|

|

|

|

|||||

|

|

Cloud computing refers to the on-demand seamless access of computing resources such as servers, storage, databases, networking, software, analytics and intelligence over the Internet (the cloud) on a pay-per-use pricing model. It marks a paradigm shift from traditional on-premises infrastructure storage to remote cloud-based storage facilities and relies heavily on virtualization and automation technologies.

Instead of buying, owning and maintaining physical data centers and servers, organizations access a virtual pool of shared resources on an as-needed basis from a cloud service provider. This lowers operating costs, increases productivity with greater agility and flexibility, and improves scalability with higher economies of scale.

We have narrowed our search to five cloud computing-centric stocks that are set to provide stellar returns in the short term. These are: Five9 Inc. FIVN, Affirm Holdings Inc. AFRM, Microsoft Corp. MSFT, Juniper Networks Inc. JNPR and Tyler Technologies Inc. TYL.

These stocks have strong earnings and revenue growth potential for 2025. Moreover, they have seen positive earnings estimate revisions for 2025 in the last 60 days. Each of our picks currently carries a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

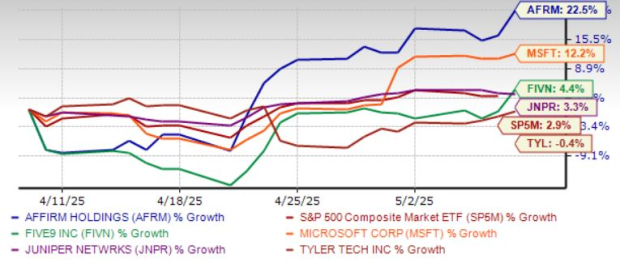

The chart below shows the price performance of our five picks in the past month.

Zacks Rank #2 Five9 provides intelligent cloud software for contact centers in the United States, India, and internationally. FIVN offers a virtual contact center cloud platform that delivers a suite of applications, enabling a broad range of contact center-related customer service, sales, and marketing functions.

FIVN’s platform comprises interactive virtual agents, agent assistance, workflow automation, workforce engagement management, AI insights, and AI summaries. It allows management and optimization of customer interactions across voice, chat, email, web, social media, and mobile channels directly or through its application programming interfaces.

FIVN has been benefiting from the growing adoption of AI tools in its call center services, with personalized AI agents emerging as a major growth driver. On Feb. 19, Five9 introduced its Intelligent CX Platform powered by Five9 Genius AI on the Google Cloud space. FIVN also released new Five9 AI agents tailor-made for Google Cloud.

Five9 has an expected revenue and earnings growth rate of 9.6% and 10.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6% in the last seven days.

Zacks Rank #1 Affirm Holdings has achieved strong revenue growth through diverse income streams, including merchant network fees, interest from loans and virtual card revenues. AFRM expects revenues in the range of $3.13-$3.19 billion in fiscal 2025. Growing active merchant numbers, improving gross merchandise value, and the average balance of loans are driving merchant network revenues and interest income.

Key partnerships, like those with Apple Pay and Hotels.com, play a vital role in AFRM’s expansion. It has officially expanded to the United Kingdom, through a partnership with Alternative Airlines. Tapping into industries like travel, hospitality, and technology bodes well for the company.

Affirm Holdings has an expected revenue and earnings growth rate of 37.1% and 96.4%, respectively, for the current year (ending June 2025). The Zacks Consensus Estimate for current-year earnings has improved 60% in the last 60 days.

Zacks Rank #2 Microsoft’s third-quarter fiscal 2025 earnings and revenues beat estimates driven by strength in AI business and Copilot adoption backed by accelerating growth in Azure cloud infrastructure unit. Productivity and Business Processes revenues rose due to a strong adoption of Office 365 Commercial solutions. MSFT’s ARPU growth was driven by E5 as well as M365 Copilot.

MSFT’s Intelligent Cloud revenues were driven by growth in Azure AI services and a rise in AI Copilot business. Focused execution drove non-AI services results aided by accelerated growth in the enterprise customer segment as well as some improvement in scale motions. MSFT’s Xbox content and services revenues benefited from stronger-than-expected performance in third-party and first-party content.

Microsoft has an expected revenue and earnings growth rate of 13.7% and 12.7%, respectively, for the current year (ending June 2025). The Zacks Consensus Estimate for current-year earnings has improved 1.4% in the last seven days.

Zacks Rank #1 Juniper Networks reported impressive first-quarter 2025 results, with both the top and bottom lines surpassing the Zacks Consensus Estimate. JNPR is benefiting from strong growth in the Enterprise vertical, backed by healthy demand for AI-driven Enterprise, hardware maintenance and professional services.

JNPR is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. JNPR is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence. JNPR’s merger with HP Enterprise is expected to accelerate innovation in cloud and AI-native networking solutions.

Juniper Networks has an expected revenue and earnings growth rate of 7.3% and 21.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% in the last seven days.

Zacks Rank #2 Tyler Technologies is benefiting from higher recurring revenues and the rebound of market and sales activities to pre-pandemic levels. The public sector’s ongoing transition from on-premise and outdated systems to scalable cloud-based systems is an upside for TYL.

The growing hybrid working trend is also driving the demand for its connectivity and cloud services. TYL’s strong liquidity position is helping it to pursue acquisitions, which are expected to continue to drive growth.

Tyler Technologies has an expected revenue and earnings growth rate of 8.9% and 15.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% in the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 31 min | |

| 43 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite