|

|

|

|

|||||

|

|

When it comes to banking giants, JPMorgan JPM and Bank of America BAC are often at the top of mind. As two of the most diversified financial institutions in the United States, they offer a broad spectrum of services, including retail banking, investment banking (IB) and wealth management on a global scale.

JPMorgan, the largest U.S. bank by assets, commands a leading position in the IB sector. In contrast, Bank of America—the second-largest by assets—boasts one of the most extensive retail banking networks across the country. Both are considered “too big to fail” under the U.S. banking regulations and are recognized for their strong credit ratings and robust capital positions. Their consistent, growing dividends also make them attractive to income-focused investors.

However, JPM and BAC are highly sensitive to macroeconomic factors such as interest rates, inflation and the Federal Reserve’s monetary policy. While they generally benefit from rising interest rates, current challenges, including looming tariffs and uncertainty around future Fed actions, pose significant headwinds to their performance.

Let’s analyze JPMorgan's and Bank of America's business models to determine which currently presents the stronger investment opportunity.

JPM and BAC are pursuing different strategies to enhance their operations and unlock growth opportunities.

JPMorgan is expanding its reach despite the rise of mobile banking. It plans to open more than 500 new branches by 2027, with 150 already built in 2024. This move will solidify its position as the bank with the largest branch network, covering all 48 U.S. states. The strategy aims to boost market share and seize cross-selling opportunities in cards and auto loans.

JPM is also committed to renovating 1,700 existing locations by 2027 to serve its customers better. Apart from this, in 2021, the company launched its digital retail bank Chase in the U.K. and plans to expand the reach of its digital bank across the European Union countries. JPMorgan is also focused on bolstering the Commercial & Investment Bank (CIB) and Asset & Wealth Management businesses in China.

Further, JPM has been growing through on-bolt acquisitions, both domestic and international. In 2023, the company increased its stake in Brazil's C6 Bank to 46% from 40%, formed a strategic alliance with Cleareye.ai and acquired Aumni and First Republic Bank (a FDIC-assisted deal). These deals, along with several others, are expected to support the bank's plan to diversify revenues and expand the fee income product suite and consumer bank digitally.

In contrast, Bank of America has prioritized organic, domestic growth through a strategic expansion of its physical and digital presence. By 2026, the bank plans to open more than 165 new financial centers in both new and existing markets, reinforcing its commitment to nationwide accessibility. At the same time, it is modernizing its existing locations through an extensive renovation initiative aimed at delivering a consistent, state-of-the-art client experience.

Over the past four years, these upgrades have helped transform financial centers into spaces where clients can interact directly with specialists in a modern, service-focused environment. Coupled with the growing adoption of digital tools such as the Zelle money transfer system and the AI-powered assistant Erica, these initiatives support BAC's ability to enhance digital engagement and cross-sell a range of products, including mortgages, auto loans and credit cards.

As global deal-making activities came to a grinding halt at the beginning of 2022, mainly due to the Russia-Ukraine conflict, fears of economic slowdown and high inflation numbers, the IB business of JPM and BAC was majorly affected. Last year, the trend reversed following the election of President Donald Trump (as the administration was regarded to be more business-friendly, with an expected rollback of stringent oversight) and the gradual improvement in the macroeconomic and geopolitical situation (stabilizing or declining interest rates, tightening credit spreads and strong public market valuations).

But the timeline for the major rebound in mergers and acquisitions (M&As) has now shifted to the second half of 2025 because of Trump’s tariff plans, which resulted in extreme market volatility. These developments have led to economic uncertainty, data indicating a slowdown/recession in the U.S. economy, and mounting inflationary pressure. Amid such a backdrop, companies are rethinking their M&A plans despite stabilizing rates and having significant investible capital.

The delay in the expected IB rebound will adversely impact JPMorgan and Bank of America, which generate billions in revenues from M&A advisory fees.

Speaking of the numbers, JPMorgan's total IB fees (in the CIB segment) plunged 59% in 2022 and 5% in 2023. Nonetheless, in 2024, the company’s IB fees soared 49% year over year. Even in the first quarter of 2025, the company’s IB performance was solid, with a wallet share of 9% and rank #1 for global IB fees. For now, management has taken a cautious stance on the IB business while expecting a turnaround with the reduction of the uncertainties.

Coming to Bank of America, the above-mentioned factors had a similar impact on its IB business, with fees from the same declining 46% in 2022 and 3% in 2023. Last year, the company’s total IB fees jumped 31% year over year, with the trend persisting in the first quarter of 2025.

Like all banks, JPMorgan and Bank of America depend on interest rates to generate revenues. Given the sticky inflation number and the current tariff-related ambiguity, market participants now expect the Fed to cut rates three to four times in the back half of the year.

As such, JPMorgan’s net interest income (NII) is likely to face “headwind on an exit rate going into next year” as its balance sheet is highly asset-sensitive. The company’s NII witnessed a five-year (2019-2024) CAGR of 10.1%, mainly driven by the high-interest rate regime since 2022 and the acquisition of First Republic Bank in 2023. The momentum continued in the first quarter of 2025, driven by solid loan and deposit growth and higher revolving balances in Card Services. The company expects NII (managed) to be $94.5 billion for 2025, with almost $4.5 billion coming from Markets NII. In 2023, NII (managed) was $93.1 billion.

On the other hand, Bank of America is one of the most rate-sensitive banks. Yet, when the Fed lowered the interest rates by 100 basis points last year, the company’s NII benefited from it. Fixed-rate asset repricing, higher loan balance and decline in deposit costs drove NII. The same persisted in the first quarter of 2025. Management projects NII growth to be in the range of 6-7% this year, with the fourth-quarter NII between $15.5 billion and $15.7 billion.

JPM and BAC are showcasing solid capital distribution activities that reflect confidence in their liquidity and earnings stability. Being part of “systematically important financial institutions,” they are required to undergo annual stress tests conducted by the Fed before announcing any capital distributions.

JPMorgan raised its quarterly dividend in March by 12% to $1.40 per share. Before this, the company hiked its dividend by 10% to $1.15 per share in September 2024. The company has raised its dividend five times in the last five years, with an annualized dividend growth rate of 6.8%.

On the other hand, Bank of America increased its quarterly dividend in July 2024 by 8% to 26 cents per share. It has raised its dividend four times in the last five years, with an annualized dividend growth rate of 8.8%.

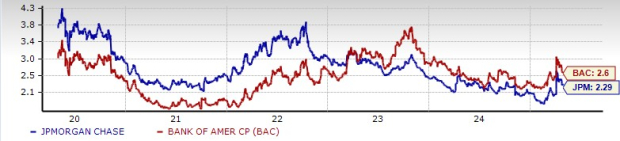

At present, JPM has a dividend yield of 2.29% and BAC has a yield of 2.60%.

JPM & BAC Dividend Yield

Additionally, JPM and BAC have share repurchase programs in place. In July 2024, JPMorgan authorized a new share repurchase program of $30 billion. As of March 31, 2025, almost $11.7 billion in authorization remained available. Likewise, BAC authorized a $25 billion stock repurchase program, which became effective from Aug. 1, 2024. As of March 31, 2025, almost $14.4 worth of authorization remained available.

JPMorgan and Bank of America’s financial performance is heavily influenced by the Fed’s monetary policy changes and overall economic growth. As such, the current major concern for these banks is the economic downturn/recession because of Trump’s tariff plans and resultant uncertainty. This has also added complexity to the Fed's goal of bringing inflation down to its 2% target.

Subdued economic growth is likely to suppress loan demand, particularly in areas like commercial lending and mortgages. As demand for loans weakens, JPM and BAC could see a slowdown in NII growth, a key driver of bank earnings.

Further, the expectations of higher for longer interest rates are likely to raise delinquency rates, mainly in the consumer loan portfolio. This will, thus, hurt both companies’ asset quality.

This year, JPM shares have gained 2% against Bank of America’s decline of 9.1%. In comparison, the S&P 500 Index has slipped 5.9% in the same time frame.

JPM & BAC Price Performance

Valuation-wise, JPM is currently trading at the 12-month trailing price-to-tangible book (P/TB) of 2.59X and BAC is trading at the 12-month trailing P/TB of 1.51X. Both are trading higher than their respective five-year median.

JPM & BAC P/TB Ratio

While JPMorgan commands a premium over Bank of America, its valuation is justified, given its superior growth trajectory.

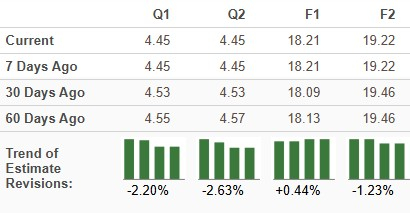

The Zacks Consensus Estimate for JPMorgan’s 2025 sales and earnings implies year-over-year decreases of 2.1% and 7.8%, respectively. On the other hand, 2026 sales and earnings imply year-over-year growth of 2.5% and 5.5%, respectively.

Further, over the past 30 days, the earnings estimates for 2025 have been revised north to $18.21, and for 2026 have moved lower to $19.22. (Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.)

JPM Earnings Estimate Trend

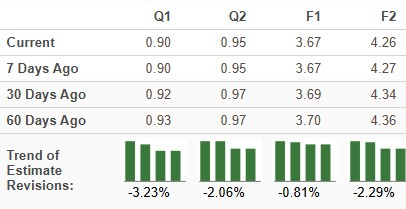

On the contrary, the Zacks Consensus Estimate for BAC’s 2025 sales and earnings implies year-over-year growth of 5.8% and 11.9%, respectively. For 2026, the consensus estimates for sales and earnings suggest increases of 5.8% and 16.2%, respectively.

Further, over the past month, the earnings estimates for 2025 and 2026 have been moved lower to $3.67 and $4.26, respectively.

BAC Estimate Revision Trend

While Bank of America focuses on domestic, organic expansion, JPM is pursuing domestic branch growth and international digital banking initiatives, including expansion in the U.K., EU, Brazil and China. This broader approach positions JPMorgan for more resilient long-term growth.

Further, JPM’s strategic acquisitions enhanced its digital, wealth management and consumer banking capabilities. These moves help diversify its revenue base and support fee income growth more effectively than BAC’s more conservative strategy.

In IB, JPM leads globally in fee generation and market share, and is better positioned for a rebound when M&A activity recovers. Also, JPMorgan’s robust capital return program—including frequent dividend hikes and a $30 billion share buyback—reflects strong financial health and shareholder value focus.

Though JPMorgan trades at a premium compared with BAC, it's justified by superior execution, international exposure and diversified income streams. Bank of America offers solid domestic growth potential but is more vulnerable to U.S. economic and rate-related headwinds. Overall, JPMorgan’s scale, strategy and global diversification make it a more compelling investment.

JPM and BAC currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 min | |

| 44 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 5 hours | |

| 10 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite