|

|

|

|

|||||

|

|

Tractor Supply Company TSCO reported first-quarter 2025 results, wherein both top and bottom lines fell short of the Zacks Consensus Estimate. While net sales increased, earnings decreased from the year-ago period’s actuals.

Tractor Supply’s posted earnings of 34 cents per share, which missed the Zacks Consensus Estimate of 37 cents. Also, the bottom line slumped 8% from the figure reported in the prior-year quarter. (Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.)

Tractor Supply Company price-consensus-eps-surprise-chart | Tractor Supply Company Quote

Net sales grew 2.1% year over year to $3.47 billion. However, sales missed the Zacks Consensus Estimate of $3.55 billion. The increase in sales can be attributed to store openings and the contribution from Allivet, partially offset by a decrease in comparable store sales.

Comparable store sales declined 0.9% against a 1.1% increase in the prior year’s first quarter. A strong 2.1% rise in comparable average transaction count, driven by year-round categories like consumable, usable and edible products, as well as winter seasonal merchandise, was offset by a 2.9% drop in comparable average ticket. The ticket decline reflects softer sales in spring seasonal goods, particularly in big-ticket categories.

Gross profit rose 2.8% to $1.26 billion and the gross margin increased 25 basis points (bps) year over year to 36.2%. Our model predicted gross profit to increase 5.6% and the gross margin to expand 40 bps to 36.4%.

Selling, general and administrative (SG&A) expenses, as a percentage of sales, increased 81 bps year over year to 29%. In dollar terms, SG&A expenses, including depreciation and amortization, rose 5.1% year over year to $1.01 billion. The higher SG&A expense rate resulted from growth investments, which comprised higher depreciation, the onboarding of the company’s 10th distribution center, and the deleverage of fixed costs given the comparable store sales decline. These were partly offset by a focus on productivity, cost control and modest gains from its sale-leaseback strategy.

The operating income was down 5.3% year over year to $249.1 million. Meanwhile, the operating margin fell 56 bps to 7.2%. We estimated operating income to increase 2.8% and the operating margin to contract 20 bps to 7.6%.

Tractor Supply ended the quarter with cash and cash equivalents of $231.7 million, long-term debt of $2.1 billion and total stockholders’ equity of $2.2 billion. In the three months ended March 29, 2025, net cash provided by operating activities was $216.8 million. In the same period, the company incurred a capital expenditure of $141.3 million.

In the first quarter, Tractor Supply repurchased 1.7 million shares of the common stock for $94 million and paid out cash dividends of $122.4 million, returning $216.4 million to shareholders.

In the first quarter of 2025, it opened 15 Tractor Supply stores and two Petsense by Tractor Supply locations, while closing two Petsense stores.

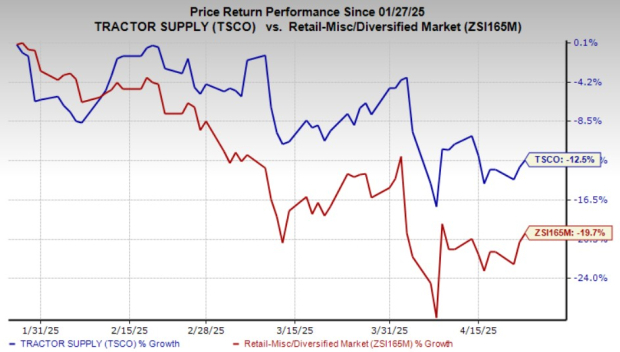

Following the mixed results, Tractor Supply’s shares lost in the pre-market trading session today. Most of this decline can be attributed to investor concern about the implications of new tariffs, due to which the company has updated its outlook. This Zacks Rank #4 (Sell) company’s shares have lost 12.5% in the past three months compared with the industry’s 19.7% decline.

For 2025, TSCO now expects net sales growth of 4-8% compared with its prior projection of 5-7%. Comparable store sales are expected to grow 0-4% compared with the prior expectation of 1-3%. The operating margin rate is now forecasted between 9.5% and 9.9%, slightly down from the previous range of 9.6% to 10%. Net income is anticipated to be between $1.07 billion and $1.17 billion compared with the earlier view of $1.12 billion to $1.18 billion. Earnings per share are now expected in the band of $2.00 to $2.18 compared with the prior range of $2.10 to $2.22.

For the second quarter of 2025, Tractor Supply expects net sales growth of approximately 3-4%, comparable store sales to range from flat to up 1% and earnings per diluted share between $0.79 and $0.81.

Nordstrom, Inc. JWN, which operates as a fashion retailer in the United States, currently flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nordstrom’s current fiscal-year sales indicates growth of 2.2% from the year-ago period’s reported figures. JWN delivered an earnings surprise of 22.2% in the last reported quarter.

The Gap, Inc. GAP operates as an apparel retail company. It sports a Zacks Rank of 1 at present. GAP delivered a trailing four-quarter average earnings surprise of 77.5%.

The Zacks Consensus Estimate for The Gap’s current fiscal-year earnings and revenues indicates growth of 7.7% and 1.5%, respectively, from the year-ago period’s reported figures.

Urban Outfitters, Inc. URBN offers lifestyle products and services. It currently carries a Zacks Rank #2 (Buy). URBN delivered a trailing four-quarter average earnings surprise of 28.4%.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year earnings and sales indicates growth of 14.5% and 6.6%, respectively, from the year-ago period’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 13 hours | |

| Feb-15 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite