|

|

|

|

|||||

|

|

Visa Inc. V, the payments technology giant, delivered another impressive quarterly performance in the second quarter of fiscal 2025, driven by continued resilience in consumer spending and robust growth in cross-border volumes. The company reported solid increases in total payment volumes and processed transactions, showcasing its extensive global network and the accelerating adoption of digital payments. Visa exceeded Wall Street expectations once again, highlighting strong operational execution despite ongoing macroeconomic challenges.

Since the earnings release, Visa shares have risen 1.8%, pushing the stock near its 52-week high of $366.54. This prompts investors to consider: Is it time to lock in gains, or does Visa still have more room to run? Let’s break down the key highlights.

Earnings & Sales Beat: Visa’s EPS of $2.76 beat the Zacks Consensus Estimate by 3% and grew 10% year over year. Also, the top line of $9.6 billion beat the consensus mark by 0.3% and improved 9.3% from a year ago. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Major Metrics Remains Solid: Processed transactions grew 9% year over year to 60.7 billion and met our model estimate. On a constant-dollar basis, cross-border volumes surged 13% year over year, as travel activity gained momentum. Also, its payment volumes grew 8% year over year on a constant-dollar basis.

Visa Stays Resilient: Despite investor worries around inflation, reduced savings, and tighter economic conditions, Visa’s performance remains strong. Since its business model is tied to transaction volumes rather than specific spending categories, it remains relatively insulated from changes in consumer preferences.

For more insights, read our blog: Visa Q2 Earnings Beat Estimates on Strong Payment Volumes.

Visa’s business model benefits from powerful network effects; the more consumers and businesses that use its services, the stronger and more profitable the network becomes. With healthy cash flows, Visa continues investing in infrastructure, marketing and innovation, ensuring long-term competitive advantage. As digital payment adoption accelerates globally, Visa is in a prime position to benefit. With a market capitalization of $647.7 billion and a dominant global presence, the company is poised for sustained growth.

Visa remains a shareholder-friendly company. In the latest quarter, it returned $5.6 billion to shareholders through $4.5 billion in share repurchases and $1.2 billion in dividends. As of March 31, 2025, Visa had $4.7 billion remaining under its existing buyback program and announced a new $30 billion authorization in April. The company’s dividend yield stands at 0.68%, closely aligned with the industry average of 0.63%, and Visa has a history of regular dividend increases.

Analyst sentiment is optimistic. The Zacks Consensus Estimate for Visa’s fiscal 2025 and fiscal 2026 EPS implies a 12.7% and 12.6% uptick, respectively, on a year-over-year basis. Similarly, the consensus mark for fiscal 2025 and fiscal 2026 revenues suggests a 10.2% and 10.4% increase, respectively. It has seen multiple upward estimate revisions in the past week.

The company beat earnings estimates in each of the past four quarters, with an average surprise of 3%.

Visa Inc. price-eps-surprise | Visa Inc. Quote

Visa’s revenue diversification strategy is helping it generate more stable earnings across various economic conditions. Value-added services such as fraud prevention, analytics, and advisory offerings continue to gain traction, creating a more balanced revenue base. Visa is also innovating in digital wallets and crypto-related payment solutions, including partnerships with fintech firms and stablecoin trials for cross-border transactions, all of which broaden its reach.

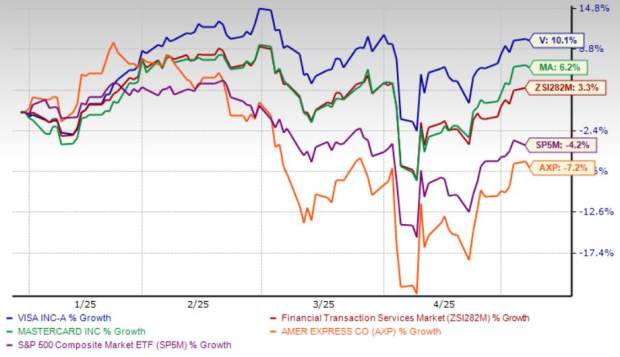

Visa stock has grown 10.1% in the year-to-date period, outperforming the industry’s gain of 3.3% and the S&P 500 Index’s fall of 4.2%. In comparison, its peers like Mastercard Incorporated MA and American Express Company AXP have gained 6.2% and lost 7.2%, respectively, during this time.

Despite the gains, investors should consider the stock’s premium valuation, which may limit near-term upside. Going by its price/earnings ratio, the company is trading at a forward earnings multiple of 28.53X, higher than its five-year median of 26.92X and the industry average of 23.12X.

Meanwhile, Mastercard and American Express are currently trading at 33.21X and 17.24X, respectively.

Investors should be aware of potential risks. Regulatory challenges, including the U.S. Department of Justice antitrust lawsuit and proposed legislation like the Credit Card Competition Act, may impact future operations. Visa and Mastercard also face ongoing legal issues in the U.K. over alleged excessive merchant fees.

Additionally, rising expenses pose a challenge. Adjusted operating expenses increased 7% year over year to $3.1 billion, driven by higher marketing and personnel costs. Interest expenses rose 92.7% year over year to $158 million, while client incentives (which reduce net revenue) increased 15% to $3.7 billion.

Visa’s strong fiscal Q2 results reaffirm its position as a market leader in digital payments. Its strategic investments, product innovation and global scale provide a solid foundation for long-term growth. However, headwinds such as regulatory scrutiny, rising costs and a premium valuation may limit near-term upside potential. While the stock remains fundamentally sound, these challenges temper its immediate appeal. As such, Visa currently carries a Zacks Rank #3 (Hold), suggesting investors may want to wait for a more attractive entry point or further catalysts before initiating or adding to positions. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

American Express Hits Dow Jones On AI Doomsday 'Work Of Fiction'

AXP -7.20%

Investor's Business Daily

|

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours |

Financial Stocks Take a Hit With AI Worries on Investors' Minds

AXP -7.20% MA -5.77% V

The Wall Street Journal

|

| 8 hours | |

| 8 hours | |

| 9 hours |

Stock Market Today: Dow Dives As EU Makes Trump Tariff Move; Novo Plunges On This (Live Coverage)

AXP -7.20%

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite