|

|

|

|

|||||

|

|

Micron Technology MU and Broadcom AVGO are both entrenched in high-growth semiconductor arenas, such as artificial intelligence (AI), data centers and cloud infrastructure, but they take radically different paths to capture value. Micron is a dominant memory chip maker, while Broadcom specializes in networking, custom silicon and infrastructure software.

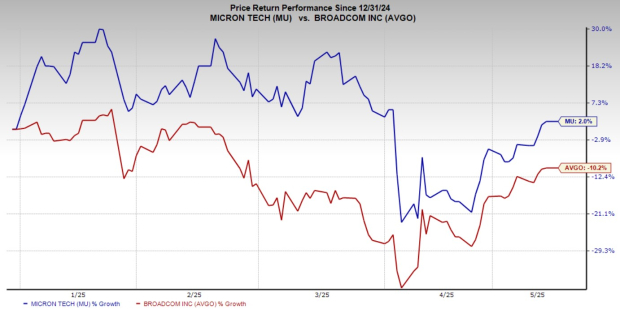

Both companies have seen share price fluctuations in 2025 amid geopolitical tensions and macroeconomic uncertainty. While MU shares have risen 2% year to date, AVGO dropped 10.2%. Yet with AI adoption accelerating, which stock stands out as the smarter semiconductor investment today? Let’s find out.

Micron is riding a powerful wave of demand for high-bandwidth memory (HBM) and DRAM products, especially as AI workloads surge. The company has made significant strides in AI-optimized memory solutions, with its HBM3E products gaining attention for their superior power efficiency and bandwidth.

In January 2025, NVIDIA revealed that Micron is a key supplier for its GeForce RTX 50 Blackwell GPUs, solidifying Micron’s positioning in the HBM market. Earlier this year, Micron revealed plans for a new HBM advanced packaging facility in Singapore, set to begin operations in 2026, with further expansions by 2027. This move aligns with Micron’s AI-driven growth strategy, ensuring diversified supply chains and increased packaging capacity for high-performance memory chips.

Despite Micron's efforts to capitalize on rising AI-related demand, margin pressures and pricing challenges raise red flags. While Micron’s top-line growth in the second quarter of fiscal 2025 was impressive, its profitability came under significant pressure. The company’s non-GAAP gross margin declined to 37.9%, down from 39.5% in the previous quarter, marking a sharp sequential fall. This deterioration was driven by weaker NAND flash pricing and ongoing startup costs at its new DRAM production facility in Idaho.

More concerning is the company’s margin outlook. For the third quarter, Micron guided for a gross margin of 36.5% at the midpoint, signaling further compression. This weaker-than-expected outlook, despite record sales in its HBM segment, indicates that margin pressures are likely to persist.

Meanwhile, Broadcom offers investors a more diversified and durable growth profile. The company is deeply embedded in next-generation AI infrastructure through its custom application-specific integrated chips (ASICs) and high-performance networking chips, which are fueling its top-line growth.

Custom AI accelerators (XPUs), a type of ASIC, are necessary to train Gen AI models, and they require a complex integration of compute, memory and I/O capabilities to achieve the essential performance at lower power consumption and costs. Broadcom expects second-quarter fiscal 2025 AI revenues to jump 44% year over year to $4.4 billion.

What’s more impressive is that Broadcom is already sampling the world’s first 3nm XPU chips and plans to launch a 2nm version using advanced 3.5D packaging later this year. The company targets scaling clusters of 500,000 accelerators for hyperscale customers. It believes that by 2027, each of its three hyperscalers plans to deploy 1 million XPU clusters across a single fabric.

Serviceable Addressable Market for XPUs and networks is expected to be between $60 billion and $90 billion in fiscal 2027 alone. Broadcom’s rich partner base, including NVIDIA, Arista Networks, DELL, Juniper and Super Micro Computer, has been a key catalyst.

From a financial perspective, Broadcom consistently delivers gross margins above 70% and operating margins above 60%, driven by its high-value custom silicon business and enterprise software portfolio. In the last reported financial results for the first quarter of fiscal 2025, the company’s non-GAAP EPS soared 45.5% on 25% higher revenues. Looking forward, Broadcom expects total revenues in the second quarter to surge 19% year over year to $14.9 billion.

The Zacks Consensus Estimate for Micron’s fiscal 2025 sales and EPS implies year-over-year growth of 41% and 433%, respectively. However, the estimate revision trend for MU’s fiscal 2025 and 2026 EPS has remained highly volatile.

The Zacks Consensus Estimate for Broadcom’s fiscal 2025 sales and EPS implies a year-over-year increase of 21% and 36%, respectively. However, unlike Micron, estimates for Broadcom’s fiscal 2025 and 2026 EPS have demonstrated a steady upward revision trend. This stability is a testament to the company’s predictable performance in a volatile sector.

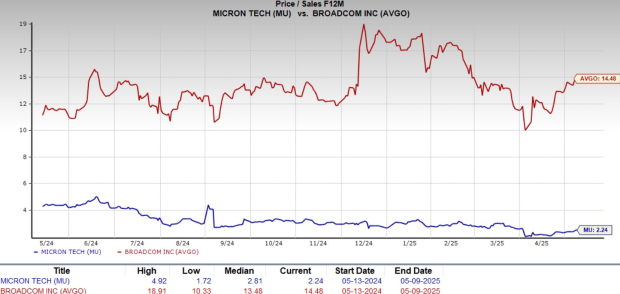

Micron is trading at a forward sales multiple of 2.24X, way below Broadcom’s 14.48X.

Broadcom does seem pricey compared to Micron. However, AVGO’s higher valuation is backed by superior profitability and a structurally more diversified business. The company boasts steady gross and operating margins compared to MU’s more variable margin profile.

Micron’s falling profitability raises questions about its ability to capitalize on the booming AI market. If the company cannot maintain healthy margins, future earnings growth could be constrained.

Both Micron and Broadcom are riding the same megatrends — AI, cloud and data centers — but they’re doing so from vastly different positions of strength.

Micron has upside potential due to its leadership in AI memory. However, that promise is being weighed down by margin pressure and pricing volatility. It’s still a play on memory cycles more than a structural AI winner.

Meanwhile, Broadcom brings more stability to the table with strong fundamentals, durable earnings, and a balanced mix of AI-driven hardware and enterprise software. While its valuation is higher, it’s supported by margin strength and earnings consistency.

So, for investors seeking a smarter semiconductor bet amid global uncertainty, Broadcom remains the more compelling choice.

Currently, AVGO has a Zacks Rank #2 (Buy), making the stock a must-pick compared to MU, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite