|

|

|

|

|||||

|

|

International Business Machines Corporation IBM has extended its multi-year partnership with Microsoft Corporation MSFT by establishing a new Microsoft Practice within IBM Consulting. Leveraging the combined strengths of both companies, the collaboration aims to develop innovative offerings and industry-specific solutions across various verticals such as retail, consumer packaged goods, government, financial services and supply chain.

Complementing IBM Copilot Runway and IBM Consulting Azure OpenAI Services, it intends to deliver customized solutions to help businesses unlock new growth opportunities, navigate complex AI (artificial intelligence), facilitate seamless cloud transition and accelerate digital transformation. The unified approach combines IBM's industry and transformation expertise with Microsoft's technology portfolio, including Copilot, Azure OpenAI, Azure Cloud, Fabric and Sentinel, to drive growth, reduce costs and build a sustainable competitive advantage.

In addition, the Microsoft Practice will integrate Microsoft's technology ecosystem into IBM Consulting's AI-powered delivery platform, IBM Consulting Advantage. This will allow clients to deploy optimal AI solutions for specific business needs while maintaining enterprise governance and security.

IBM is poised to benefit from healthy demand trends for hybrid cloud and AI, which drive the Software and Consulting segments. The company’s growth is expected to be aided by analytics, cloud computing and security in the long term. A combination of a better business mix, improving operating leverage through productivity gains and increased investment in growth opportunities will likely boost profitability.

IBM’s watsonx platform is likely to be the core technology platform for its AI capabilities. watsonx delivers the value of foundational models to the enterprise, enabling them to be more productive. This enterprise-ready AI and data platform comprises three products to help organizations accelerate and scale AI: the watsonx.ai studio for new foundation models, generative AI and machine learning, the watsonx.data fit-for-purpose data store built on an open lake house architecture and the watsonx.governance toolkit to help enable AI workflows to be built with responsibility and transparency.

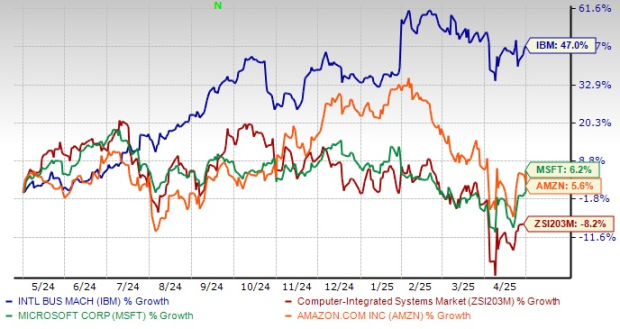

IBM has surged 47% over the past year against the industry’s decline of 8.2%, outperforming peers like Microsoft and Amazon.com, Inc. AMZN. Despite the rising adoption of Azure OpenAI and Amazon Web Services enterprise capabilities, both Microsoft and Amazon are lagging behind IBM in terms of price performance. While Microsoft gained 6.2% over the same period, Amazon was up 5.6%.

One-Year IBM Stock Price Performance

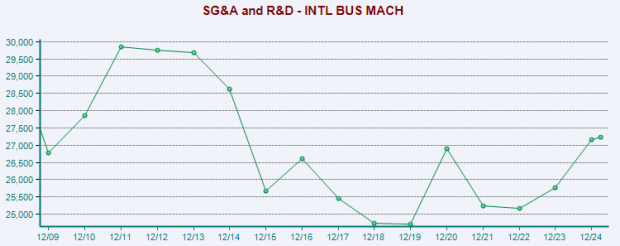

Despite solid hybrid cloud and AI traction, IBM is facing stiff competition from Amazon Web Services and Microsoft Azure. Increasing pricing pressure is eroding margins, and profitability has trended down over the years, barring occasional spikes. The company’s ongoing, heavily time-consuming business model transition to the cloud is challenging. Weakness in its traditional business and foreign exchange volatility remain significant concerns.

IBM is likely to retrench about 9,000 jobs this year in the United States to reduce operating costs. A significant part of these jobs is slated to be shifted to India under a “resource action” plan – an ongoing corporate strategy to tap the huge talent pool of the subcontinent at lower operating costs. Although the company spokesperson has refused to comment on the grapevines and commit an exact figure for the layoffs, various sources have confirmed that the action has already started.

Certain job cuts have been confirmed in Raleigh, NC, New York City, NY, Dallas, TX, and CA, impacting employees from consulting, corporate social responsibility, cloud infrastructure, sales and internal systems teams. The Cloud Classic division of IBM is likely to be the strongest hit, with the company aiming to create and/or expand roles in India for professionals with expertise in cloud computing, infrastructure, sales and consulting.

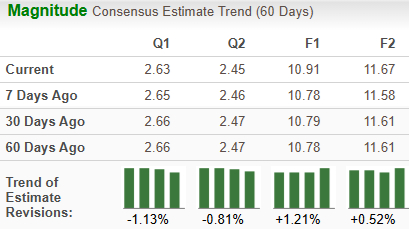

IBM is currently witnessing an uptrend in estimate revisions. Earnings estimates for 2025 have jumped 1.2% to $10.91 over the past 60 days, while the same for 2026 has increased 0.5% to $11.67. The positive estimate revision portrays bullish sentiments about the stock’s growth potential.

IBM aims to benefit from the increasing propensity of business enterprises to undertake a cloud-agnostic and interoperable approach to secure multi-cloud management with a diligent focus on hybrid cloud and generative AI solutions. With a surge in traditional cloud-native workloads and associated applications, along with a rise in generative AI deployment and quantum computing, there is a radical expansion in the number of cloud workloads that enterprises are currently managing. This has resulted in heterogeneous, dynamic and complex infrastructure strategies, which have led to a healthy demand trend.

Moreover, with improving earnings estimates, the stock is witnessing a positive investor perception at the moment. However, IBM’s growth is dented by high operating costs and stiff competition that reduce its profitability. With a Zacks Rank #3 (Hold), IBM appears to be treading in the middle of the road, and new investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 27 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Nvidia Pauses Amid Taiwan Semiconductor, ChatGPT News; Is Nvidia A Buy Now?

AMZN

Investor's Business Daily

|

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite