|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Kraft Heinz Company KHC posted first-quarter 2025 results, wherein the top line was in line with the Zacks Consensus Estimate, while the bottom line beat the same. Both metrics showed year-over-year decline. In light of continued macroeconomic uncertainty, including inflation and tariffs, the company has lowered its full-year outlook.

Nonetheless, Kraft Heinz expressed confidence in its ability to navigate a challenging economic landscape, citing a strong balance sheet, operational scale and continued investment in brand and product quality. The company emphasized its focus on managing controllable factors and driving long-term growth.

Kraft Heinz posted adjusted earnings of 62 cents per share, beating the Zacks Consensus Estimate of 60 cents. Quarterly earnings fell 10.1% year over year, mainly due to lower adjusted operating income and increased taxes on adjusted earnings. This was partially offset by favorable changes in other expense/(income) and fewer shares outstanding. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Kraft Heinz Company price-consensus-eps-surprise-chart | Kraft Heinz Company Quote

The company generated net sales of $5,999 million, down 6.4% year over year. The metric was in line with the Zacks Consensus Estimate. Net sales included a 1.6 percentage point negative impact from foreign currency and an adverse impact of 0.1 percentage point from divestitures. Organic net sales fell 4.7% year over year. Our model expected a 4.1% dip in organic sales.

Pricing increased 0.9 percentage points year over year. This upside was driven by increases in the North America and Emerging Markets segments, although this was somewhat countered by lower pricing in International Developed Markets. The favorable pricing was a result of adjustments in certain categories to address higher input costs, mainly in coffee. The volume/mix dropped 5.6 percentage points from the prior year’s levels, with declines across all segments. The unfavorable result was mainly due to a shift in Easter timing, accounting for roughly 90 basis points (bps) and a decline in Lunchables.

The adjusted gross profit of $2,061 million decreased from the $2,210 million reported in the year-ago quarter. The adjusted gross margin contracted 10 bps to 34.4%. We had expected an adjusted gross margin decline of 30 bps to 34.2%.

Adjusted operating income declined 5.2% to $1,199 million due to unfavorable volume/mix, including the impact of Easter, higher procurement cost inflation, partially offset by efficiency initiatives, and a negative impact from foreign currency. These headwinds were partially offset by lower selling, general and administrative expenses.

North America: Net sales of $4,488 million declined 7% year over year. Organic sales fell 6.5%. We expected a 5.3% decline in segment organic sales. During the quarter, pricing moved up 0.6 percentage points, but the volume/mix fell 7.1 percentage points.

International Developed Markets: Net sales of $817 million were down 4.4% year over year. Organic sales declined 1.7%, with pricing and volume/mix dipping 0.2 percentage points and 1.5 percentage points, respectively. We expected a 2.3% decline in segment organic sales.

Emerging Markets: Net sales of $694 million were down 4.7% year over year. However, organic sales grew 3.9%. We expected 2% growth in segment organic sales. Pricing up 4.3 percentage points, but volume/mix down 0.4 percentage points.

Kraft Heinz ended the quarter with cash and cash equivalents of $2,113 million, long-term debt of $20,925 million and total shareholders’ equity (excluding noncontrolling interest) of $49,460 million. Net cash provided by operating activities was $720 million for the three months ended March 29, 2025, and free cash flow was $482 million.

During the year-to-date period, Kraft Heinz paid cash dividends worth $477 million and made share buybacks worth $225 million. As of March 29, 2025, the company had shares worth $1.7 billion remaining under its buyback plan.

For fiscal 2025, Kraft Heinz now expects organic net sales to decline 1.5% to 3.5% year over year compared with the previous outlook of flat to down 2.5%. Management anticipates organic sales to improve sequentially throughout all quarters in 2025, including a flat to somewhat positive contribution from pricing.

Constant currency adjusted operating income is projected to decline 5% to 10%, down from the previous forecast of a 1% to 4% decline. Adjusted gross profit margin is now expected to decrease 25-75 bps compared with the earlier projection of flat to slightly expanding.

The company now anticipates adjusted EPS to be between $2.51 and $2.67, revised from its prior guidance of $2.63 to $2.74.

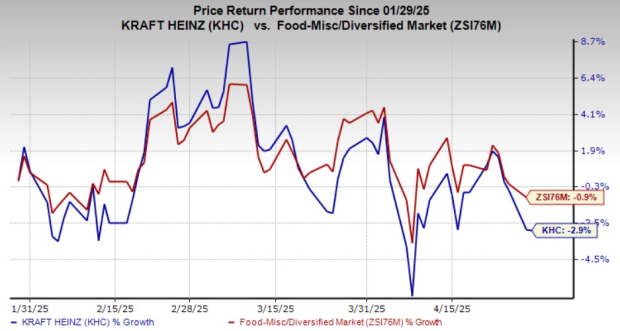

Shares of this Zacks Rank #4 (Sell) company have lost 2.9% in the past three months compared with the industry’s decline of 0.9%.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

Utz Brands UTZ engages in the manufacture, marketing and distribution of snack foods in the United States and presently carries a Zacks Rank of 2. UTZ delivered a trailing four-quarter earnings surprise of 8.8%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year sales and earnings indicates growth of 1.4% and 10.4%, respectively, from the year-ago numbers.

Post Holdings, Inc. POST operates as a consumer-packaged goods holding company in the United States and internationally. It presently carries a Zacks Rank of 2. Post Holdings delivered a trailing four-quarter earnings surprise of 22.3%, on average.

The Zacks Consensus Estimate for Post Holdings’ current financial-year sales and earnings indicates growth of 0.3% and 2.2%, respectively, from the year-ago numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite