|

|

|

|

|||||

|

|

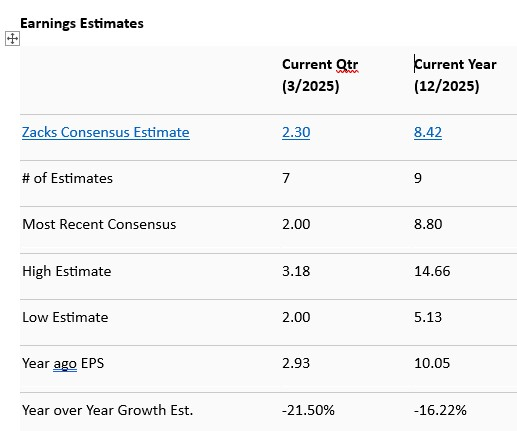

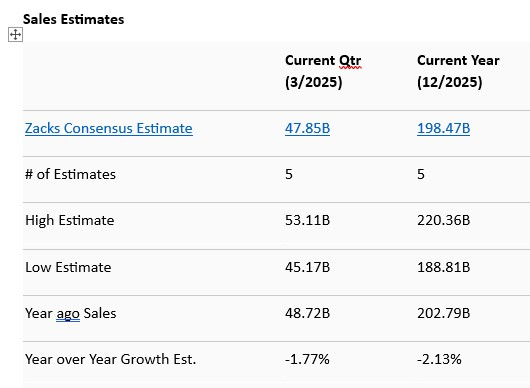

Energy supermajor Chevron Corporation CVX is slated to release its first-quarter 2025 results on May 2, before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share (EPS) and revenues is pegged at $2.30 per share and $47.9 billion, respectively.

The earnings estimates for the to-be-reported quarter have been revised downward by 7.6% over the past 30 days. The bottom-line projection indicates a decline of 21.5% from the year-ago reported number. The Zacks Consensus Estimate for quarterly revenues, meanwhile, suggests a year-over-year decrease of a modest 1.8%.

For full-year 2025, the Zacks Consensus Estimate for CVX’s revenues is pegged at $198.5 billion, implying a drop of 2.1% year over year. The consensus mark for 2025 EPS stands at $8.42, indicating a contraction of around 16.2%.

In the trailing four quarters, the oil and gas company surpassed EPS estimates twice and missed in the other two, as reflected in the chart below.

Chevron Corporation price-eps-surprise | Chevron Corporation Quote

Our proven model does not conclusively predict an earnings beat for Chevron this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

CVX has an Earnings ESP of -5.51% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Chevron’s earnings, particularly from its upstream operations, move in tandem with global oil prices — and that’s a double-edged sword in today’s uncertain climate. Lately, crude prices have swung sharply as escalating trade tensions cloud the demand outlook. The ongoing trade standoff, with the U.S. economy showing signs of strain and China ramping up its resistance to tariff pressure from the Trump administration, has made the energy market jittery. Adding to the downside risk, geopolitical easing — such as ceasefires in the Middle East and Ukraine — combined with rising supply from OPEC+ and non-OPEC producers, has further weighed on oil prices. These broader economic and political shifts feed directly into oil demand and pricing expectations, which in turn affect how much Chevron earns per barrel produced. In other words, the company’s upstream earnings remain highly exposed to the ebbs and flows of macroeconomic policy and geopolitical noise.

Chevron’s production, however, offers a more stabilizing story. The company’s average output of crude oil and natural gas has remained over three million oil-equivalent barrels per day (BOE/d) since the third quarter of 2023, and this time its no exception. With strong volumes from the Permian basin — America's hottest and lowest-cost shale region — Chevron’s total production volume during the first quarter is estimated to have been 3.315 million BOE/d, according to the Zacks Consensus Estimate.

Taking these factors together, Zacks forecasts Chevron’s total upstream income to reach $4.2 billion for the quarter — down from the $5.2 billion reported in Q1 2024.

Chevron’s downstream segment reported a loss of $248 million in the previous quarter, compared to a profit of $1.15 billion in the same period a year earlier. This drastic swing reflects the impact of new global refining capacity from countries like China, Nigeria and Mexico, which is pressuring margins. Additionally, falling demand for products like jet fuel and ongoing structural headwinds could continue weighing on earnings. Consequently, the Zacks Consensus Estimate for CVX’s first-quarter downstream income is pegged at $258 million, implying a plunge from $783 million recorded in the year-ago period. Given that downstream operations contribute a significant share of total revenues, this trend poses a meaningful drag on profitability.

(See the Zacks Earnings Calendar to stay ahead of market-making news.)

In early April, Chevron shares were trading close to $168. Fast forward to today, and the stock is hovering near $140 — marking a drop of roughly 17%. That’s nearly twice the decline seen in rival ExxonMobil XOM over the same period. To be fair, Chevron had a solid start to the year, even touching a 52-week high of $168.96 on March 26. ExxonMobil, by contrast, last peaked at $126.34 back in October. Despite these moments of strength, both energy giants have lagged behind the broader market. Over the past two years, Chevron has delivered a price return of -16%, while ExxonMobil has shed around 5%. In comparison, the S&P 500 has surged 34% during this period.

From a valuation standpoint, Chevron appears reasonable. It is trading at a multiple of 5.76 based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization). This compares favorably to ExxonMobil. For value-focused investors, this could be a catalyst.

A fully integrated energy firm, Chevron is positioned as one of the top global integrated oil firms, set for sustainable production growth, particularly due to its dominant position in the lucrative Permian Basin. Chevron’s financial stability is also a key advantage. The company maintains a healthy balance sheet and continues to emphasize shareholder returns. With high dividend safety, Chevron returned billions in cash to investors even during oil price swings. This financial prudence supports long-term investor confidence.

However, uncertainty around Hess Corporation’s HES acquisition and arbitration risks cloud the stock’s outlook. Chevron’s $53 billion acquisition of Hess faces significant risks due to arbitration over the 11Bboe Stabroek assets. Exxon Mobil (XOM) may exercise its right of first refusal over Hess’ 30% stake, potentially forcing Chevron to revise or abandon the deal. The arbitration hearing, set for May 2025, adds uncertainty and CEO Darren Woods of Exxon has hinted at a counterbid. A negative ruling could lead to a significant strategic setback and impact Chevron’s expansion plans.

Overall, while Chevron offers robust fundamentals and shareholder returns, near-term headwinds suggest a cautious stance. For risk-tolerant investors, it remains a reliable option, but others may find more compelling opportunities within the energy sector.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 8 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite