|

|

|

|

|||||

|

|

Payments giant Mastercard Incorporated MA is set to report first-quarter 2025 results on May 1, 2025, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at $7.57 per shareon revenues of $7.13 billion. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

First-quarter earnings estimates have remained stable over the past 60 days. The bottom-line projection indicates an increase of 7.9% from the year-ago reported number. The Zacks Consensus Estimate for quarterly revenues suggests year-over-year growth of 12.3%.

For 2025, the Zacks Consensus Estimate for Mastercard’s revenues is pegged at $31.59 billion, implying a rise of 12.2% year over year. Also, the consensus mark for 2025 earnings per share is pegged at $15.89, implying a jump of around 8.8% on a year-over-year basis.

Mastercardhas a robust history of surpassing earnings estimates, beating the consensus estimate in each of the last four quarters, with the average surprise being 3.3%. This is depicted in the figure below.

Mastercard Incorporated price-eps-surprise | Mastercard Incorporated Quote

However, our proven model does not conclusively predict an earnings beat for the company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat, but that’s not the case here.

MA has an Earnings ESP of -0.05% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for the company’s total Gross Dollar Volume (GDV) for all MA-branded programs suggests an 8.1% rise from the prior-year quarter’s reported figure, whereas our model predicts a 7.4% increase. We expect GDV from domestic operations to increase by almost 7% year over year and 8% in international operations. Increasing strength in Latin American and European operations is likely to have driven the metric.

Switched transactions are expected to have experienced an upsurge, driven by resilient consumer spending and increased contactless acceptance initiatives pursued by the payment technology company. The Zacks Consensus Estimate for its switched transactions indicates a 9.9% rise from the prior-year quarter’s reported figure, whereas our estimate suggests a 7.7% increase.

Growing cross-border travel is anticipated to have had a positive impact on Mastercard's cross-border volumes. As such, the consensus estimate for cross-border assessments suggests an increase of 14% compared with the previous year, while our projection indicates growth of 15.7%. Further, our model predicts domestic assessments and transaction processing assessments to witness an 8.4% and 8.9% year-over-year increase, respectively.

The Zacks Consensus Estimate for Value-added Services and Solutions net revenues indicates 17% year-over-year growth, while our model estimate suggests nearly 15% increase in the first quarter. Continued demand for its consulting and marketing services and loyalty solutions is likely to have driven this metric.

While the above-mentioned factors are expected to have positioned the company for growth from the past year, rising expenses, rebates and incentives are likely to have partially offset the positives, making an earnings beat uncertain.

Mastercard’s adjusted operating costs are likely to have increased in the first quarter due to higher G&A costs and Advertising & Marketing expenses, potentially hampering its profitability. We expect total adjusted operating expenses to rise 13.7% from the prior-year quarter’s actuals. Furthermore, our estimate for payments network rebates and incentives suggests a 10.6% year-over-year increase.

Mastercard's stock has exhibited an upward movement over the year-to-date period. Its gain of 1.5% has outperformed the industry’s decline of 0.9%. In comparison, its peers like Visa Inc. V jumped 6.8% during this time while American Express Company AXP fell 10.7%. Both Mastercard and Visa have outpaced the S&P 500, which has decreased 6.4% during the same period.

Now, let’s look at the value Mastercard offers investors at current levels.

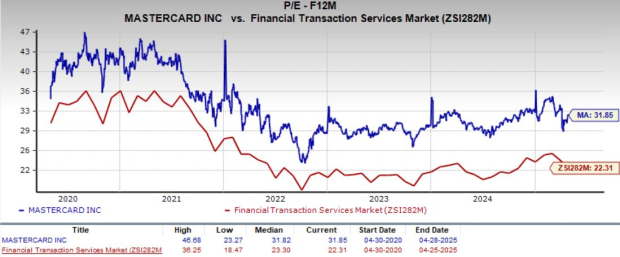

The company’s valuation looks stretched compared with the industry average. Currently, Mastercard is trading at 31.85X forward 12 months earnings, above its five-year median of 31.82X and the industry’s average of 22.31X.

In comparison, both Visa and American Express offer better value at the moment, trading at a forward P/E of 27.84X and 16.63X.

Mastercard is a fundamentally strong company with high margins, long-term global expansion potential, and growing revenues from value-added services like cybersecurity and data analytics. However, its current valuation far exceeds the industry average, raising concerns about overvaluation, especially given rising macroeconomic risks.

A crowded digital payments landscape adds competitive pressure, which can affect pricing. Meanwhile, the temporary pause in tariff wars offers limited relief, as trade uncertainty and cost inflation persist.

Mastercard's rising operating expenses could limit margin growth. Regulatory and legal pressures are also mounting, including risks tied to the Credit Card Competition Act and other lawsuits. While Mastercard remains a strong long-term hold, current headwinds suggest that investors might consider waiting for a better valuation before adding to their position.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite