|

|

|

|

|||||

|

|

Super Micro Computer, Inc. SMCI is set to report its third-quarter fiscal 2025 on April 29.

For the fiscal third quarter, the company expects revenues between $5 billion and $6 billion. The Zacks Consensus Estimate is pegged at $5.34 billion, indicating growth of 38.6% from the year-ago quarter’s reported value.

Super Micro Computer expects non-GAAP earnings per share between 46 cents and 62 cents. The Zacks Consensus Estimate for earnings is pegged at 52 cents per share, suggesting a decline of 22.4% from the year-ago reported figure. The figure has remained unchanged over the past 60 days. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Super Micro Computer’s earnings beat the Zacks Consensus Estimate twice in the trailing four quarters while missing once and matching the same on the other, delivering an average negative surprise of 1.82%.

Super Micro Computer, Inc. price-eps-surprise | Super Micro Computer, Inc. Quote

Our proven model does not conclusively predict an earnings beat for Super Micro Computer this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Though SMCI sports a Zacks Rank #1 at present, it has an Earnings ESP of 0.00%. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Super Micro Computer’s third-quarter fiscal 2025 results are likely to benefit from the rising demand for artificial intelligence (AI) workloads. The company is likely to gain from the proliferation of data centers and expansion of the existing ones, which is anticipated to have driven the demand for SMCI’s high-performance and energy-efficient servers in the to-be-reported quarter.

As SMCI’s liquid-cooled and modular servers are gaining traction among cloud service providers, government customers and enterprises as these can handle AI at scale, this is likely to positively reflect in SMCI’s third-quarter fiscal 2025 results. Moreover, the enhancement of its AI expertise by partnering with NVIDIA NVDA and integrating NVIDIA’s Blackwell GPUs for high compute power is likely to have boosted third-quarter financial performance.

SMCI’s stronghold in the Direct Liquid Cooling market, where it holds approximately 70% of the market share, is likely to have provided stability to its top line in the to-be-reported quarter. As SMCI is rapidly ramping up its production facilities across Malaysia, Taiwan, Europe, and the United States, these factors are likely to reflect positively in the third quarter of fiscal 2025 results.

Super Micro Computer’s robust traction across high-end data centers, expanding cloud service providers, enterprise/channel and edge/IoT/telco customers due to its robust next-generation AI and CPU platforms is expected to have been upsides in the to-be-reported quarter.

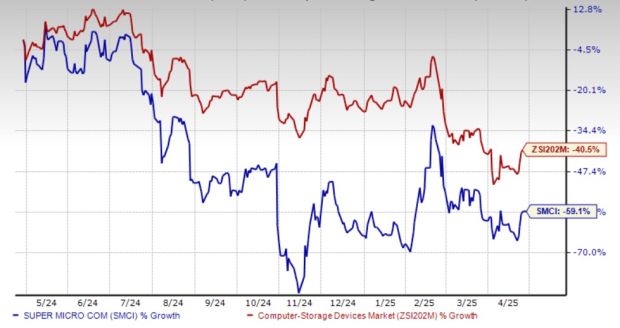

Super Micro Computer shares have plunged 59.1% over the past year, underperforming the Zacks Computer – Storage Devices industry’s decline of 40.5%.

Now, let us look at the value Super Micro Computer offers to its investors at current levels. Currently, SMCI is trading at a discount with a forward 12-month price-to-earnings (P/E) of 11.60X compared with the industry’s 16.46X.

Super Micro Computer is rapidly emerging as a dominant force in AI infrastructure, leveraging its liquid cooling leadership, scalable manufacturing and broad AI product portfolio to drive sustained long-term growth.

The latest announcement of ramping up the production of its latest AI data server solution that features NVIDIA’s Blackwell platform will boost Super Micro Computer’s revenue growth in the upcoming quarters. The company’s strong cash flow generation, expanding margins and accelerating AI-driven demand reinforce its investment appeal.

Super Micro Computer’s leadership in the scalable AI training and inference infrastructure space, leveraged by its integration of Intel INTC Gaudi 3 accelerators, is likely to drive the demand for its product in this space.

Additionally, Super Micro is also using Advanced Mechanical Devices AMD-based accelerators to deliver performance for AI, high-performance computing and data-intensive workloads.

Super Micro has established a high reliability with the integration of AMD and Intel processors and that will be reflected in the to-be-reported quarter’s report. SMCI has integrated Intel’s built-in accelerator engines, such as AMX, QAT, DSA, and IAA, in SMCI’s X13 Systems.

Super Micro Computer’s H14 Series servers use Advanced Micro Devices’ EPYC 9005 CPUs and its GPU-Accelerated Systems utilize Advanced Micro Devices’ Instinct MI325X GPUs.

Given the strong fundamentals, low valuation multiple and promising long-term growth prospects in the AI infrastructure market, it would be wise for investors to invest in Super Micro Computer shares. The company is well-positioned to continue delivering robust growth, particularly as the demand for AI remains strong.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 48 min | |

| 55 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite