|

|

|

|

|||||

|

|

The Estee Lauder Companies Inc. EL reported third-quarter fiscal 2025 results, with the top and bottom lines surpassing the Zacks Consensus Estimate. However, net sales and earnings declined year over year. These decreases were primarily due to continued weak consumer sentiment and reduced conversion rates in China. In addition, the company faced ongoing retail challenges across several brands and declining consumer confidence in the Americas.

Adjusted earnings of 65 cents per share surpassed the Zacks Consensus Estimate of 29 cents in the fiscal third quarter. The bottom line decreased 33% from earnings of 97 cents in the year-ago quarter. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The Estee Lauder Companies’ quarterly net sales of $3,550 million surpassed the Zacks Consensus Estimate of $3,507.2 million. However, the top line declined 10% year over year. Organic net sales declined 9% to reach $3,605 million.

The Estee Lauder Companies Inc. price-consensus-eps-surprise-chart | The Estee Lauder Companies Inc. Quote

Skin Care’s sales were down 12% year over year to $1,807 million. The downside can be attributed to a drop in its Asia travel retail business. Brands like Estee Lauder and La Mer were impacted by continued weak consumer sentiment and lower conversion rates among Chinese shoppers. In addition, the company faced a tough year-over-year comparison. Compounding the challenge, retailers in both Korea and mainland China shifted their focus toward more profitable duty-free models, resulting in reduced replenishment orders.

Makeup revenues declined 9% year over year to $1,035 million, primarily due to weaker sales from key brands such as M·A·C and Estée Lauder.

In the Fragrance category, revenues of $557 million declined 3%. The decline in sales was largely attributed to lower performance from Clinique — mainly due to softness in the Clinique Happy fragrance line — and Estee Lauder, which reflected weaker retail demand in the Asia-Pacific region.

Hair Care sales totaled $126 million, down 12% year over year, largely due to softer performance from Aveda, resulting from ongoing weakness in the company’s salon and freestanding store channels.

Sales in the Americas fell 6% year over year to $1,052 million. Revenues in the Europe, the Middle East & Africa (EMEA) region declined 18% to $1,358 million. In the Asia-Pacific region, sales tumbled 3% to $1,140 million.

The Estee Lauder Companies’ adjusted gross margin improved by 310 basis points (bps) year over year to 75%. This growth was primarily fueled by gains from the company’s Profit Recovery and Growth Plan (PRGP). The margin also benefited from a favorable 240 bps impact tied to an in-period charge for under-absorbed manufacturing overhead in the prior-year period. However, this was partially offset by a 100 bps negative impact from a similar charge recorded in the third quarter of fiscal 2025.

The adjusted operating margin contracted by 270 bps to 11.4%. The decline was primarily due to increased investments in consumer-facing initiatives and sales volume deleverage. However, these pressures were partially offset by net benefits from the company’s PRGP, which helped reduce non-consumer-facing expenses.

This Zacks Rank #3 (Hold) company exited the quarter with cash and cash equivalents of $2,631 million, long-term debt of $7,298 million and total equity of $4,345 million.

The net cash flow provided for operating activities for the nine months ended March 31, 2025, was $671 million. Capital expenditures during this time amounted to $395 million. The company said it paid a dividend totaling $492 million during this time.

The company announced a quarterly dividend of 35 cents per share on its Class A and Class B Common Stock, payable June 16, 2025, to its shareholders of record as of May 30, 2025.

In February 2025, The Estee Lauder Companies announced an expansion of its Profit Recovery and Growth Plan (PRGP), including a comprehensive restructuring initiative aimed at transforming its operating model. The plan is set to be largely executed throughout fiscal 2025 and 2026, with completion expected in fiscal 2027, when the company anticipates realizing nearly all of the full run-rate benefits. The PRGP is strategically designed to support a return to sales growth, restore a solid double-digit adjusted operating margin and help mitigate ongoing external market volatility. The company has made significant progress in executing the plan, as reflected in consistent adjusted gross margin expansion.

The Estee Lauder Companies anticipates incurring restructuring and related charges ranging from $1.2 billion to $1.6 billion before taxes as part of its PRGP. The restructuring initiative is expected to generate annual gross benefits estimated between $800 million and $1.0 billion, before taxes. As part of this effort, the company projects a net workforce reduction of approximately 5,800 to 7,000.

For fiscal 2025, reported net sales are projected to decline 8-9% compared to the prior-year level. The company’s adjusted organic net sales are also anticipated to fall 8-9% in the year.

The adjusted earnings per share (EPS) are likely to slump by 40-50%, ranging from $1.30 to $1.55 in the fiscal 2025. The decline can mainly be attributed to continued challenges in EL’s global travel retail business and weaker performance in the Asia-Pacific region. The company expects to report an adjusted gross margin of 73.5% and an effective tax rate of around 38%.

The company anticipates a sharper sequential double-digit net sales decline in its global travel retail business for the fourth quarter of fiscal 2025. This expected drop is primarily due to retailer shifts toward more profitable duty-free business models in Korea and mainland China, along with continued weak consumer sentiment and lower conversion rates among Chinese travelers. The decline is further compounded by a challenging year-over-year comparison.

In addition, the company projects a high single-digit organic net sales decline in the Asia-Pacific region for fiscal 2025. This anticipated decrease is mainly attributed to continued weak consumer sentiment among Chinese shoppers and the company’s strategic exit of the Dr.Jart+ brand from Korea’s travel retail channel.

The company is actively monitoring the ongoing impact of global macroeconomic factors, including potential recession risks, currency fluctuations, inflation and supply chain disruptions. Additional concerns include geopolitical tensions, social and political developments, competitive pressures, regulatory changes, tariffs and global security issues.

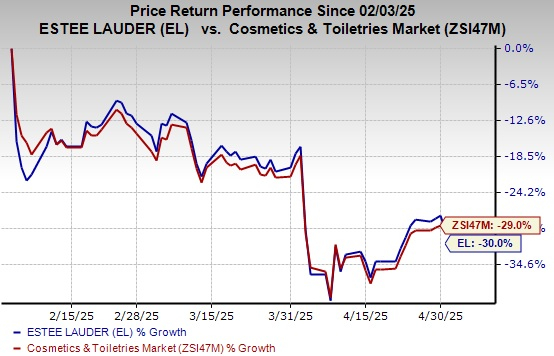

EL stock has dropped 30% in the past three months compared with the industry’s decline of 29%.

The Gap, Inc. GAP operates as an apparel retail company, which offers apparel, accessories and personal care products for men, women and children under the Old Navy, Gap, Banana Republic and Athleta brands. It sports a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GAP’s current fiscal-year sales and earnings indicates growth of 1.5% and 7.7%, respectively, from the year-ago reported figures. The Gap delivered an earnings surprise of 77.5% in the trailing four quarters, on average.

Nordstrom, Inc. JWN operates as a fashion retailer in the United States. The company provides apparel, shoes, beauty, accessories and home goods for women, men, young adults and children. It currently flaunts a Zacks Rank #1. Nordstrom delivered an earnings surprise of 22.2% in the last reported quarter.

The Zacks Consensus Estimate for JWN’s current fiscal-year sales and earnings indicates growth of 2.2% and 1.8%, respectively, from the year-ago reported figures.

G-III Apparel Group, Ltd. GIII designs, sources, distributes and markets women's and men's apparel in the United States and internationally. It carries a Zacks Rank #2 (Buy) at present. G-III Apparel delivered a trailing four-quarter average earnings surprise of 117.8%.

The Zacks Consensus Estimate for GIII’s current fiscal-year earnings and revenues implies declines of 4.5% and 1.2%, respectively, from the year-ago actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Estée Lauder Files Lawsuit Against Walmart Alleging Sales of Counterfeit Products

EL

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite