|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Microsoft MSFT is slated to report third-quarter fiscal 2025 results on April 30.

The Zacks Consensus Estimate for revenues is pegged at $68.38 billion, indicating growth of 10.55% from the figure reported in the year-ago quarter.

The consensus mark for earnings has remained steady at $3.20 per share over the past 30 days, suggesting 8.84% year-over-year growth.

See the Zacks Earnings Calendar to stay ahead of market-making news.

In the last reported quarter, the company delivered an earnings surprise of 3.86%. The company’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 4.34%.

Microsoft Corporation price-eps-surprise | Microsoft Corporation Quote

Our proven model does not conclusively predict an earnings beat for Microsoft this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

MSFT has an Earnings ESP of -0.51% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Microsoft's upcoming third-quarter fiscal 2025 results are expected to demonstrate steady growth, though several indicators suggest investors should consider holding positions or awaiting more favorable entry points. The company's performance continues to be anchored by its cloud-focused segments, with varying growth patterns across its diverse business units.

In the Productivity and Business Processes segment, Microsoft projects revenues between $29.4 billion and $29.7 billion, with model estimates indicating 8.9% year-over-year growth to $29.51 billion.

Office 365 Commercial revenues are anticipated to grow 14-15% at constant currency (cc), highlighting the continued shift from traditional on-premise solutions to cloud-based offerings. While Office Commercial products revenues are expected to remain flat, Office Consumer products and cloud services demonstrate resilience with projected mid-to-high single-digit growth.

LinkedIn performance appears moderate with forecasted low-to-mid single-digit revenue increases, while Dynamics 365 maintains stronger momentum with mid-teens growth expectations.

The Intelligent Cloud segment continues as Microsoft's primary growth engine, with revenue projections between $25.9 billion and $26.2 billion. Our model estimate for this segment is pegged at $26.06 billion, indicating growth of 17.7% from the figure reported in the year-ago quarter.

Azure remains the standout performer, with anticipated revenue growth of 31-32% at cc, reinforcing Microsoft's AI-focused strategy. Enterprise Services is projected for modest low-to-mid single-digit growth, contrasting with expected mid-single-digit declines in Server product revenues.

The More Personal Computing segment presents a more measured outlook, with revenue projections of $12.4-$12.8 billion. Our model estimate for this segment is pegged at $12.77 billion, indicating growth of 1.3% from the figure reported in the year-ago quarter.

Windows revenue performance appears contingent on improving while slow PC demand trends. According to the preliminary results from the International Data Corporation Worldwide Quarterly Personal Computing Device Tracker, first-quarter 2025 worldwide PC shipments reached 63.2 million units, growing 4.9% year over year, though Microsoft expects Windows OEM revenues to decline in low-to-mid single digits.

The competitive landscape shows steady results, with Lenovo LNVGY achieving 10.8% shipment growth while Hewlett Packard HPE and Dell Technologies DELL experienced an increase of 6.1% and 3%, respectively.

Gaming segment revenues are projected for low-single-digit growth, with Xbox content and services expected to achieve low-to-mid single-digit increases. This moderate performance in consumer-facing segments contrasts with the stronger enterprise and cloud divisions.

While Microsoft maintains solid fundamentals with consistent growth in key strategic areas, particularly cloud services and AI initiatives, the varied performance across segments suggests potential headwinds. Investors should carefully evaluate the company's ability to maintain premium valuation multiples given the modest growth projections in personal computing and certain business segments, potentially supporting a cautious approach ahead of the earnings announcement.

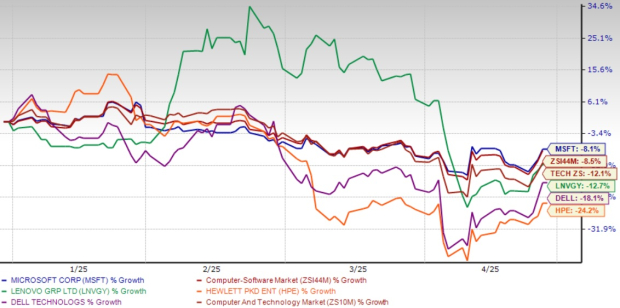

Shares of MSFT have declined 8.1% in the year-to-date period compared with the broader Zacks Computer & Technology sector which has decreased 12.1%. Shares of LNVGY, DELL and HPE have lost 12.7%, 18.1% and 24.2%, respectively in the same period.

Now, let’s look at the value Microsoft offers investors at current levels. MSFT is trading at a premium with a forward 12-month P/S of 9.49X compared with the Zacks Computer - Software industry’s 7.94X, reflecting a stretched valuation.

Microsoft presents a compelling but nuanced investment opportunity ahead of third-quarter fiscal 2025 results. While the company maintains strong fundamentals through its cloud dominance (Azure) and productivity suite (Office 365), with strategic AI initiatives providing long-term growth potential, investors should consider adopting a cautious stance. The company's diversified revenue streams offer stability, but cloud market competition from Amazon and Google, potential enterprise IT spending constraints, and increasing regulatory scrutiny create near-term headwinds. Current valuations may not fully account for these challenges despite Microsoft's strong balance sheet and consistent shareholder returns. Investors might benefit from holding existing positions or waiting for more favorable entry points following the upcoming earnings announcement, when market expectations and growth projections can be reassessed against actual performance metrics.

Microsoft's strong performance in productivity and collaboration offerings is expected to drive steady growth in the third quarter of fiscal 2025 despite a premium valuation and fierce competition in the cloud market. Maintaining a position in Microsoft appears prudent at present. Investors looking to buy the stock should, however, exercise caution and wait for a better entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

OpenAI Nears $100 Billion Funding Round. Why These AI Stocks Could Get A Lift.

MSFT

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite