|

|

|

|

|||||

|

|

MercadoLibre MELI is slated to report first-quarter 2025 results on May 7.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $5.53 billion, suggesting year-over-year growth of 27.54%. The consensus mark for earnings is pinned at $7.67 per share. The estimate indicates year-over-year growth of 13.13%.

See the Zacks Earnings Calendar to stay ahead of market-making news.

In the last reported quarter, the company delivered an earnings surprise of 73.69%. The company’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, and missed once, with the average surprise being 16.37%.

Our proven model predicts an earnings beat for MercadoLibre this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

MELI has an Earnings ESP of +2.30% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

MercadoLibre’s e-commerce platform grew strongly in 2024, reaching more than 100 million unique buyers. The company improved user experience with features like virtual try-ons and tire installation scheduling. It also launched Full Super, a new grocery section designed to make shopping easier, help users reorder quickly, and show progress toward free shipping to boost basket sizes. These innovations are expected to have increased customer satisfaction and engagement in the first quarter of 2025.

Furthermore, the company saw strong user frequency and growth in low-ticket categories in the prior quarter, which is expected to have continued in the first quarter. Overall e-commerce growth is likely to have remained strong, with top line growing significantly. The advertising business might also have contributed marginally to the top line in the first quarter. MercadoLibre is strengthening partnerships, enhancing advertising technology and incorporating display, brand, and video advertisements. These efforts are expected to have boosted monetization, increased engagement and improved product visibility in the quarter to be reported.

Mercado Pago, MercadoLibre’s fintech arm, surpassed 60 million monthly active users in 2024, supported by the launch of 5.9 million new credit cards. Instant access to pre-approved credit and flexible 18-month instalment plans helped drive adoption and boosted engagement during high-value purchases. The company expanded its offerings with the MELI Dollar stablecoin and localized investment options like LCI and LCA. This is expected to have continued growing the company’s top line, supported by expanded credit issuance and new investment products.

MercadoLibre experiences fewer listings after Christmas, summer vacation and other holidays, which results in weaker demand in the first quarter. The first quarter remains the weakest for the company in a year. The top line and bottom line are expected to have taken a hit due to the seasonality.

Competition from the likes of e-Commerce giants, such as Amazon AMZN, Alibaba BABA, and Walmart WMT, might have intensified in the first quarter, especially in Mexico and Brazil. These global rivals bring pricing pressure, fulfillment scale, and brand recognition. Their push into low-ticket and essential items could have challenged MELI’s margins and user retention in the quarter under review.

The Zacks Consensus Estimate for first-quarter 2025 Argentina revenues is pegged at $1.15 billion, suggesting a decline of 11.9% from the figure reported in the year-ago quarter.

The consensus mark for Brazil revenues is pinned at $3.08 billion, indicating a decrease of 1.72% from the figure reported in the year-ago quarter.

The consensus mark for Mexico revenues is pinned at $1.21 billion, indicating a 9.94% decline from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for revenues from other countries is pegged at $271 million, suggesting a 0.74% increase from the figure reported in the year-ago quarter.

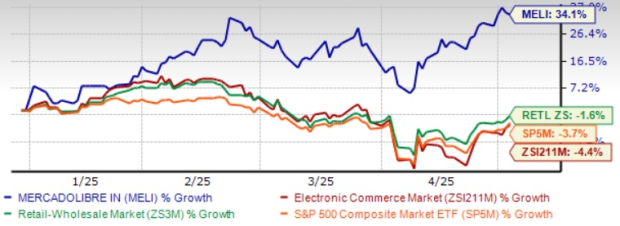

Shares of MELI have returned 34.1% in the year-to-date period, outperforming the Retail-Wholesale and the S&P 500 index’s decline of 1.6% and 3.7%, respectively. MELI shares have been riding on its dominant presence in Latin America as the company benefits from accelerating commerce and fintech revenues.

From a valuation perspective, MELI currently trades at a forward 12-month Price/Sales ratio of 4.15X, which is at a premium compared to the Zacks Internet – Commerce industry average of 1.86X. While this valuation gap suggests that investors have high growth expectations for this stock, it is not a good pick for a value investor. A value score of D further reinforces an unattractive valuation for MercadoLibre at this moment.

MercadoLibre enters the first quarter of 2025 with strong engagement across its commerce and fintech platforms, supported by healthy user growth, expanding credit products, and ongoing logistics improvements. However, investors should maintain a hold stance heading into earnings. Increased promotional activity could weigh on marketplace take rates, while ad monetization remains early-stage. Furthermore, seasonality seen in the first quarter of every year is likely to have put some pressure on revenues and profits. MELI’s long-term position remains strong, but patience may reward investors seeking better risk-reward dynamics.

Although MercadoLibre reported stellar financial performance in the prior quarter, suggesting a very promising growth trajectory, its current valuations are unattractive as the stock is trading at a premium. Expected seasonality and intense competition indicate that investors should maintain existing positions while awaiting a more favorable entry point. Rising GMV and expansion of its fintech services provide long-term growth potential, but prudent investors might benefit from patience ahead of first-quarter results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 38 min | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite