|

|

|

|

|||||

|

|

Payments giant Mastercard Incorporated MA reported strong first-quarter 2024 results, driven by growth in gross dollar volume, cross-border transactions, and rising demand for its value-added services. However, cross-border transaction growth slowed in regions like the Middle East and Africa, impacted by reduced travel activity.

Despite this, investors reacted positively. MA shares have climbed 3.5% since the earnings release, pushing the stock near its 52-week high of $582.23. This raises the question: Should investors continue buying at these levels, or is it time to hold off?

Earnings & Sales Beat: Mastercard’s EPS of $3.73 beat the Zacks Consensus Estimate by 4.5% and grew 13% year over year. Also, the top line came in at $7.3 billion, beating estimates by 1.8% and increasing 14% from the prior year. For a detailed analysis, read our blog here. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Key Metrics Show Continued Growth: Gross dollar volume increased 9% year over year on a local-currency basis to $2.4 trillion, though it missed the Zacks estimate by 2.6%. Switched transactions rose 11%, and Mastercard reported 3.5 billion Mastercard and Maestro-branded cards issued as of March 31, 2025.

Cross-Border Volumes: On a local-currency basis, cross-border volumes grew 15% in the first quarter of 2025, down from 19% in the year-ago quarter. A slowdown in global travel and international e-commerce may further impact this metric. Trade tensions and other macroeconomic challenges could add pressure. That said, resilient consumer spending and job growth are providing support to payment volumes. Major rival Visa Inc. V is experiencing similar dynamics, though its larger domestic footprint could mean different exposure levels.

Growing Services Business: Mastercard is aggressively investing in its services business — especially in cybersecurity and data analytics — to diversify beyond traditional payments. These services contributed 39% of total net revenues in the first quarter, with value-added services bringing in $2.8 billion, up 16.1% year over year. Growth was supported by demand for customer acquisition, engagement tools, and market intelligence.

Mastercard’s footprint in emerging markets, especially in Southeast Asia and Latin America, is positioning the company for sustained long-term growth. These initiatives help compensate for revenue lost from its exit from the Russian market. With millions of underbanked consumers in these regions, the company has a strong runway for expansion.

The global transition to digital payments remains a powerful tailwind. Mastercard is well-positioned to capitalize on this trend through its vast network and growing suite of services. Its strong cash position enables it to invest in AI, fraud prevention, and strategic acquisitions, strengthening its leadership in the evolving payments space.

Mastercard continues to return significant capital to shareholders, backed by robust cash-generating abilities. In 2024, the company repurchased 23 million shares worth $11 billion and paid $2.4 billion in dividends. In the first quarter of 2025 alone, it returned $694 million in dividends and $2.5 billion through buybacks. As of April 28, 2025, it had $11.8 billion in remaining buyback authorization, following $884 million repurchased quarter-to-date. Operating cash flow in the first quarter reached $2.4 billion, up from $1.7 billion a year ago.

The Zacks Consensus Estimate for Mastercard’s EPS points to growth of 9.3% in 2025 and 16.9% in 2026. Revenue is expected to rise 12.9% and 12.1%, respectively. The stock has seen multiple upward earnings estimate revisions over the past week.

Mastercard has also beaten earnings estimates in each of the last four quarters, with an average surprise of 3.7%.

Mastercard Incorporated price-eps-surprise | Mastercard Incorporated Quote

Despite its strengths, investors should keep an eye on some risks:

Adjusted operating expenses have consistently increased: 10.7% in 2022, 10.5% in 2023, 11% in 2024, and 12.7% in the first quarter of 2025. Additionally, rebates and incentives—classified as contra-revenue items—rose 16.1% in 2024 and 11.7% in first-quarter 2025, pressuring net revenue growth.

Mastercard settled a significant London lawsuit in December 2024 over card fees and resolved a pay bias case earlier this year, agreeing to conduct internal audits. These legal issues add to costs and may affect the company’s public perception.

The U.K.'s Payment Systems Regulator is considering a cap on cross-border card fees. This could reduce fee income for Mastercard and Visa in the U.K. The proposed Credit Card Competition Act also threatens to introduce more competition in a space long dominated by these two players.

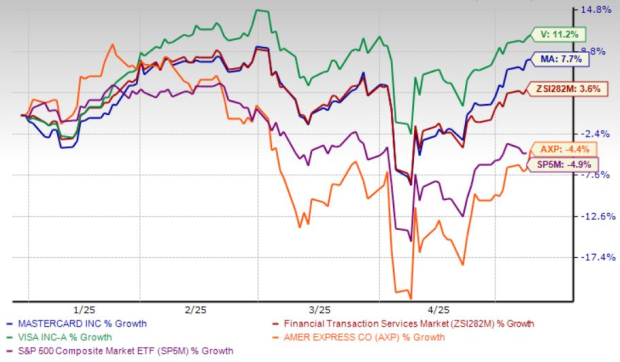

Mastercard stock has gained 7.7% over the past year, outperforming the industry’s 3.6% growth. Competitors like Visa gained 11.2% during this time while American Express AXP lost 4.4%. Meanwhile, the S&P 500 has declined 4.9% in the same period.

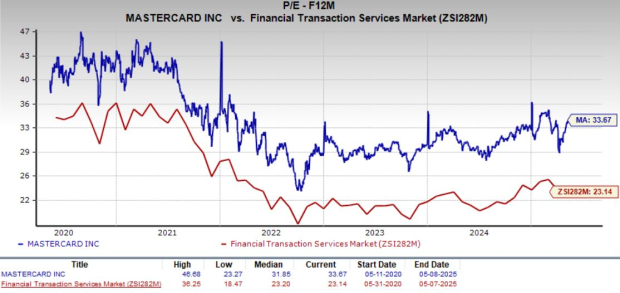

From a valuation standpoint, Mastercard is trading at a forward P/E ratio of 33.67X, higher than its five-year median of 31.85X and well above the industry average of 23.14X. In comparison, Visa trades at 28.81X and American Express at 17.75X. Mastercard’s high valuation raises overvaluation concerns, especially as it trades near its 52-week high.

Mastercard continues to demonstrate strong fundamentals, supported by consistent earnings growth, expanding services revenue, and robust global payment volumes. Its long-term growth drivers — like digital transformation, emerging market expansion, and increased demand for value-added services — remain firmly intact. However, rising costs, regulatory pressures, and a slowdown in cross-border growth introduce near-term uncertainties. Given its premium valuation and potential headwinds, the stock may face limited upside in the short run. As such, Mastercard currently carries a Zacks Rank #3 (Hold), signaling that investors may want to maintain existing positions and wait for a more attractive entry point before adding further exposure.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 19 min | |

| 46 min | |

| 49 min | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

World Trade Center's last office tower soon will get built and house American Express

AXP

Associated Press Finance

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite