|

|

|

|

|||||

|

|

Intel Corporation INTC recently announced that it has successfully achieved industry-first full NPU (Neural Processing Unit) compliance in the MLPerf Client v0.6 benchmark. MLPerf is an industry-standard benchmarking suite created to assess AI system performance. The newly released MLPerf Client v0.6 Benchmark is a subset of MLPerf designed to evaluate client devices such as laptops and PCs with a strong emphasis on large language model acceleration and NPU performance. It offers a clear assessment of hardware and software capabilities in swiftly handling AI tasks such as content generation and summarization.

During the process, Intel Core Ultra Series 2 processors showcased the fastest NPU response time with an impressive token latency of just 1.09 seconds and the highest NPU throughput at 18.55 tokens per second. Intel also demonstrated remarkable GPU performance during the process. Intel Core Ultra processor is the only NPU to achieve complete compliance, accentuating its strong AI compute capabilities.

Intel has been taking several strategic decisions to gain a firmer footing in the expansive AI sector, spanning cloud and enterprise servers to networks, volume clients, and ubiquitous edge environments, in line with the evolving market dynamics. Intel’s Xeon 6 processors with Performance-cores have garnered significant industry attention owing to their high-performance AI processing. Intel XEON platforms offer extensive performance improvements coupled with energy efficiency and easy-to-deploy software. With these features, Intel XEON has set a new benchmark in 5G cloud native core, which is driving demand from software vendors and independent telecom manufacturers. The company is witnessing solid market traction in the AI PC market. Backed by strong demand for its core Ultra Chips, Intel remains firmly on track to power more than 100 million AI PCs by the end of 2025.

Intel is also venturing into the automotive market to capitalize on the growing AI proliferation in that industry. The company’s second-generation AI-powered software-defined vehicle system-on-chip with multi-process node chiplet architecture brings advanced capabilities. The chip offers 10x performance enhancement for generative and multimodal AI, 3x graphics performance, and enhances camera and image processing features. Such state-of-the-art features will boost Intel’s new AI chip demand in Advanced Driver Assistance Systems.

Intel is divesting 51% of its Altera business to Silver Lake, a prominent global technology investment firm. The move highlights Intel’s strategy to reshape its portfolio, optimize cost structure, strengthen its liquidity position, and boost focus on core operations.

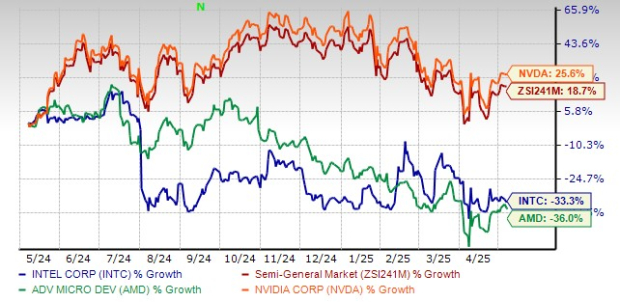

Intel has plunged 33.3% in the past year against the industry’s growth of 18.7%. The company has underperformed its peer NVIDIA Corporation NVDA but outperformed Advanced Micro Devices, Inc. AMD.

Despite investing heavily in new chip design and manufacturing, Intel is playing a catch-up game with NVIDIA and AMD. In the CPU space, AMD has gained a strong foothold with its Ryzen and EPYC processors. AMD’s strategy of offering competitive pricing with high performance has challenged Intel’s dominance in the CPU market.

In the graphics and AI acceleration space, NVIDIA has made significant inroads. It is witnessing strong demand for generative AI and large language models using GPUs based on NVIDIA Hopper and Blackwell architectures. Backed by strong industry expertise, both NVIDIA and AMD are aiming to expand their influence in the automotive segment. Intensifying competition with NVIDIA and AMD across multiple end markets is weighing on Intel’s margin.

Intel’s debt-to-capital ratio stands at 32% compared to the industry average of 17.3%. As of March 31, 2025, Intel had cash and cash equivalents of $8.95 billion with $44.91 billion of long-term debt. A high debt level may limit sufficient cash flow generation, which is required to meet future debt obligations. Additionally, Intel has a significant presence in China. Growing Sino-U.S. trade hostilities can impact its operations.

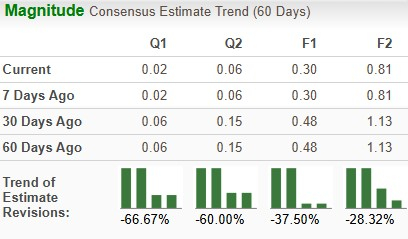

Earnings estimates for Intel for 2025 have moved down 37.5% to 30 cents over the past 60 days, while the same for 2026 has declined 28.32% to 81 cents. The negative estimate revision depicts bearish sentiments for the stock.

Intel’s strong AI focus and the expansion of its portfolio offerings for AI PCs, data centers, and automotive markets are commendable. Its effort to lower costs and improve liquidity with strategic divestiture is a positive. However, intensifying competition in the commercial PC, server, storage and networking markets remains a major headwind. In addition, its high dependence on China, imposition of trade tariffs, and Beijing’s move to replace U.S.-made chips with domestic alternatives are impeding Intel’s commercial prospects.

Its high debt levels make it vulnerable to economic downturns and growing geopolitical unrest. Declining earnings estimate revisions underscore dwindling investors' confidence. Despite heavy investment in chipset innovation and AI acceleration, Intel’s ability to regain a competitive edge appears to be a challenging endeavor. Intel carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 min | |

| 56 min | |

| 1 hour |

Stock Market Today: Dow Weakens As Nasdaq Lags; Biotech Name Hits Record (Live Coverage)

NVDA

Investor's Business Daily

|

| 1 hour |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

NVDA

Investor's Business Daily

|

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite