|

|

|

|

|||||

|

|

CME Group CME hit a 52-week high of $286.48 on May 7. Shares closed at $284.82 after gaining 22% year to date, outperforming the industry, the sector and the Zacks S&P 500 composite in the same time frame.

CME Group has outperformed its peers, Cboe Global Markets CBOE and Intercontinental Exchange Inc. ICE, which have gained 19.9% and 18.5%, respectively, year to date.

With a capitalization of $102.6 billion, CME Group is the largest futures exchange in the world in terms of trading volume and notional value traded. The average number of shares traded in the last three months was 2.6 million.

Its solid portfolio of futures products in emerging markets, diversified derivative product lines and global reach, along with its OTC offerings, increased electronic trading, cross-selling through alliances, and a strong global presence and liquidity position should continue to drive CME Group.

CME shares are trading above the 50-day and 200-day moving averages, indicating a bullish trend.

CME Group shares are trading at a premium to the industry. The company’s price-to-earnings of 25.33X is higher than the industry average of 24.55X.

The stock is also expensive compared with other players like Intercontinental Exchange and Cboe Global Markets.

Cboe Global Markets is the largest stock exchange operator by volume in the United States and a leading market globally for ETP trading. Its strategy of expanding its product line across asset classes, broadening geographic reach and diversifying the business mix reflects operational expertise, which, in turn, poises it well for growth.

Intercontinental Exchange is poised for growth, banking on the strength of its compelling portfolio and expansive risk-management services, which also ensure revenue flow, as well as strategic buyouts, a solid balance sheet and effective capital deployment. Its dividend history is impressive.

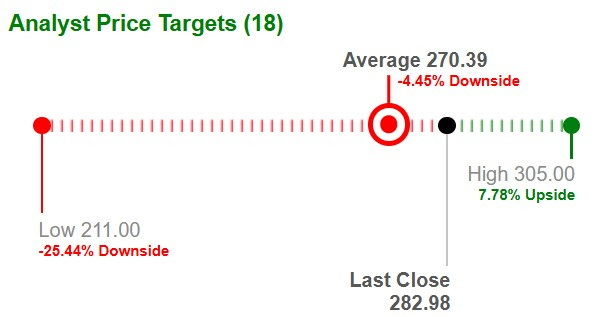

Based on short-term price targets offered by 18 analysts, the Zacks average price target is $270.39 per share. The average indicates a potential 4.6% downside from the last closing price.

The Zacks Consensus Estimate for 2025 earnings is pegged at $11.11, indicating an 8.3% year-over-year increase on 6.7% higher revenues of $6.5 billion. The consensus estimate for 2026 is pegged at $11.50, indicating a 3.5% year-over-year increase on 4.5% higher revenues of $6.8 billion. The expected long-term earnings growth rate is 6.5%.

The consensus estimate for 2025 and 2026 earnings has moved 3.6% and 2.9% north in the past 30 days, respectively, reflecting analyst optimism.

Return on equity, which reflects the company’s efficiency in utilizing shareholders' funds, was 14% in the trailing 12 months, better than the industry average of 13.9%.

Return on invested capital (ROIC) hovered around 10% over the last few years, reflecting CME’s efficiency in utilizing funds to generate income. However, ROIC in the trailing 12 months was 0.6%, which compared unfavorably with the industry average of 5.2%.

CME Group demonstrates strong organic growth. Given that CME is an exchange, it naturally benefits from heightened market volatility, which fuels trading activity and, in turn, increases clearing and transaction fees. These fees continue to be the largest contributor to CME’s top line, and their sustained growth bodes well for future revenue expansion.

CME Group is also seeing rising electronic trading activity and increasing traction in crypto assets, driven by growing participation in the broader crypto economy. With Donald Trump’s second term ushering in a more crypto-friendly regulatory climate, CME is well-positioned to capitalize on these trends.

CME’s investments are delivering positive returns, and its ongoing focus on cost efficiency is helping to improve margins. A robust capital base supports initiatives to grow its market data business, broaden its product range, and pursue strategic capital deployment.

Moreover, CME has consistently delivered strong financial performance, with free cash flow conversion exceeding 85% in recent quarters—a testament to its solid earnings quality.

Nonetheless, CME remains exposed to concentration risk, as it continues to rely heavily on Interest Rate and Equity products for a large portion of its clearing and transaction fee revenues, despite diversification efforts. It also operates in a highly competitive environment. The derivatives exchange segment faces rising pressure from crypto trading platforms, while other segments contend with competition from electronic communication networks, single-dealer platforms, and bank-owned trading venues.

A strong global presence, a compelling product portfolio, focus on over-the-counter clearing services and a solid capital position poise CME well for growth. A crypto-friendly regulatory climate will add to the upside.

CME’s dividend history is impressive too. It pays five dividends per year, with the fifth being variable and based on excess cash flow, making it an attractive pick for yield-seeking investors.

Despite its premium valuation, an unfavorable ROIC and concentration risk, the tailwinds make this Zacks Rank #2 (Buy) stock worth adding to one’s portfolio. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

CPI Inflation Data Will Lower Fed's Guard; S&P 500 Futures Firm (Live Coverage)

CME

Investor's Business Daily

|

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite