|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As artificial intelligence (AI) continues to attract outsized investor interest, two names — Innodata INOD and BigBear.ai Holdings BBAI — are gaining attention for their specialized roles in the AI ecosystem. While both are small-cap pure plays in the space, they offer very different business models, risk profiles and growth trajectories.

In this face-off, we analyze each stock’s strengths and weaknesses to assess which may offer better upside potential heading into the back half of 2025.

Innodata offers a compelling, high-growth opportunity at the intersection of generative AI, data engineering and model safety. As a trusted infrastructure partner to leading Big Tech companies, Innodata is increasingly central to the global AI buildout. In 2024, Innodata delivered record financial results, with revenues nearly doubling year over year to $170.5 million and adjusted EBITDA soaring 250% to $34.6 million. Net income swung to a $28.7 million profit from a prior-year loss. Management has guided to continued revenue growth of 40%+ in 2025, supported by a strong deal flow and a robust pipeline, highlighting the durability of demand.

A notable move is the launch of its Generative AI Test & Evaluation Platform in partnership with Nvidia (NVDA). This platform offers tools for adversarial testing, model benchmarking and vulnerability detection — key concerns for enterprises deploying AI at scale — and addresses enterprise and regulatory concerns over AI risk, bias and transparency. With early adopters like MasterClass already onboard, Innodata’s move into AI assurance reflects foresight and growing relevance in a critical segment.

The company’s strategic relationships are another key strength. Serving five of the “Magnificent Seven” and three additional tech giants, Innodata is benefiting from multibillion-dollar AI infrastructure investments. Particularly, it is a trusted partner with leading AI companies like Microsoft Corp. MSFT, Alphabet Inc. GOOGL and Amazon.com Inc. AMZN, among others. This customer base is particularly valuable, given that Amazon, Alphabet, Meta and Microsoft alone are expected to invest a cumulative $325 billion in generative AI infrastructure in 2025. Innodata’s core competencies in LLM data preparation, model fine-tuning and safety evaluations make it a natural beneficiary of these investments.

Despite efforts to broaden its revenue base, nearly 48% of Innodata’s 2024 revenues were derived from a single customer. While the company has made notable progress in growing relationships with other major tech firms, this level of customer concentration poses a significant operational risk should contract renewals falter or client priorities change.

In the rapidly evolving AI, BigBear.ai presents itself as a niche player focused on decision intelligence for government and enterprise customers. Positioned as a pure-play AI provider, BigBear.ai delivers mission-critical solutions in defense, intelligence, logistics and cybersecurity — sectors with high barriers to entry and sticky contracts.

The company’s expanding contract backlog, surging from $168 million in 2023 to $418 million by year-end 2024, offers strong forward revenue visibility and signals growing confidence from key customers. The $13.2 million sole-source contract from the U.S. Department of Defense exemplifies the trust placed in BigBear’s capabilities. Strategic alliances with Amazon Web Services and Palantir further validate BigBear’s technological relevance and bolster its credibility in critical government applications.

However, the bullish long-term outlook is tempered by near-term financial strain. BigBear reported a steep $108 million net loss in the fourth quarter of 2024, largely due to a $93 million non-cash charge linked to convertible notes. SG&A rose considerably amid acquisition integration (Pangiam) and headcount expansion, leading to deteriorating EBITDA. Management’s expectation about adjusted EBITDA to stay negative in the low-single-digit millions in 2025, reflecting ongoing investments and the continued integration of recent acquisitions, suggests profitability is still a distant goal.

Further compounding the risk profile is BigBear’s reliance on U.S. government and defense contracts, which are vulnerable to political gridlock and budget uncertainty. Additionally, its capital structure, including convertible debt maturing in 2029, adds financial complexity and heightens the need for disciplined execution.

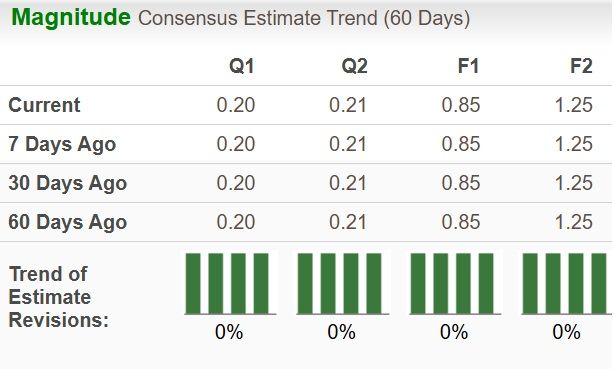

For INOD, the Zacks Consensus Estimate for 2025 sales and EPS implies a year-over-year increase of 44.38% and a decline of 4.49%, respectively. However, the EPS estimates have remained unchanged over the past 60 days.

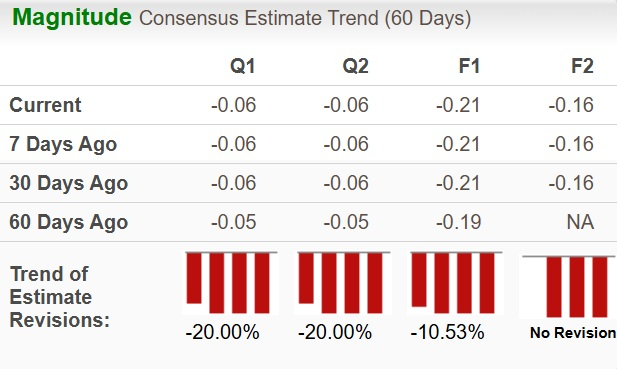

For BBAI, the Zacks Consensus Estimate for 2025 sales and EPS implies year-over-year growth of 5.67% and 80.91%, respectively. However, the EPS estimates for 2025 have been trending southward over the past 60 days. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

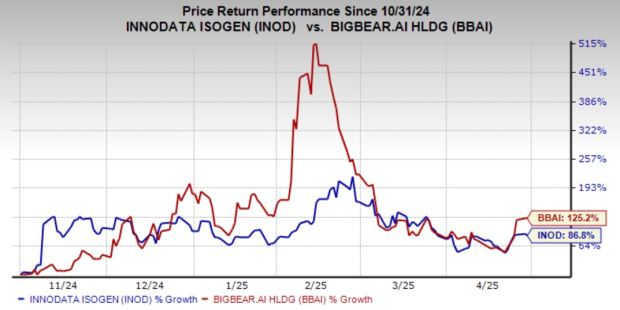

In the past six months, BigBear.ai shares have surged 125.2%, while Innodata shares have rallied 86.8%.

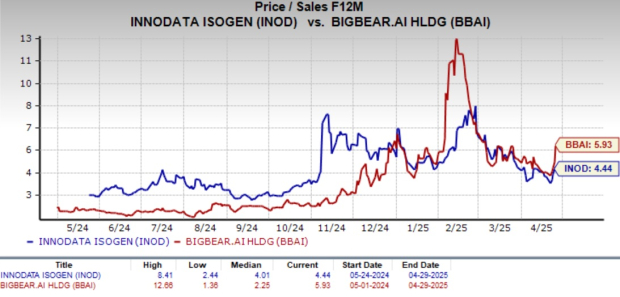

INOD is trading at a forward 12-month price-to-sales (P/S) multiple of 4.44X, which is slightly above its one-year median of 4.01X. BBAI does seem pricey with its forward 12-month P/S multiple sitting at 5.93X, well above its one-year median of 2.25X.

Considering both perspectives, Innodata stands out with strong financial momentum, strategic positioning and early leadership in the rapidly growing generative AI space. As a trusted partner to Big Tech and enterprises, it's becoming a key player in AI infrastructure. Its NVIDIA-backed evaluation platform arrives at a critical moment for AI oversight. Substantial investments from Amazon, Meta, Microsoft and Alphabet present growth opportunities. Given, the current valuation, existing shareholders may hold, while new investors might await a more favorable entry during market pullbacks.

By contrast, BigBear.ai’s differentiated positioning and growing contract pipeline present strong strategic value in a high-demand niche. However, investors must weigh this against larger immediate losses, balance sheet risk and dependence on government spending cycles. BBAI also seems pricey, and its southward estimates revisions reflect analysts’ bearish sentiments.

While INOD carries a Zacks Rank #3 (Hold), BBAI has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 min | |

| 12 min | |

| 26 min | |

| 39 min | |

| 39 min | |

| 47 min | |

| 57 min | |

| 58 min | |

| 58 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite