced its most compact streaming sticks, upgraded Roku-made TVs, and expanded into smart home tech with battery-powered indoor and outdoor cameras. Roku’s Smart Home OS and new Smart Projector design aim to increase user engagement. These innovations are part of Roku’s broader strategy to make streaming simpler, more connected, and more enjoyable, while continuing to grow its presence in the global home entertainment and smart device markets.

Roku’s device segment faced significant challenges in the fourth quarter of 2024, as weak holiday demand and excess inventory led to aggressive discounting, pressuring profit margins. While the company anticipates a return to normal margins in 2025, near-term device profits are expected to remain flat despite potential sales growth.

This makes Roku’s latest product launches especially timely. The introduction of compact streaming sticks, upgraded Roku TVs, and smart home devices is aimed at reigniting sales momentum and expanding user engagement. These innovations not only improve the overall “Roku Experience” but also help differentiate the brand in a crowded market, positioning Roku to recover from recent setbacks and continue growing its platform business.

Roku hit a major milestone in the fourth quarter of 2024, crossing $1 billion in platform revenues for the first time, which was up 25% year over year. The company ended the year with 89.8 million global streaming households, gaining 4.3 million in the fourth quarter alone. Roku passed 90 million households in early January 2025 and aims to reach 100 million soon through continued platform growth and global expansion.

User engagement also climbed, with total streaming hours rising 18% year over year to 34.1 billion in the fourth quarter and reaching 127.1 billion for 2024. The Roku Channel stood out, with an 82% surge in streaming hours, now reaching about 145 million U.S. viewers. It remains the #3 app on the platform by reach and engagement, helping drive Roku’s ad-supported revenue momentum.

For 2025, Roku expects total net revenues of $4.61 billion, indicating 12% year-over-year growth. Platform revenues are anticipated to reach $3.95 billion, suggesting an increase of 12% year over year. Excluding political ad spending, this suggests 15% growth, slightly above the 2024 rate.

Roku projects an adjusted EBITDA of $350 million for 2025, indicating a 35% increase from the 2024 level. This demonstrates improving profitability as the company scales.

The Zacks Consensus Estimate for 2025 revenues is pegged at $4.59 billion, suggesting year-over-year growth of 11.58%. The consensus mark for 2025 earnings is pinned at 1 cent per share, which has been revised upward from a loss of 26 cents per share over the past seven days.

Roku’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 55.07%

See the Zacks Earnings Calendar to stay ahead of market-making news.

Roku operates in a highly competitive advertising industry and competes for revenues with other companies that have launched ad-supported streaming. Some of these companies include Netflix NFLX, Warner Bros. Discovery WBD and Disney DIS.

Since its launch, Netflix’s ad-supported tier reached 70 million global monthly users as of late 2024, while Warner Bros. Discovery expanded its ad-supported tier on Max to more than 45 countries in the past 15 months. As of January this year, Disney had approximately 157 million global monthly active users watching ad-supported content across its streaming platforms. If Roku is unable to improve its own platform’s capabilities to face the increasing competition, both business and growth prospects of the company may be harmed.

In the year-to-date period, Roku shares have plunged 20.3%, underperforming the Zacks Consumer Discretionary sector’s decline of 7% and the Zacks Broadcast Radio and Television industry’s growth of 9.3%. Shares of its competitors Warner Bros. Discovery and Disney have lost 24.7% and 22.7%, respectively, while Netflix has gained 16.7%.

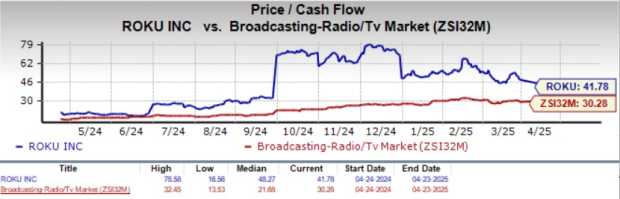

From a valuation perspective, Roku currently trades at a price-to-cash flow ratio of 41.78X, which is at a significant premium compared to the Zacks Broadcast Radio and Television industry average of 30.28X. While this valuation gap suggests that investors have high growth expectations for this stock, it is not a good pick for a value investor. A value score of D further reinforces an unattractive valuation for ROKU at this moment.

Despite recent margin pressures in its device segment and fierce competition in the ad-supported streaming space, Roku’s long-term outlook remains promising. The company is making smart investments in product innovation, platform enhancements, and international expansion, all of which aim to increase user engagement and grow monetization. Its strong growth in platform revenues, rising streaming hours, and expanding user base reflect a scalable business model. However, elevated valuation levels and underperformance in the stock price suggest that near-term caution is warranted. As Roku continues improving profitability and executing on its strategy, investors should monitor its progress and consider holding the stock for now.

ROKU currently carries a Zacks Rank #3 (Hold), suggesting that it may be wise for investors to wait for a more favorable entry point in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite