|

|

|

|

|||||

|

|

Merck MRK reported its first-quarter 2025 results last week, beating estimates for both earnings and sales. Adjusted earnings of $2.22 per share rose 12% year over year, excluding foreign exchange impact. Revenues of $15.53 billion rose 1% year over year as higher sales of blockbuster cancer drug, Keytruda, new products like Welireg, Winrevair and Capvaxive and strong performance of the Animal Health segment were partially offset by lower sales of the HPV vaccine Gardasil in China.

Keytruda, the biggest product in Merck’s portfolio, generated sales of $7.21 billion in the quarter, up 6% year over year. Sales of Gardasil declined 40% due to lower demand in China,

Merck maintained its sales guidance in the range of $64.1-$65.6 billion. Merck expects sales to accelerate in the second half of the year.

The adjusted gross margin guidance was lowered by 50 basis points from the prior guidance of 82.5% to 80% due to the potential negative impact of tariffs. Merck expects $200 in costs from tariffs implemented to date, primarily between the United States and China, and to a lesser degree, Canada and Mexico. The adjusted EPS guidance was lowered from a range of $8.88-$9.03 to $8.82-$8.97 to include a one-time charge of 6 cents related to an M&A transaction that will close in the second quarter. If we exclude the one-time charge, the company’s adjusted guidance range remained unchanged

Nonetheless, a single quarter’s results are not so important for long-term investors, and the focus should rather be on the company’s strong fundamentals. Let’s understand the company’s strengths and weaknesses to better analyze how to play MRK stock in the post-earnings scenario.

Merck boasts more than six blockbuster drugs in its portfolio, with the blockbuster PD-L1 inhibitor Keytruda being the key top-line driver. Keytruda, approved for several types of cancer, alone accounts for around 50% of the company’s pharmaceutical sales. The drug has played an instrumental role in driving Merck’s steady revenue growth in the past few years.

Keytruda’s sales are gaining from rapid uptake across earlier-stage indications, mainly early-stage non-small cell lung cancer. Continued strong momentum in metastatic indications is also boosting sales growth. The company expects continued growth from Keytruda, particularly in early lung cancer.

Merck is working on different strategies to drive Keytruda's long-term growth. These include innovative immuno-oncology combinations, including Keytruda with LAG3 and CTLA-4 inhibitors. In partnership with Moderna MRNA, Merck is developing a personalized mRNA therapeutic cancer vaccine (V940/mRNA-4157) in combination with Keytruda for patients with certain types of melanoma and non-small cell lung cancer (NSCLC). Merck and Moderna are conducting pivotal phase III studies on V940, in combination with Keytruda, for earlier-stage and adjuvant NSCLC and adjuvant melanoma.

Merck is also developing a subcutaneous formulation of Keytruda that can extend its patent life.

Merck has been making meaningful regulatory and clinical progress across areas like oncology (mainly Keytruda), vaccines and infectious diseases while executing strategic business moves.

Merck’s phase III pipeline has almost tripled since 2021, supported by in-house pipeline progress as well as the addition of candidates through M&A deals. This has positioned Merck to launch around 20 new vaccines and drugs over the next few years, with many having blockbuster potential. Merck’s new 21-valent pneumococcal conjugate vaccine, Capvaxive, and pulmonary arterial hypertension (PAH) drug, Winrevair have the potential to generate significant revenues over the long term. Both products have witnessed a strong launch.

Merck has other promising candidates in its late-stage pipeline, such as enlicitide decanoate/MK-0616, an oral PCSK9 inhibitor for hypercholesterolemia, tulisokibart, a TL1A inhibitor for ulcerative colitis and Daiichi-Sankyo-partnered antibody-drug conjugates. A regulatory application seeking approval for clesrovimab, its respiratory syncytial virus vaccine, is under review in the United States, with an FDA decision expected in June.

To foray into the lucrative obesity market, Merck has in-licensed global rights to an investigational oral GLP-1 receptor agonist, HS-10535, from Chinese biotech Hansoh Pharma.

Merck is heavily reliant on Keytruda. Though Keytruda may be Merck’s biggest strength and a solid reason to own the stock, it can also be argued that the company is excessively dependent on the drug and it should look for ways to diversify its product lineup.

There are rising concerns about the firm’s ability to grow its non-oncology business ahead of the upcoming loss of exclusivity of Keytruda in 2028.

Also, competitive pressure might increase for Keytruda in the near future. In 2024, Summit Therapeutics SMMT reported positive data from a phase III study (conducted in China by partner Akeso) in patients with locally advanced or metastatic NSCLC, in which its lead pipeline candidate, ivonescimab, a dual PD-1 and VEGF inhibitor, outperformed Keytruda. Summit believes iivonescimab has the potential to replace Keytruda as the next standard of care across multiple NSCLC settings.

Sales of Gardasil, which is Merck’s second-largest product, are declining due to a weak performance in China, which resulted from sluggish demand trends amid an economic slowdown. Lower demand in China resulted in above-normal channel inventory levels at Merck’s commercialization partner in China, Zhifei. Accordingly, Merck decided to temporarily halt shipments of Gardasil in China. At the midpoint of the total revenue guidance for 2025, Merck assumes no further Gardasil shipments to China this year.

However, Gardasil sales remain strong in almost every major region outside China, including the United States.

Merck is also seeing declining demand for its diabetes products and the generic erosion of some drugs.

Merck’s shares have lost 16.1% so far this year compared with an increase of 1.5% for the industry. The stock has also underperformed the sector and the S&P 500 Index, as seen in the chart below. The stock is also trading below its 50-day as well as 200-day moving averages.

From a valuation standpoint, Merck appears attractive relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 8.99 forward earnings, lower than 15.70 for the industry as well as its 5-year mean of 13.08.

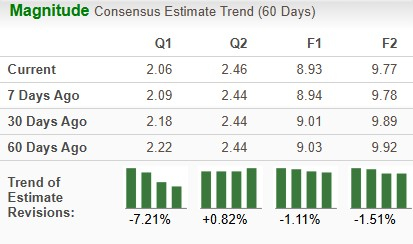

The Zacks Consensus Estimate for 2025 earnings has declined from $9.01 to $8.93 per share over the past 30 days, while that for 2026 has declined from $9.89 to $9.77 per share over the same timeframe.

With a weak fourth-quarter earnings report in February, along with an unimpressive guidance for 2025, Merck began the year on a dismal note.

With the company beating estimates and maintaining its full-year guidance, the company’s first-quarter results were not that bad. Importantly, the company said that it believes the potential impact of additional tariffs on pharmaceutical imports is manageable. Merck believes that its global supply chain and inventory levels can help manage the impact of tariffs in the short term.

Since 2018, Merck has invested $12 billion in U.S. manufacturing while committing to an additional investment of $9 billion plus for projects through 2028. This effort can improve supply and help mitigate the impact of import tariffs in the long run. These comments seem to have brought relief to investors, explaining the stock’s 3.6% increase post earnings.

Merck has one of the world’s best-selling drugs in its portfolio, generating billions of dollars in revenues. Though Keytruda will lose patent exclusivity in 2028, its sales are expected to remain strong until then.

Merck has its share of headwinds in the form of persistent challenges for Gardasil in China, potential competition for Keytruda and rising competitive and generic pressure on some drugs. All these factors have raised doubts about Merck’s ability to navigate the Keytruda loss of exclusivity period successfully. However, Merck’s new products, Capvaxive and Winrevair, are witnessing strong launches and have the potential to generate significant revenues over the long term. The company also has a promising pipeline.

We believe investors with a long-term horizon should stay invested in this Zacks Rank #3 (Hold) stock due to its strong fundamentals. However, short-term investors may consider exiting due to MRK’s near-term challenges, as the company may take some time to recover.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 8 hours | |

| 10 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

FDA reversal on mRNA-1010 could transform the seasonal influenza vaccines market

MRNA

Clinical Trials Arena

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite