|

|

|

|

|||||

|

|

U.S. stocks rebounded last week in hopes that trade tensions with China will ease as negotiations begin, offering some relief after weeks of turmoil that pushed major indexes into correction territory. Although President Trump’s 90-day tariff halt briefly calmed investors, worries about the economy’s strength persist, and negotiations between the United States and its trading partners are still in their early stages, suggesting continued volatility for a longer period.

In this environment, dividend-paying stocks remain attractive for cautious, income-focused investors. This brings investors’ attention to Realty Income O, which has earned its repute as "The Monthly Dividend Company". It is an S&P 500 Dividend Aristocrats index member and has hiked its dividend 130 times since its listing on the NYSE in 1994.

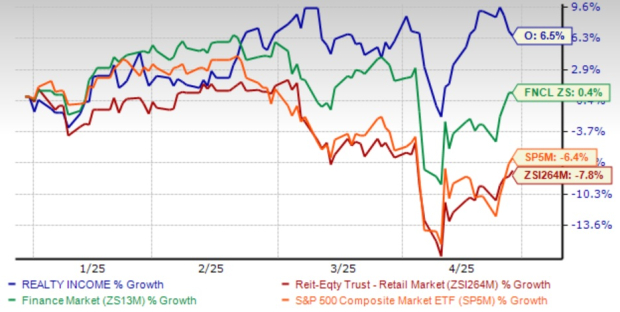

The stock has declined 1.9% over the past month, closing at $56.89 on Friday. However, the recent market sell-off has pushed Realty Income’s dividend yield higher, creating a potential buying opportunity for investors. The stock now offers an attractive yield of 5.66%. So far in the year, the stock has outperformed the Zacks REIT and Equity Trust - Retail industry and the S&P 500 composite.

Still, before making a quick decision to sell or add this stock to your portfolio, it's crucial to carefully assess whether this REIT possesses solid growth prospects to support its dividend payouts. It’s equally important to consider whether the current market concerns could meaningfully affect the company’s long-term performance.

Year-to-Date Price Performance

Realty Income’s reputation as “The Monthly Dividend Company” is well-earned, backed by a solid history of dividend reliability and growth. The company has achieved 30 consecutive years of rising dividends and 110 straight quarterly increases, delivering a compound annual dividend growth rate of 4.3% since 1994. This strong track record showcases its resilience and makes Realty Income a compelling choice for income-focused investors seeking stable returns amid economic uncertainty. Check Realty Income’s dividend history here.

Encouragingly, Realty Income’s dividend payouts are firmly supported by strong fundamentals. As of Dec. 31, 2024, the company owned 15,621 properties across all 50 U.S. states, the U.K. and six additional European markets. It boasts A3/A- credit ratings from Moody’s and S&P, respectively, alongside $3.7 billion in liquidity. With a manageable net debt to annualized pro-forma adjusted EBITDAre of 5.4X and a well-laddered debt maturity profile averaging 6.6 years, Realty Income's financial position remains healthy and secure.

Realty Income’s expansion strategy has strengthened its growth prospects. The REIT has diversified beyond traditional retail, moving into industrial, gaming and data center assets. Notable investments like Encore Boston Harbor and Bellagio Las Vegas and a partnership with Digital Realty DLR for data centers show its forward-thinking approach. Apart from joining hands with Digital Realty, its growing European footprint and massive addressable market position Realty Income to sustain long-term expansion and protect against sector-specific downturns. O expects a full-year 2025 investment volume of approximately $4 billion.

Despite its strengths, Realty Income is not without challenges. The company's bad debt provision increased to 75 basis points in 2024 due to difficulties with a few tenants, many acquired through M&A activity. While management expects effective rent recapture, reliance on financially unstable tenants could impact cash flows in the short term and, if not contained, could pressure its dividend reliability over time. Moreover, uncertainty around tariffs could further strain retailers in its portfolio, potentially impacting overall performance.

Another concern is Realty Income’s vulnerability to rising interest rates. As Treasury yields climb due to inflation worries, bonds become more attractive relative to income-focused REITs like Realty Income. This shift could lead to reduced investor demand for REIT stocks, potentially weighing on Realty Income’s stock price and limiting its ability to raise low-cost capital for future investments.

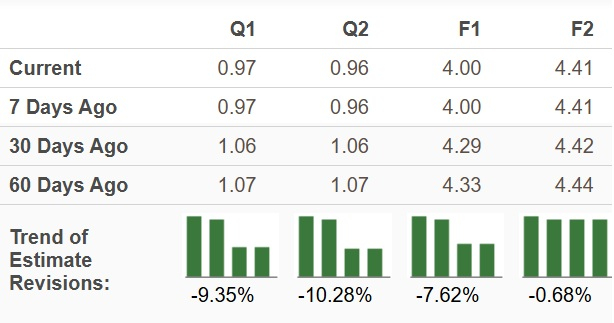

The estimate revisions reflect a somewhat bearish trend. The Zacks Consensus Estimate for 2025 adjusted funds from operations (AFFO) per share has declined 6.8% over the past month, while the same for 2026 has also moved south by a cent over the same time frame.

O’s Estimate Revision Trend

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Realty Income stock is trading at a forward 12-month price-to-FFO of 13.76X, below the retail REIT industry average of 15.19X but higher than its one-year median of 13.07X. Although Realty Income stock is currently trading at a discount compared to its industry peers like Agree Realty Corporation ADC, this valuation disparity might not be as favorable as it seems. Agree Realty is trading at a forward 12-month price-to-FFO of 17.55X.

O: Forward 12 Month Price-to-FFO (P/FFO) Ratio

Realty Income continues to be a leading dividend stock, offering a combination of steady income and growth potential. Its diverse tenant base, along with a long-term net lease strategy, ensures stable revenues. A significant portion of its rents comes from tenants in non-discretionary, low-price-point sectors, enhancing predictability. Additionally, its expansion into non-traditional assets like gaming and foray into data centers through a partnership with Digital Realty demonstrate a forward-thinking approach. Supported by a healthy balance sheet and strategic diversification, Realty Income is well-positioned for long-term growth.

However, despite trading at a relative discount to peers like Agree Realty, investors may want to wait for clarity on policy changes and the macroeconomic environment before determining if the stock presents a buying opportunity or potential risks. Existing shareholders may prefer holding the stock due to its consistent dividend growth and resilient asset base.

At present, Realty Income carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 5 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite