|

|

|

|

|||||

|

|

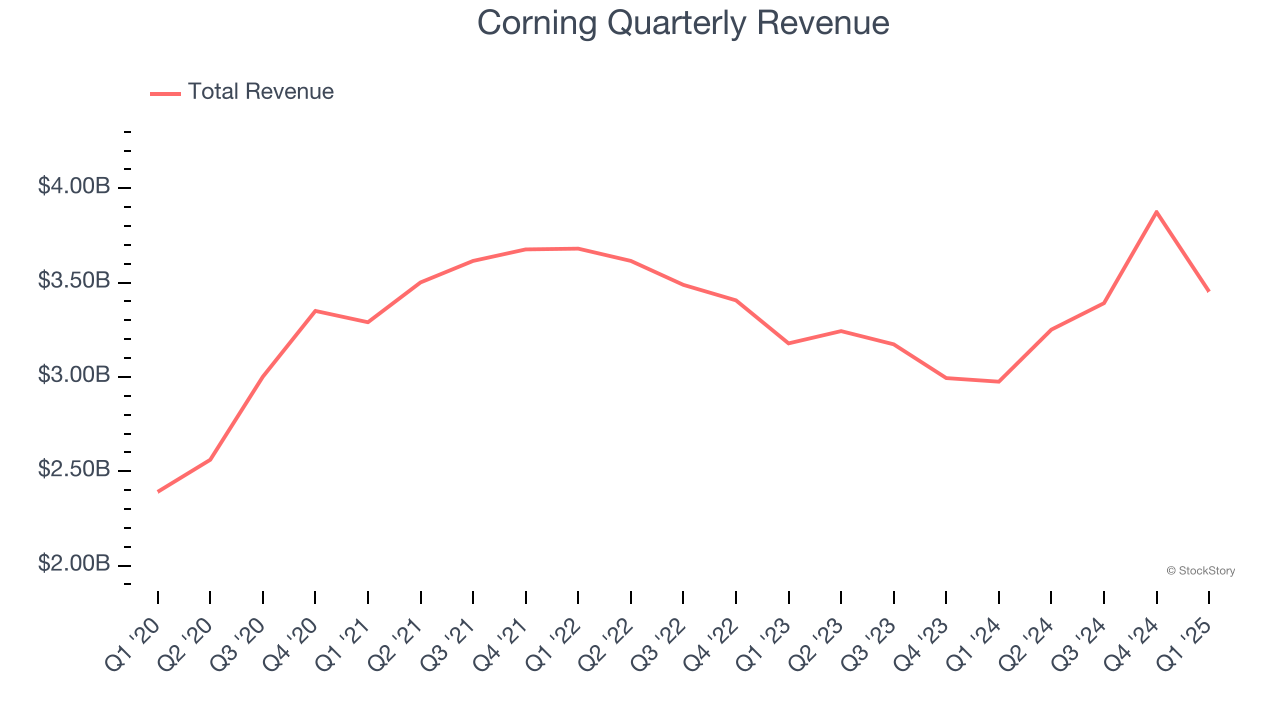

Glass and electronic component manufacturer Corning (NYSE:GLW) missed Wall Street’s revenue expectations in Q1 CY2025, but sales rose 16% year on year to $3.45 billion. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $3.85 billion at the midpoint, or 5% above analysts’ estimates. Its non-GAAP profit of $0.54 per share was 5.4% above analysts’ consensus estimates.

Is now the time to buy Corning? Find out by accessing our full research report, it’s free.

Supplying windows for some of the United States’s earliest spacecraft, Corning (NYSE:GLW) provides glass and other electronic components for the consumer electronics, telecommunications, automotive, and healthcare industries.

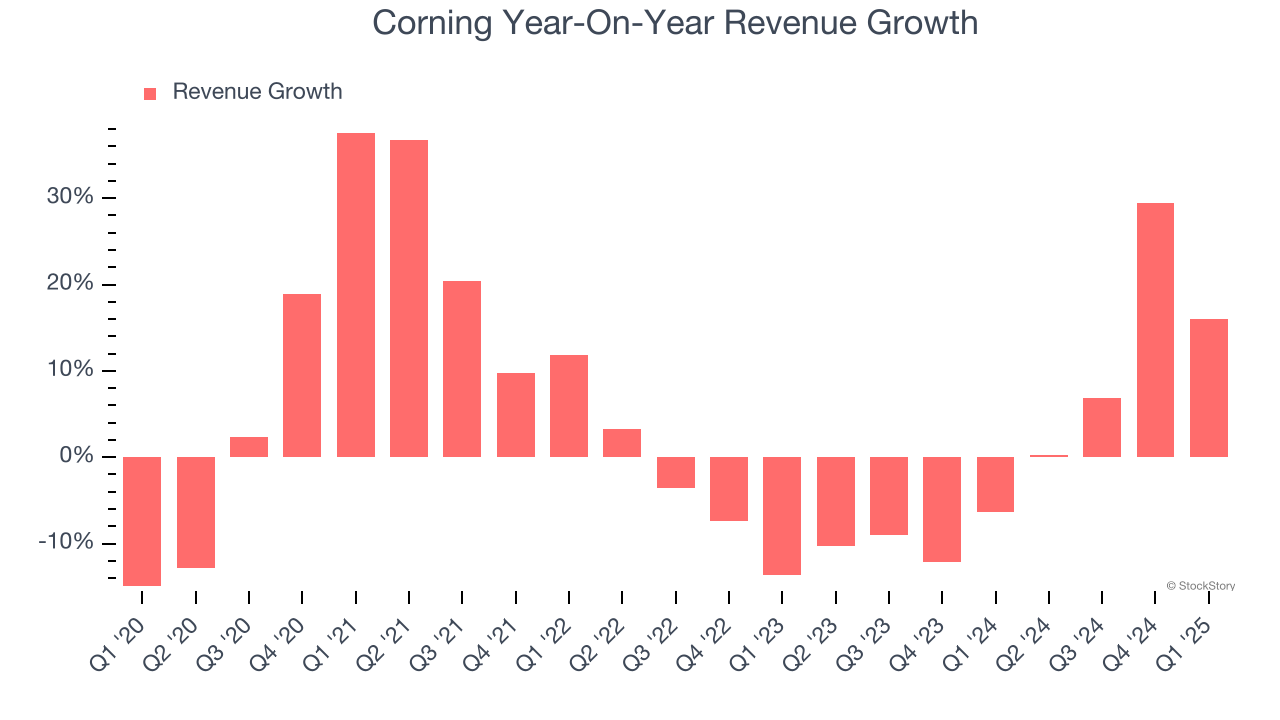

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Corning’s sales grew at a tepid 4.7% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Corning’s recent performance shows its demand has slowed as its annualized revenue growth of 1% over the last two years was below its five-year trend. We also note many other Electronic Components businesses have faced declining sales because of cyclical headwinds. While Corning grew slower than we’d like, it did do better than its peers.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Optical Communications and Display Technologies, which are 39.3% and 26.2% of revenue. Over the last two years, Corning’s Optical Communications revenue (optical fiber & cables) averaged 5.8% year-on-year growth while its Display Technologies revenue (glass for flat panel displays) averaged 12.7% growth.

This quarter, Corning’s revenue grew by 16% year on year to $3.45 billion but fell short of Wall Street’s estimates. Company management is currently guiding for a 18.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

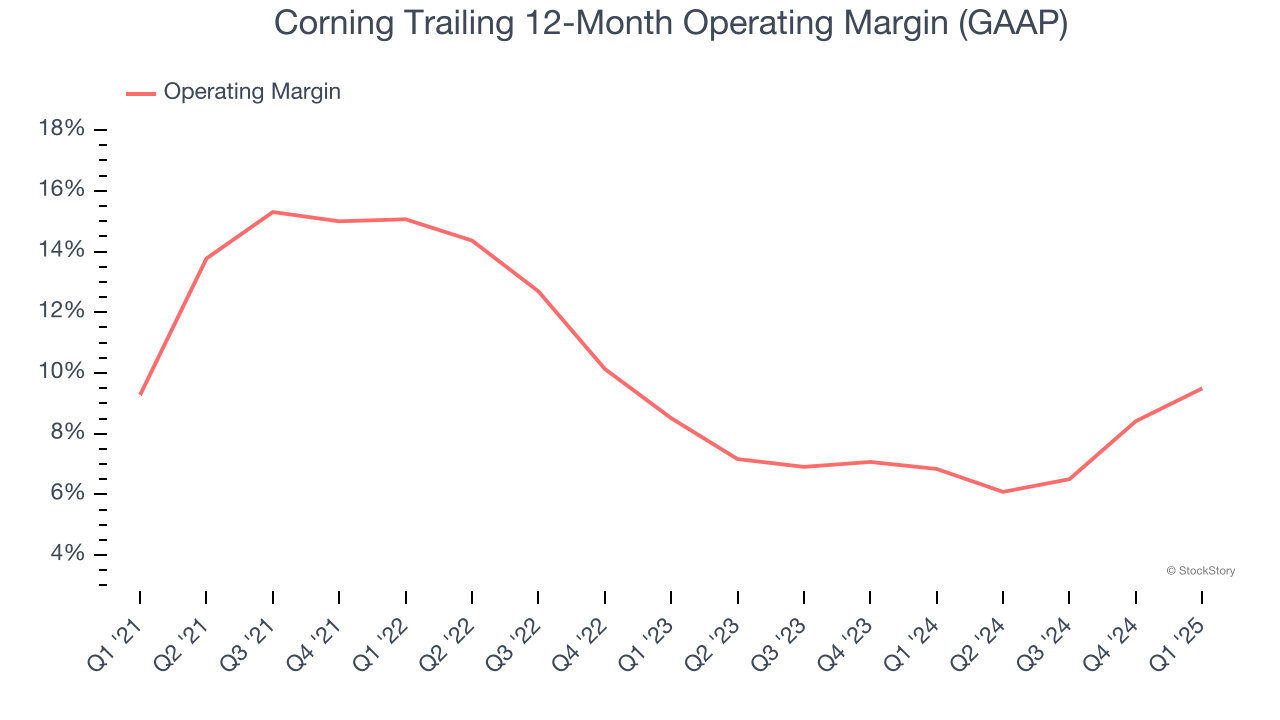

Corning has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Corning’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Corning generated an operating profit margin of 12.9%, up 4.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

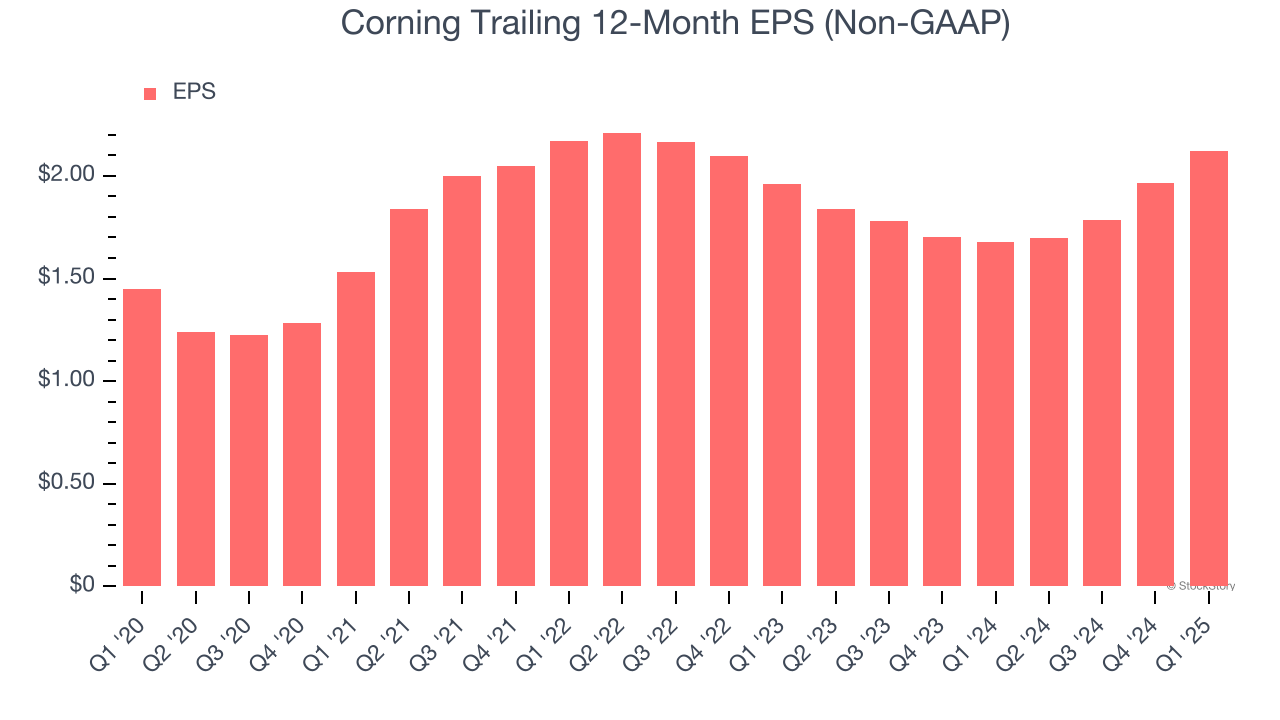

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Corning’s EPS grew at an unimpressive 8% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Although it wasn’t great, Corning’s two-year annual EPS growth of 4% topped its 1% two-year revenue growth.

In Q1, Corning reported EPS at $0.54, up from $0.38 in the same quarter last year. This print beat analysts’ estimates by 5.4%. Over the next 12 months, Wall Street expects Corning’s full-year EPS of $2.12 to grow 12.9%.

It was great to see Corning’s revenue and EPS guidance for next quarter top analysts’ expectations. We were also glad its EPS topped Wall Street’s estimates. On the other hand, its revenue slightly missed. Still, this quarter had some key positives. The stock traded up 1.4% to $44.66 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| 6 hours | |

| Feb-17 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 |

Why a 175-Year-Old Glassmaker Is Suddenly an AI Superstar

GLW +8.31% GLW +7.56%

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite