|

|

|

|

|||||

|

|

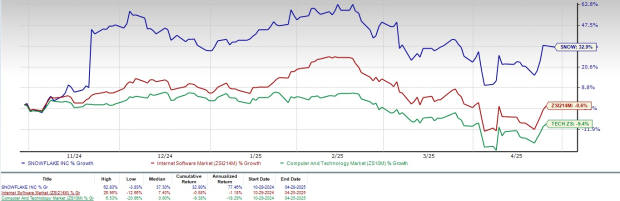

Snowflake SNOW shares have surged 32.9% in the trailing six-month period, outperforming the Zacks Computer and Technology sector’s decrease of 9.4% and the Zacks Internet Software industry’s decline of 0.6%.

The outperformance can be attributed to a strong portfolio and an expanding partner base. As of Jan. 31, 2025, SNOW had 11,159 customers, increasing from 9,384 customers as of Jan. 31, 2024. The clientele included 745 of the Forbes Global 2000 and accounted for 45% of SNOW’s fiscal 2025 revenues of $3.6 billion, up 29% from fiscal 2024.

Snowflake is also benefiting from strong adoption and increasing usage of its platform, as reflected by a net revenue retention rate of 126% as of Jan. 31, 2025. The number of customers that contributed more than $1 million in trailing 12-month product revenue increased from 455 to 580 as of Jan. 31, 2024 and 2025, respectively.

Snowflake’s expanding portfolio has been noteworthy. Products like Apache Iceberg and Hybrid tables, Polaris, Cortex Large Language Model and ML functions are helping Snowflake win new clients.

Building on this momentum, in April 2025, Snowflake enhanced its AI Data Cloud by integrating core capabilities with Apache Iceberg tables. This enabled seamless open lakehouse strategies, improved query performance, comprehensive security, and data sharing while advancing open-source contributions.

Snowflake’s investments in artificial intelligence (AI) and machine learning, including the introduction of Cortex AI and its integration with models from OpenAI and Anthropic, drove customer engagement. More than 4,000 customers are using Snowflake’s AI and ML technology weekly.

SNOW's strong partner base, which includes major players like Microsoft MSFT, Amazon AMZN, NVIDIA NVDA, ServiceNow, Fiserv, EY, LTMindtree, Next Pathway and S&P Global, has been a major growth driver of its success.

In April 2025, SNOW announced an expanded partnership with Microsoft to integrate OpenAI’s models into Snowflake Cortex AI through Azure OpenAI Service, empowering enterprises to build AI-powered apps. This collaboration also brings Snowflake Cortex Agents to Microsoft 365 Copilot and Microsoft Teams, enhancing productivity with AI-driven insights.

Snowflake’s partnership with NVIDIA enables businesses to build customized AI data applications using Snowflake Cortex AI and NVIDIA AI Enterprise software, driving enhanced AI performance and integration.

SNOW’s partnership with Amazon’s cloud computing platform, Amazon Web Services (AWS), has expanded to drive customer-focused innovation, enhance industry-specific solutions, deepen product integrations, and increase collaborative sales and marketing efforts to serve more than 6,000 joint customers, including major Fortune 500 companies.

In April 2025, Snowflake also achieved Department of Defense (DoD) Impact Level 5 Provisional Authorization on AWS GovCloud US-West, enabling secure solutions for handling Controlled Unclassified Information across DoD and related agencies.

For the first quarter of fiscal 2026, Snowflake expects product revenues in the range of $955-$960 million. This indicates year-over-year growth between 21% and 22%.

For fiscal 2026, Snowflake expects product revenues to increase 30% from fiscal 2025 to $3.46 billion.

The Zacks Consensus Estimate for first-quarter fiscal 2026 revenues is currently pegged at $1 billion, indicating 21.13% year-over-year growth. The consensus mark for earnings is currently pegged at 22 cents per share, which has remained unchanged over the past 30 days. This suggests an increase of 57.14% year over year.

Snowflake Inc. price-consensus-chart | Snowflake Inc. Quote

The Zacks Consensus Estimate for SNOW’s fiscal 2026 revenues is pegged at $4.44 billion, indicating year-over-year growth of 22.47%. The consensus mark for earnings is pegged at $1.15 per share, which remained unchanged in the past 30 days. This suggests an increase of 38.55% on a year-over-year basis. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Snowflake shares are currently overvalued, as suggested by its Value Score of F.

The SNOW stock is trading at a premium with a forward 12-month Price/Sales of 11.2X compared with the industry’s 4.86X.

Snowflake’s strong portfolio and expanding partner base continuously contribute to its growth prospects, driving top-line growth. These factors justify the company’s premium valuation.

SNOW stock currently carries a Zacks Rank #2 (Buy) and has a Growth Score of B, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 20 min | |

| 36 min | |

| 47 min | |

| 48 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite